New unit vehicle sales fell off the torrid pace set in January 2013. On a seasonally adjusted basis, unit sales fell back from the 57 834 units sold in January to 52 760 units sold in February. We had suggested that January sales may have been boosted by pre-emptive buying in response to rand weakness.

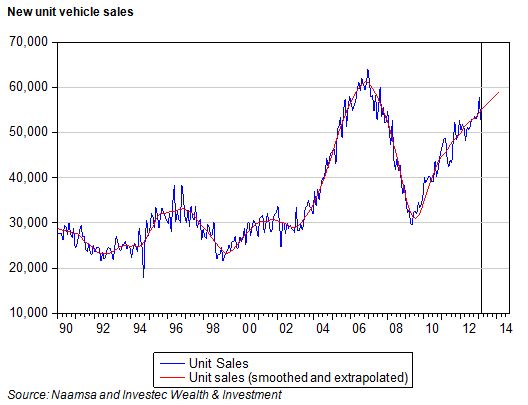

As we show in the chart below, unit sales (seasonally adjusted and smoothed) remain on an upward tack. If current trends are maintained, the distributors of new cars in SA could be looking to monthly sales (seasonally adjusted) of 59 000 units by this time next year. This would take the industry almost back to the record levels of sales achieved in 2006. It is instructive to notice how little growth in vehicle sales volumes occurred between 1990 and 2002, but also how sales took off in the boom years (2003- 2007) before the recession knocked them back again. That sales are again approaching boom time volumes should be regarded as very good news about the resilience of the SA consumer.

While sales in the local market are satisfactory, even as their growth may have slowed, the motor manufacturers and component suppliers will be well pleased with fast growing export volumes. New vehicle exports numbered 27 011 units, or 5 057 more units than exported a year ago, a gain of 22.4%. It will be appreciated that vehicle exports are now running at a fraction more than 50% of domestic sales. This boost to exports will be particularly appreciated by the authorities and the currency traders worried about the slow pace of exports and the large trade deficit recorded in January 2013. Clearly vehicle sales have been encouraged by low interest rates and available bank credit. The low interest rates and banks eager to lend are very likely to continue to add impetus to the vehicle market. The weaker rand however, will make it harder for the dealers to compete on the price front – not only with other dealers but with all other goods and services that compete for a share of the household budget. Brian Kantor