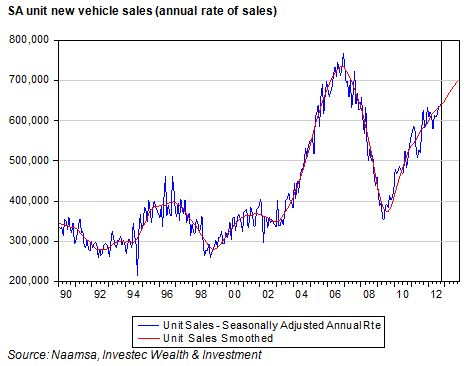

We play close attention to two important indicators of the state of the SA economy. These are new vehicle sales and the notes issued by the SA Reserve Bank. The great advantage of these data points is that they are very up to date and that they are based on hard numbers rather than sample surveys that inevitably have measurement issues.

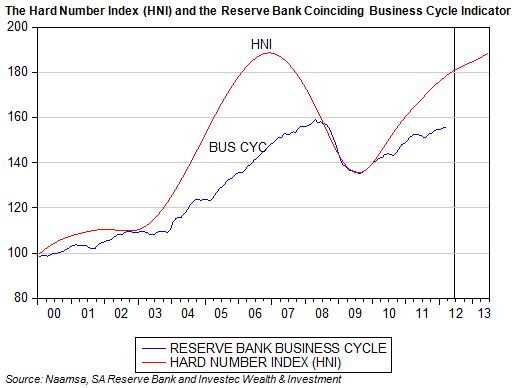

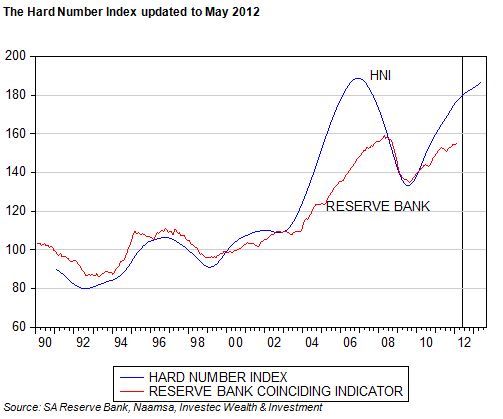

We combine these two hard numbers to form our Hard Number Index (HNI) of the current state of the SA economy. We deflate the note issue by the Consumer Price Index (extrapolated one month ahead) to establish the real note issue that makes up half of the HNI. As we show below, the HNI has provided a very good leading indicator of the SA Business Cycle as calculated by the Reserve Bank. The recent turning points in the two cycles have coincided very closely.

The advantage of the HNI is that it provides an early indication of the state of the economy in June2012. The Reserve Bank Indicator only gives us an estimate of the state of the economy as of March 2012, for which period we anyway have the much broader GDP figures and other national income estimates.

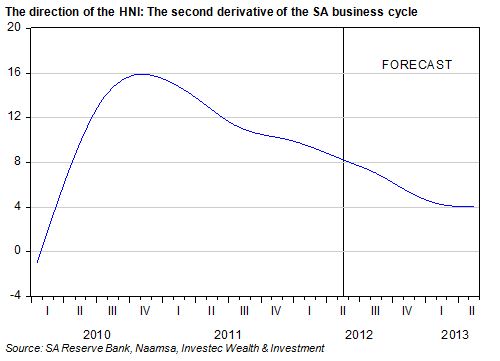

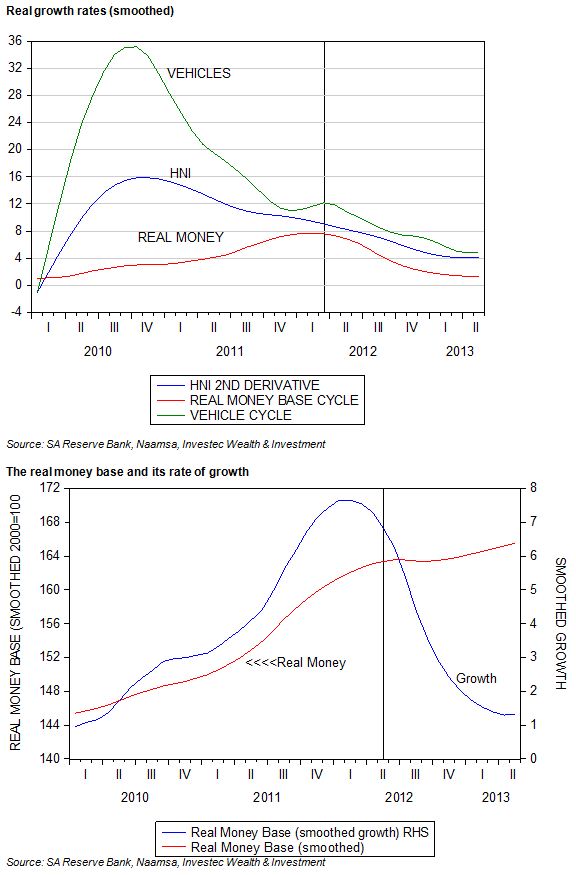

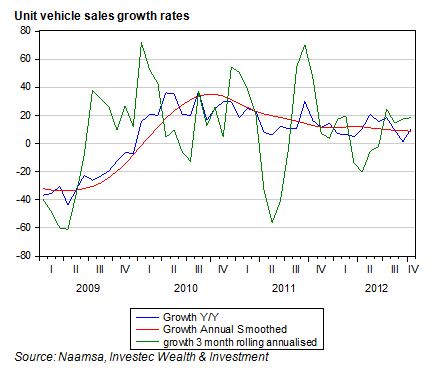

It may be seen from the HNI that economic activity in SA continued to expand in June. The pace of growth in June, as reflected by the rate of change of the HNI (what may be regarded as the second derivative of the business cycle) has however continued to slow. Nevertheless June 2012 was a very solid month for new vehicle sales and the note issue in June showed a marked pick up compared to the note issue three months before.

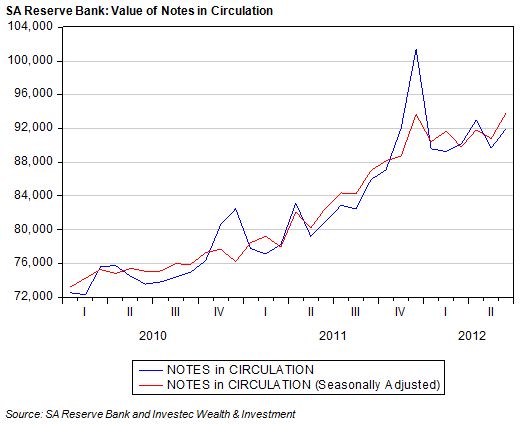

As we show below, the note issue, having grown very strongly towards year end 2011, fell back between January and May 2012 only to recover in June 2012. Clearly the demand for notes is affected by the spending seasons, especially in December, and can only be interpreted with the aid of an adjustment for seasonal influences. That the value of the notes issued in June 2012 grew so strongly in response to the extra demands for cash from by the public and the banks, is an encouraging sign of improving spending propensities.

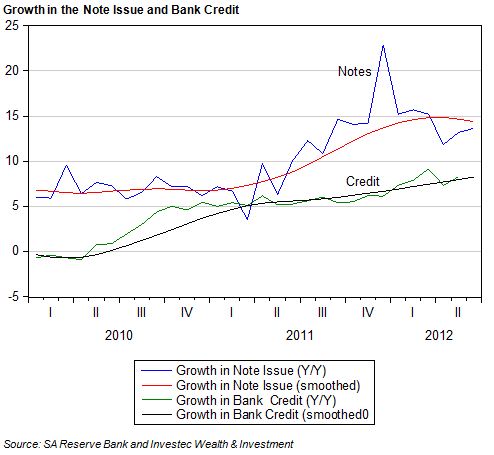

It is of interest that the note issue has grown significantly faster than the supply of bank credit or of broader measures of the money supply. This implies that these may take a similar path to that of bank credit extension to the private sector. This would suggest that the additional demand for cash is coming from the public to fulfill spending intentions rather than from the banks. It is the informal rather than the formal sector of the economy that uses cash rather than access to bank deposits as its principal medium of exchange. Therefore this may suggest that the informal sector is growing faster than the formal sector and by so doing is helping to sustain the pace of economic activity.

The Reserve Bank is likely to take much more notice of the slower growth in bank credit than the faster growth in its note issue when deciding on the right level of interest rates. It is the weak credit numbers, combined with threats to the global economy and so to export volumes and prices, which could lead the Reserve Bank to lower its repo rate next week when its Monetary Policy Committee (MPC) reconvenes.

The SA economy is still operating below its potential growth of about 4% p.a. Lower interest rates would encourage more domestic spending and borrowing and help prevent some further economic slippage (in the form of a still wide gap between potential and actual output that exports cannot realistically be expected to close anytime soon). With an improved inflation outlook it would make sense for the Reserve Bank to do what it can to help sustain domestic spending – the one potentially brighter light in an otherwise difficult economic environment. Hopefully the Reserve Bank will make a similar judgment. Brian Kantor