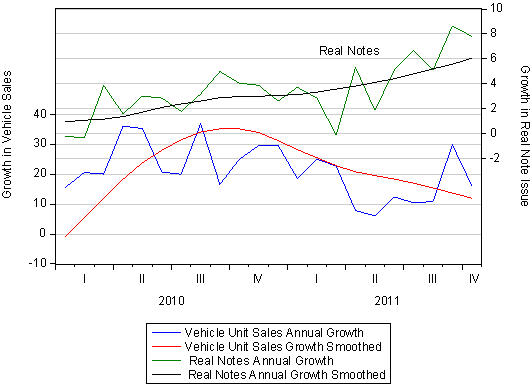

The economic signs from the Hard Numbers in October (vehicle sales and the note issue) provide some encouraging confirmation of the improving state of the SA economy.

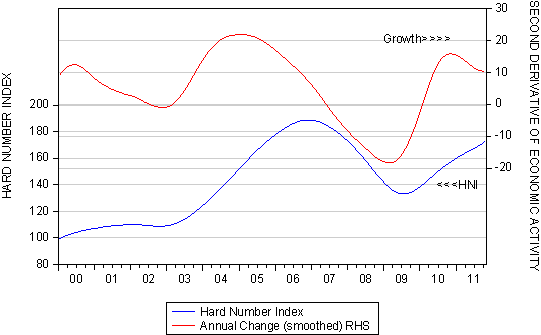

The Hard Number Index of Economic Activity in South Africa (HNI) continued its upward trajectory in October. This indicates that the economy – based on two hard numbers for October, unit vehicle sales and notes in circulation – maintained a positive rate of growth in October. The direction of the economy (forwards or backwards) is shown by the HNI: when it moves higher the economy is moving ahead; when lower it is going in reverse. The economy, according to these up to date and hard numbers, is clearly moving ahead. The speed at which the economy moved ahead in October may however have slowed down, as we show below.

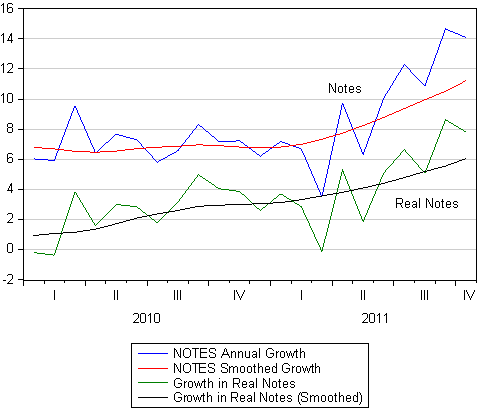

The changing speed at which it moves forward is indicated by the growth in the HNI. The speed of the economy slowed because vehicle sales in October 2011, while very strong compared to a year before, were down on September sales that were extraordinarily strong that month. However the other half of the HNI is made up of the notes issued by the Reserve Bank. These are issued in response to the demand for notes by banks and the public adjusted for the CPI. These growth rates have picked up very strongly in recent months. (See Below)

It may be seen below that the demand for and supply of notes has picked up significant momentum this year and that the pace at which notes are being issued is accelerating. Notes are held by banks in their branches and ATM machines and by the public in their wallets and purses to facilitate their spending intentions. It would therefore appear that at month end October, spending was gaining momentum. These trends will have to be confirmed but only much later by official estimates of retail activity. The most recent statistic of this kind for the retail sector is only for August 2011. These latest indicators confirm for us that the economy, after a slower patch in the second quarter, has picked up momentum.

The Reserve Bank however has never seemed to regard the narrow or broader definitions of the money supply and its growth as an objective of policy or of interest rate settings. Its decisions to lower short term interest rates at its meeting this week not are unlikely to be influenced by the accelerating growth in the note issue. Furthermore the growth in broader money (to September 2011) remained rather modest when viewed on a year on year basis. This may be so, but if interest rates are cut this week, this may add some pro-cyclical impetus to monetary policy. Brian Kantor