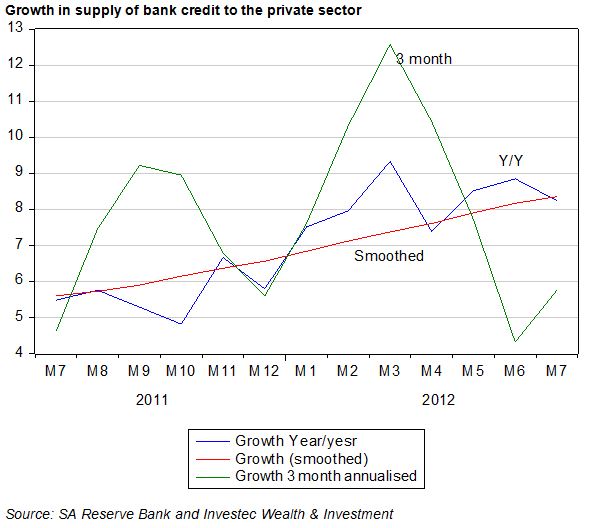

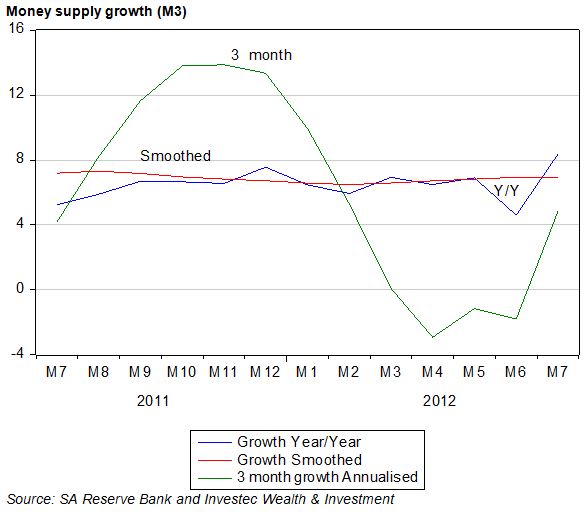

Bank credit and money supply statistics for July 2012, released yesterday, indicate that growth in the demand for and supply of credit and money continues at a sedate pace. The pace of growth appears strong enough to keep the economy moving forward – but at a pace that will not fully engage the economy’s potential.

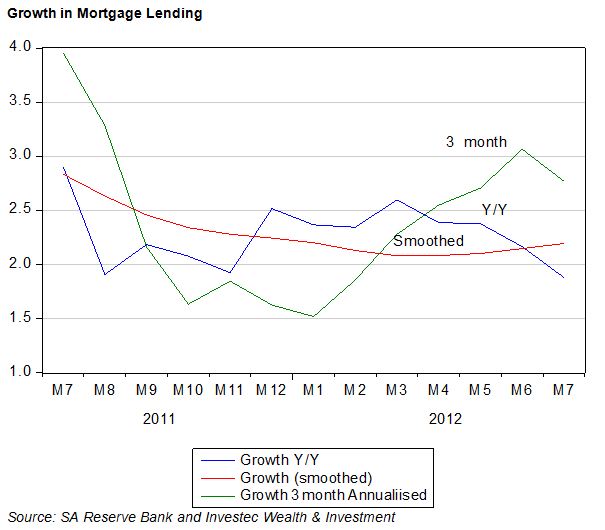

In line with house prices, that are at best moving sideways, mortgage lending by the banks continues to grow very slowly, at about a 2% per annum rate. Growth in mortgage lending over the past three months however did pick up some momentum – perhaps indicating some reversal of recent trends. Without a demand from their customers for secured credit, the interest the banks have in expanding access to unsecured credit will hopefully be sustained, supplying some impetus to the economy that is sorely needed.

These trends confirm that monetary policy will stay on an accommodative course – designed to encourage domestic spending when little help can be expected from the global economy and demand for exports. Credit and money supply trends help make the argument for lower rather than higher short term interest rates. Brian Kantor