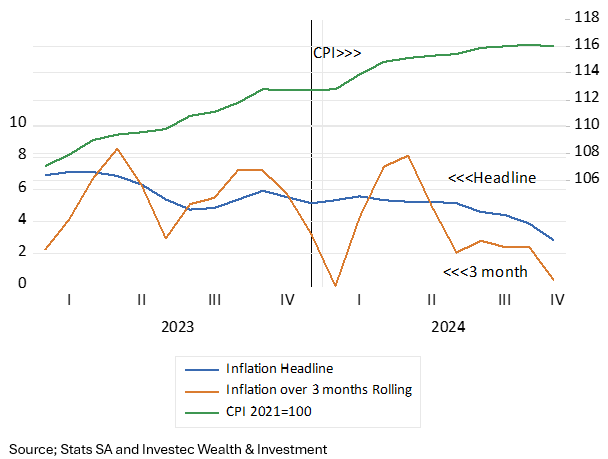

Inflation in SA has nearly halved since June. From 5.1% p.a then to 2.8 in October. Indeed average consumer prices have hardly risen at all since June. In October they fell marginally, and over the past three months the CPI has hardly budged, and price increases were close to zero.

Inflation and the SA CPI; Monthly Data

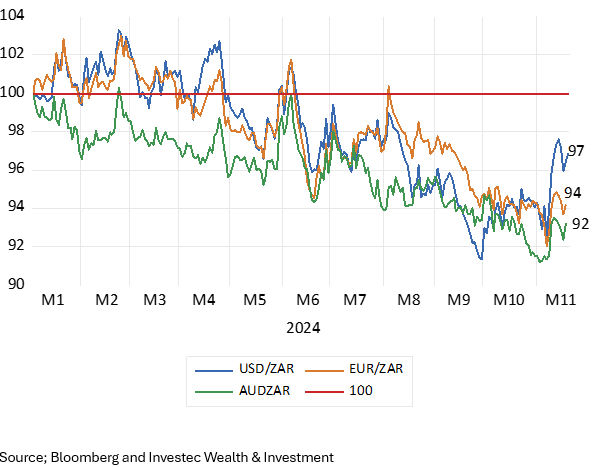

One observation that one can make is that such price stability could not have occurred without a very strong rand. A rand that has gained value against a range of low inflation currencies. This year to date the rand is worth four per cent more USD, can buy six per cent more Euros and seven per cent more Aussie dollars. The year before the rand had weakened VS these currencies by over 10%. Its surely no surprise that inflation in SA accelerated in 2023 and has sharply decelerated this year.

The ZAR Vs the USD, the Euro and the Aussie Dollar. Daily Data (2024=100)

One can also conclude that the exchange value of the ZAR drives the direction of prices in SA – rather than the other way round. SA is a very open economy. Flows of exports and imports account each for about 30% of GDP- of total supply and demand in the economy. What we pay in rands for imports and receive for exports helps determine all prices in a systematic way. You can tell as much at the petrol pump.

And so how then can SA achieve currency strength and low inflation? The answer would also seem obvious enough. Form a government of national unity that is expected to raise growth rates, improve the outlook for SA bonds and equities and so more capital will flow in more than out leads to less rand weakness and inflation expected in the future. Lower long term bond yields, lower costs of capital generally, all reinforce the growth momentum. And with lower inflation short term interest rates decline just as predictably, as they can be expected to rise with rand weakness. Yet expectations of faster growth have to be reinforced with consistent growth enhancing actions. Investors can be encouraged, they can as easily be disappointed.

It is not only in South Africa that politics and the economic policies and outcomes associated with a change in leadership drive the direction of the exchange rate. And depending on the degrees of openness to foreign trade that will then drive the direction of all prices. The exchange rate leads and prices follow, and the exchange moves in response to changes in expectations of returns in the capital market. The exchange value of the USD, the essential reserve currency, is subject to large changes in direction, persistently so, that have little to do with differences in inflation between the US and its principle trading partners. And everything to do with expected returns on capital invested. But will have a significant impact on the profits and growth prospects of businesses that engage in foreign trade.

The DXY is a weighted Index of the exchange value of the USD Vs the major currencies, the Euro, Yen etc.. It gained nearly 50% additional exchange value between 1995 and 2000. It then declined from an Index value of 120 to 70 by the time of the Global Financial Crisis. The dollar since has been on a mostly upward tack since and clearly has received a boost from the Trump ascendancy. From which the ZAR has not be immune but has behaved broadly in line with all other currencies. Dollar strength will be far more easily managed provided the ZAR holds its own with the other low inflation currencies, as it has been doing.

But for the Trump administration the impact of the potentially stronger dollar on trade flows may be far more important than the impact of higher tariffs on imports and the retaliation that may follow and on prices US consumers will pay. The unpredictability of exchange rates, despite low rates of inflation in the developed world, especially of the exchange value of the USD, is a fundamental flaw of global trade and finance that all economies including SA have to cope with.

The exchange value of the US dollar