Recently released data on the broadly defined money supply (M3) to August 2012 and new unit vehicle sales updated to September 2012 are consistent with a pattern observed for other indicators of the state of the economy. These include retail sales volumes and the note issue (cash held by the banks and public). The message is that a strong pick-up in activity was recorded in the final quarter of 2011 and was followed by, at best, a sideways trend until May. In June 2012 activity picked up and the higher levels of activity have been sustained since then.

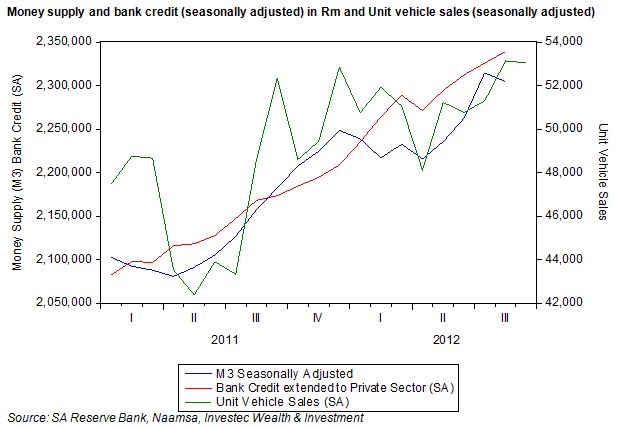

We show this pattern of monthly activity, seasonally adjusted, below. Vehicle sales volumes now exceed the strong sales realised in December 2011 when seasonally adjusted. This recovery in sales volumes should be regarded as highly satisfactory by the industry. The money supply trends, also seasonally adjusted, show a similar pattern, while bank credit extended to the private sector has advanced more steadily as may also be seen in the chart.

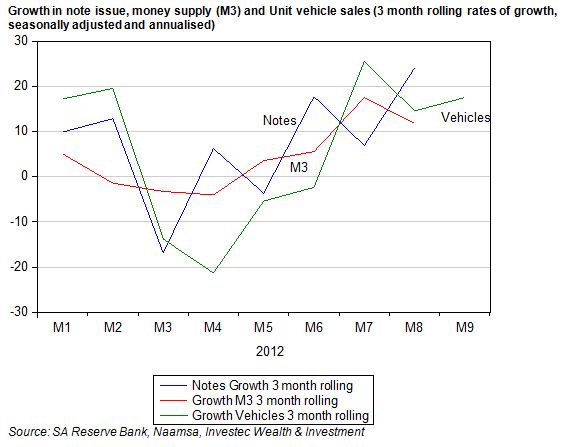

Year on year growth rates do not tell the story of what can happen within a 12 month period. That vehicle sales have slowed down (off a higher base) to 1.34% p.a. appears to be something of a disappointment to the Industry but should not be. The growth in vehicle sales on a three month rolling basis – when seasonally adjusted and annualised – tells a much happier story about the state of the vehicle market. It also tells a happier story about the state of the domestic economy more generally when the note issue and the broadly defined money supply, calculated on a three month rolling basis, are taken into account.

The SA economy clearly picked up momentum in mid year while activity appears to be well sustained at higher levels. This strength has perhaps not been widely recognised, given a focus on year on year growth rates. These will come under further pressure from the higher base realised in late 2011. The strength of demand has however shown up in higher imports and (given pressure on export revenues volumes) in a wider trade deficit.

Lower interest rates have been helpful for sustaining domestic demand. Interest rates will need to stay low, and perhaps decline further, to encourage demand in the absence of any likely stimulus for the economy from exports – particularly exports from the disrupted mining sector.