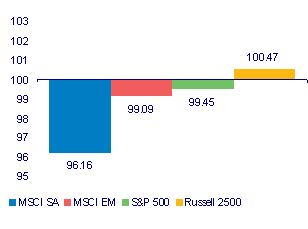

March 2011, by month end, proved a very satisfactory month for foreign investors in the JSE. The SA component of the benchmark MSCI Emerging Market Index ( that excludes the dual listed companies on the JSE), performed very well and in line with the emerging markets benchmark, as we show below.

To view the graphs and tables referred to in the article, see Daily Ideas in todays Daily View:Daily View 4 April: Equity market earnings: A volatile month ends well (especially for offshore investors)

The total return performance of the JSE and of the MSCI SA in March 2011 was assisted by the strength in the rand against the US dollar and also by the relative strength in JSE reported earnings, especially when converted into US dollars. JSE reported earnings in US dollars are now growing significantly faster than those reported by the EM stocks included in our Investec Big Cap emerging market index.

Such faster growth is implicit in the currently superior rating enjoyed by the JSE. As we show below the JSE is trading at 15.3 times trailing earnings and our EM Index at a less demanding 12.3 times.

The S&P 500 by contrast is now trading at 17 times reported earnings. The annual growth in these S&P earnings is now 50% but this is growth off a highly depressed level of 2009 and 2010 – when S&P earnings collapsed from a peak level of over US$80 in late 2007 to less than US$10 per share by mid 2009, as a result of the global financial crisis.

Thus it will take until the end of the year to make proper sense of the underlying growth in reported S&P earnings; these are currently US$77 per share and are expected to approach US$100 within 12 months. The issue of how best to normalise S&P earnings will remain a very difficult one for many years, given the collapse of 2009.

Investec Securities calculates normalised earnings for the JSE. Its calculation (as shown below) suggests that the price to normalised JSE earnings ratio is below the trailing multiple. This indicates that if earnings continue to normalise, the price earnings multiple for the JSE may recede further. The bottom up forecasts of JSE earnings one year ahead indicate expected growth in JSE earnings in rands of close to 30% to be reported over the next 12 months.

The earnings outlook for the JSE appears to us as strongly supportive of current valuations. Our view remains however that the most obvious value in equity markets is suggested by the S&P rather than emerging markets, of which the JSE is an integral part. Should S&P earnings proceed as expected and approximate US$100 in 12 months, the multiple adjusted for expected rather than trailing earnings falls to about 13 times. This is well below long term averages for the S&P.

However any strength in the S&P that becomes realised as investors grow more confident about the earnings outlook is unlikely to mean weakness in emerging markets, but only perhaps a relative underperformance. Should the growth in S&P earnings materialise as expected, this will indicate that the US economy is in good enough health to withstand higher interest rates.

The usual tug of war between better earnings and higher interest rates can be expected to resume within the next 12 months. However it is only expected to restrain in part any rerating of the S&P and the advance of the S&P itself. We regard good 12 month S&P returns of the order of 10-12% as a distinct possibility. Brian Kantor