The news from the credit and money supply fronts is not very encouraging. Money and credit supplies need encouragement from lower interest rates, not discouragement from ill timed regulatory intervention

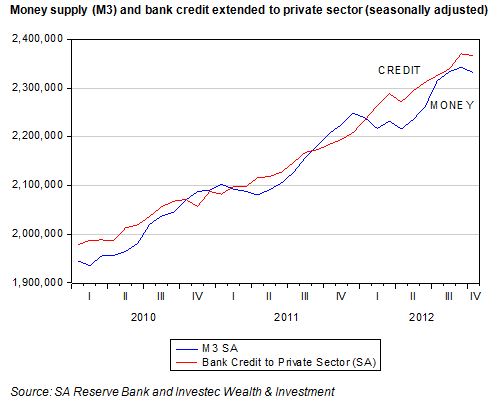

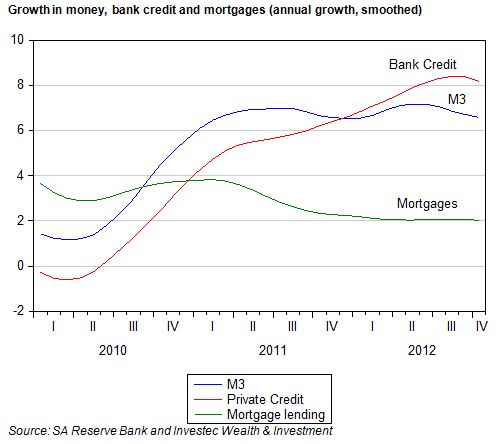

Broadly defined money supply (M3), as well as bank credit extended to the private sector declined marginally in October 2012 on a seasonally adjusted basis. Annual growth in these aggregates, when smoothed, also declined marginally. The broadly defined money supply, mostly made up of deposits with the banks, is now growing at an underlying rate of about 6.6% p.a. while underlying growth in credit extended to the private sector is about 8.2% p.a. Mortgage lending by the banks is growing at an even slower rate of about 2% p.a.

It should be appreciated that these are very modest growth rates, especially given inflation of the order of 6% p.a. With the economy operating well below its potential, it needs all the help it can get from domestic spending and the support money supply and credit growth give to domestic spending. With export prices and especially export volumes under severe pressure, household spending has been supporting economic growth and so the employment and incomes of employees. This helps them maintain their credit.

At this especially vulnerable stage for the SA economy, attempts to reform the credit system in SA are especially likely to lead to less credit being offered, less spending and still slower growth in incomes. Any additional restraints on the willingness to supply credit or to secure credit are precisely the wrong recipe. They are likely to lead to more, not less, distress in credit markets as the economy slows down. Brian Kantor