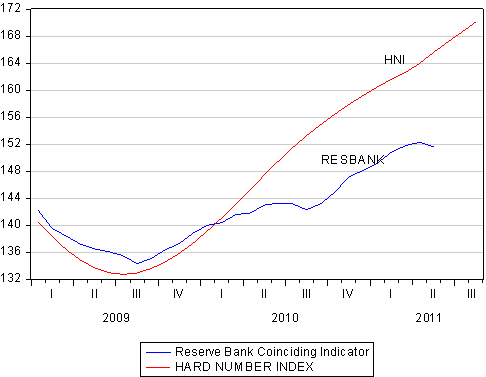

With the release of unit vehicle sales and the size of the note issue for August 2011 we are able to update our hard Number Index (HNI) of the state of the SA economy. As we show below the HNI confirms the SA economy is maintaining its growth momentum. The HNI for July and August 2011 show very little change. The economy appears to moving ahead at a constant speed.

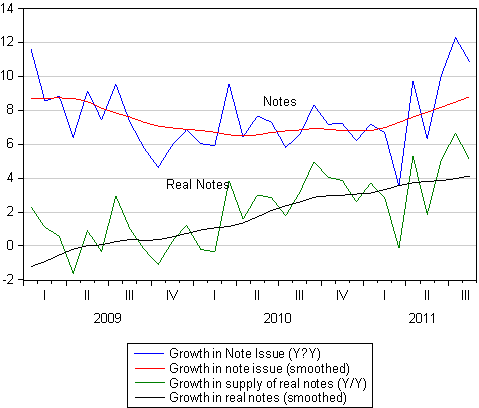

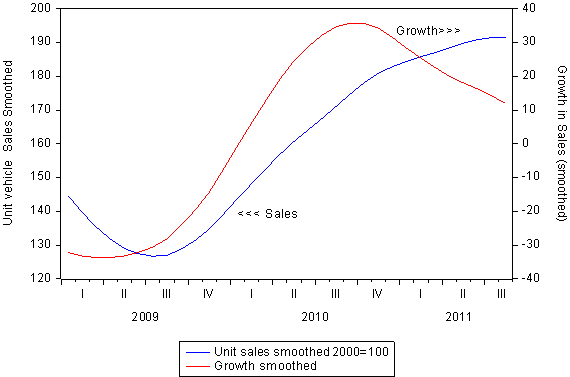

The HNI is an equally weighted mix of vehicle sales and the notes in circulation, adjusted for inflation. The vehicle sale cycle has turned lower – while still indicating good growth. As we reported previously vehicle sales in August recovered well from July 2011 levels – however this pickup in sales was not enough to reverse the declining growth trend.

As we also show, the HNI provides a much more up to date measure of the current state of the SA economy than the Business Cycle indicator, released by the Reserve Bank (which is only updated to May). As may be seen the HNI and the Reserve Bank Indicator tuned up in the same quarter of 2009. It may also be seen that the Reserve Bank indicator turned lower in May 20011; though the subsequent progress of the HNI strongly suggests that this economic activity indicator will have followed the HNI higher since then.

However what was negative for the HNI on the vehicle front was made up almost completely by the strength in demand for extra notes by the public and the banks. Adjusted for inflation, this growth in the note issue has picked up good momentum as we show below. This trend must be regarded as a very helpful one for the SA economy. Growth in the demand for and supply of notes indicates an improved willingness of the public to spend more. It has proved to be a very good indicator of the state of the SA economy. It suggests that the gloom about the prospects for the domestic economy may be overdone.