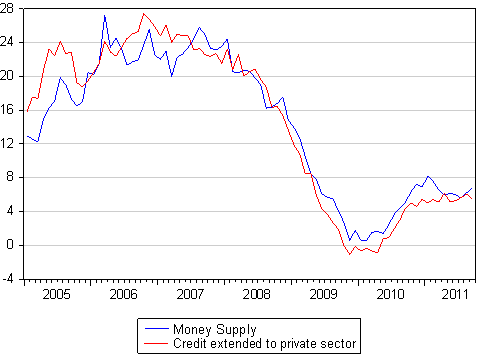

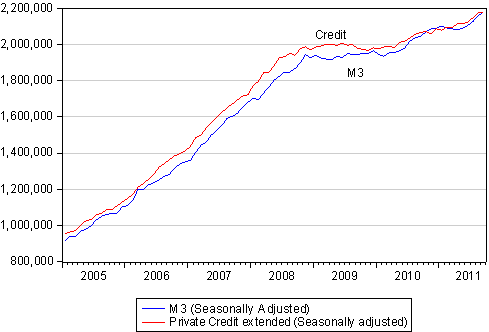

Money supply and bank credit numbers have been updated to September 2011. The year on year growth rates have recovered from their cyclical lows of late 2009 but appear to have stabilised in the 6% range. Broadly defined money supply covers almost all of the liabilities side of the balance sheets of the banks; while credit extended to the private sector accounts for almost all of the assets held by banks and so the growth rates are bound to be almost identical.

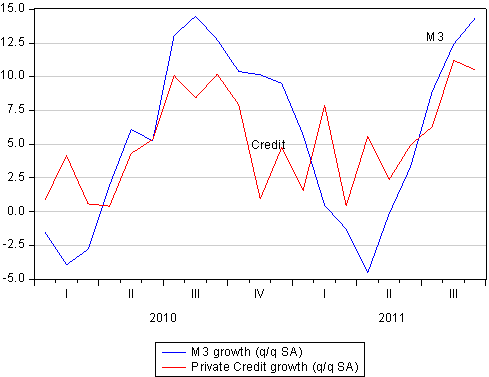

A closer look at the bank statistics over the past three months reveals a somewhat more encouraging picture. On a seasonally adjusted basis both money supply (M3) and bank credit have picked up momentum.

When these statistics are converted into a rolling quarter to quarter annualised rate of growth we observe a strong recovery to growth rates of +10% from the slower rates of growth realised earlier in the year.

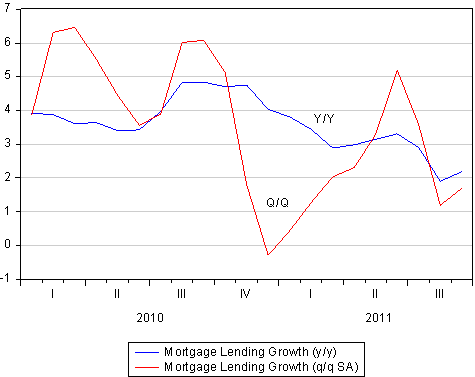

Mortgage credit demanded and supplied (accounting for about half all bank lending) however remains highly subdued, with growth rates tending lower rather than higher. House price inflation leads mortgage credit supplied and it would appear that the housing market remains in the doldrums.

The money supply and credit trends confirm our impression from vehicle sales, activity at retail level and the growth in the narrowly defined money supply (notes in circulation) that the SA economy has rather more life in it than is perhaps generally recognised. We await data on the note issue and vehicle sales in October, due to be released this week to give us a more up to date impression of the current state of the economy.

Yes they are high, and for minimum caovrege. Minimum caovrege might keep Johnny law off your butt, but it won’t do much for you if you injure someone or do major damage.