31st July 2024.

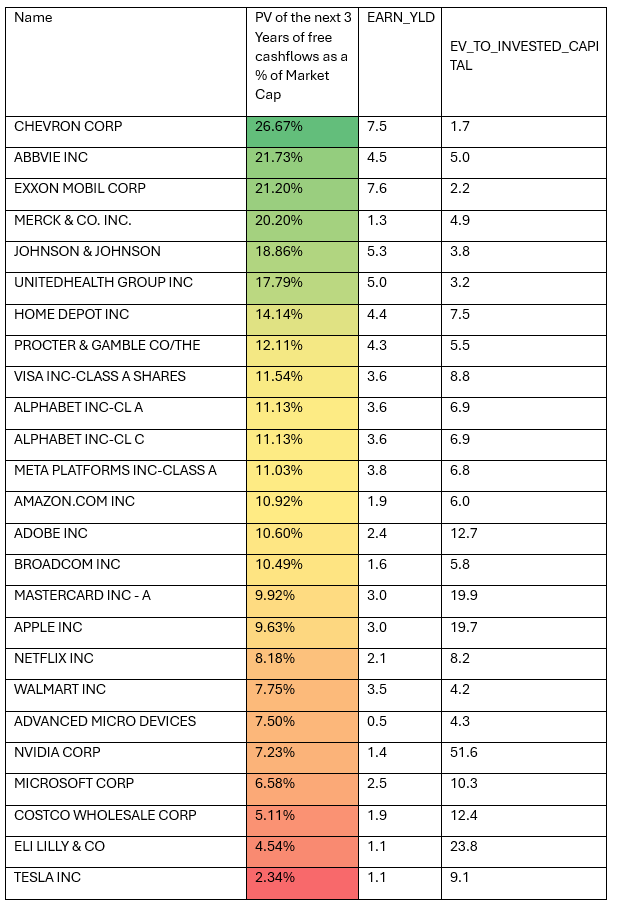

Much of the value of any company can be attributed to profits expected over the long run. If we discount the next three years of Microsoft’s (MSF) free cash flow- cash flow after capex- (FCF) as estimated by Bloomberg- discounted at 8% p.a. – we can explain only 6.6% of its current value. Nvidia has 7.2% of its present value explained this way. The 97% dependence of Tesla on growth beyond the next three years is greater still. By contrast 27% of oil producer Chevron and 22% of Exxon Mobile can be explained by the immediate short-term outlook. They are clearly value stocks.

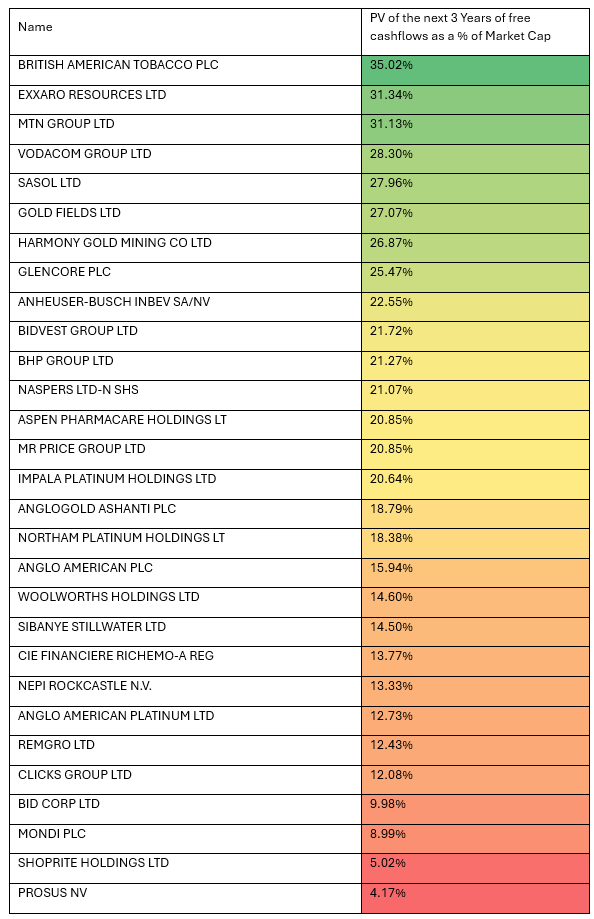

Most of the Top 40 stocks listed on the JSE, fall into the value category. A relatively high 32% of MTN and 28% of Vodacom, depend on the next three years of FCF – discounted at a much higher 14% p.a. While about 21 per cent of Mr Price and Bidvest can be explained this way. Anglo at 16.13% is therefore expected to deliver on its restructuring plans.

Table; Share of Market Value (July 2024) explained by Present Value of next 3 years of Free Cash Flow (FCF)

US Companies – FCF discounted at 8%

JSE Listed Companies. Discounted at 14%

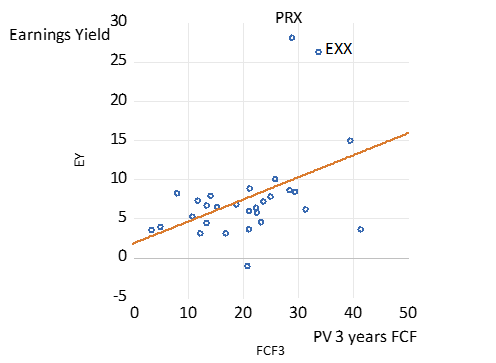

A scatter plot for the JSE Table. Earnings

Yield and PV of FCF. Sample 29 companies in Table.

But as may be seen there are notable exceptions on the JSE that are priced for growth. The value of Clicks registers a mere 12% dependence on the next three years of performance while Shoprite with a 5% ratio, is even more of a growth stock by this measure. There is a strong link on the JSE between the PV of the FCF over the next three years and the initial earnings yield- the reciprocal of the P/E ratio as shown in the scatter plot.

Note, a 100 dollars or rands expected in 20 years’ time is worth 21.5 today at a discount rate of 8%. And worth only a third as much (7.28) if we raise the discount rate to 14%. The way to raise the value of SA economy facing companies is to lower the discount rate. As would follow faster economic growth. With a stronger economy the numerator of the SA Present Value calculation- operating profits – would rise and the denominator, the discount rate would fall, to provide a double whammy for present values.

Clearly the share market takes a long-term view. The observed day to day volatility of share prices is explained by the difficulty of forecasting profits or earnings or cash flows over the long run. And the longer the run, the more dependence of present value on future growth, the more that can go wrong or right for shareholders.

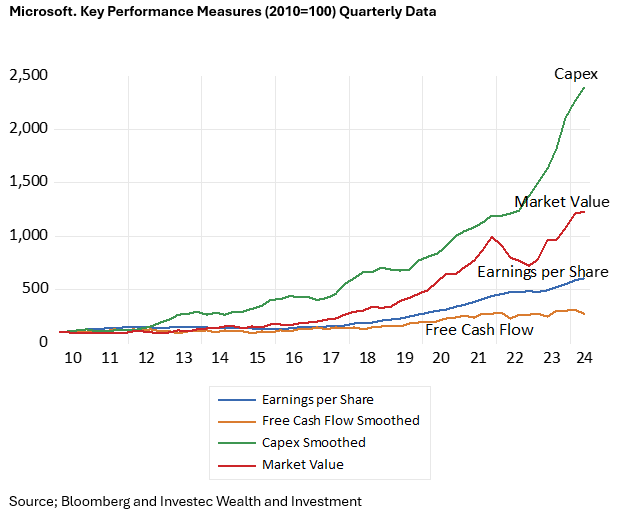

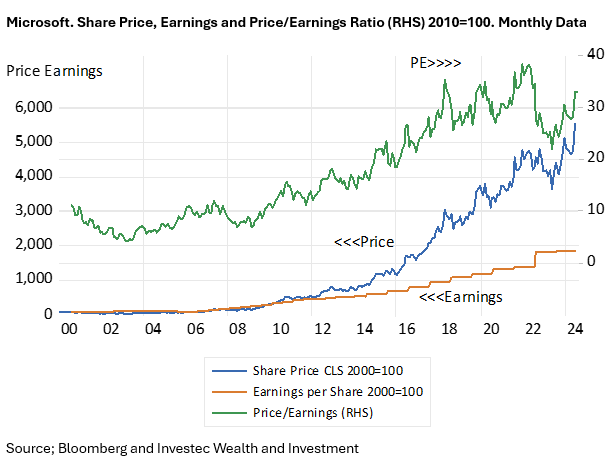

There is always the danger that investors will overestimate the growth potential of a growth company and the disappointment will reveal itself in much lower valuations. But even a very expensive growth company, by the usual metrics, can prove to be a great buy. Take the extraordinary case of MSF itself. It is a hugely successful company that transformed itself after 2010. And was rerated accordingly. In January 2010 MSF was worth $247 billion with a price to earnings ration of 11. By early 2019 the value of MSF had grown to over $800 billion and was then valued expensively and demandingly of growth at 26 times current earnings. The company is now worth over $3.3 trillion, an increase of 142% or by an average 25% p.a. since 2019.

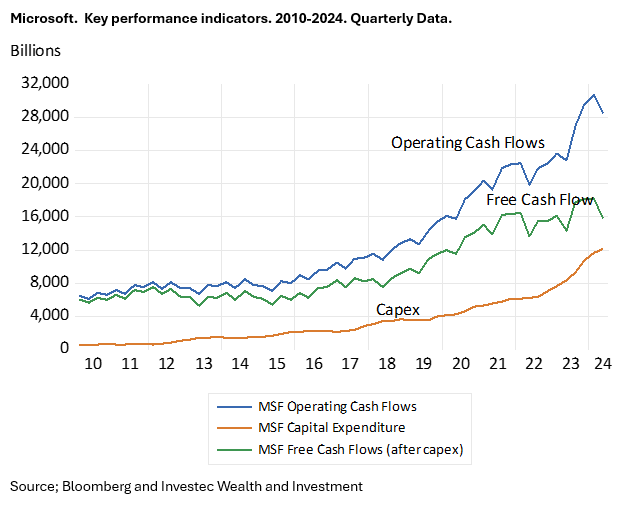

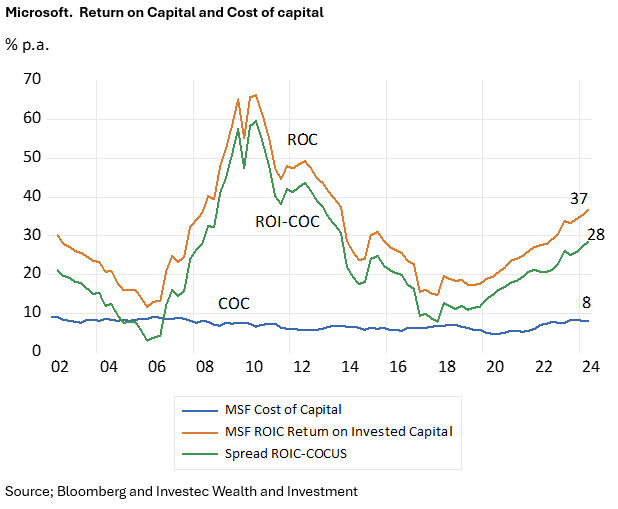

And MSF is now trading at about 38 times earnings after it reported yesterday 30th July. Is it still a buy? The answer will depend on just how well its extraordinary growth in Capex continues to transform into profits – by filling the cloud with data centres powered by microchips and by charging for generative IT. How well will this extra capex be monetised is the essential question? MSF Capex is now 25 times higher than it was in 2010. MSF Capex increased from $8943b to 13873b or 43%, this quarter compared to a year ago. While net cash from operations was up impressively by 29%. And accompanied by a large value adding margin between the return on Capital Invested by MSF – now 28% p.a. The largely unchanged MSF share price (down today by about 1%) indicates that MSF has satisfied very demanding expectations. The expectations of fast and profitable growth remain as they were. The same question is being asked of all the IT companies and not only the Magnificent Seven [1] that are adding aggressively to their plant and equipment.

[1] The original cast of the 1960 production of the Magnificent Seven included Yul Brynner Eli Wallach Steve McQueen Charles Bronson Robert Vaughn Horst Buchholz James Coburn