Published in Sunday Independent November 20th 2011

Brian Kantor

15th November 2011

It is surely clear that the SA economy can do with all the help it might get from lower interest rates. It is not getting that help from the Reserve Bank because the inflation outlook has deteriorated. The inflation outlook however has deteriorated because of a weaker rand. And the rand is weaker for reasons completely out of the influence of the MPC – that is the Euro debt crisis.

The MPC should know but seems not to recognize that interest rate settings in SA have no predictable influence at all on the exchange value of the rand. The correlation between changes in interest rates and the changes in the value of the rand is close to zero- that is there is no observable influence of changes in interest rates on the exchange value of the rand. And therefore interest rates have no predictable influence on the prices paid for imported and exported goods that have such a strong direct bearing on consumer prices in South Africa. Moreover over the past twelve months, since the MPC last cut interest rates, the rand has been all over the place, driving inflation in one and then the other direction.

The evidence is overwhelming, no doubt awful to contemplate for those with a text book view of monetary policy in South Africa is that interest rates and therefore monetary policy settings have not had any meaningful influence on inflation outcomes in SA. And moreover they cannot be expected to have any predictably anti inflationary purpose until the rand responds to SA, rather than global forces. This surely cannot be predicted to happen any time soon.

Like it or not monetary policy can only influence aggregate demand in South Africa. Its impact on the price level has been and will be overwhelmed by moves in the rand. Thus higher interest rates, especially when accompanied by a weaker rand and the higher prices that follow, can only mean less spending and less output and employment in South Africa- without having any helpful influence on inflation or the outlook for inflation that will be dominated by the outlook for the rand. By not lowering rates or even, heaven forbid at this stage of the business cycle, contemplating raising them, because the inflation rate might breach the inflation targets, the MPC has burdened the SA economy with less growth and no more or less inflation.

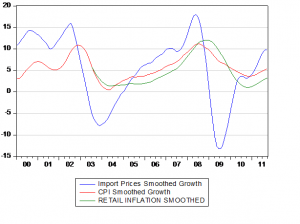

And should the Reserve Bank response to this critique take the form that monetary policy must fight not just inflation but inflationary expectations, it should also be recognized that there is also no evidence of this in South Africa. Inflation may have affected inflation expected in South Africa, even though inflation expected has been remarkably stable, suggesting that such effects have been of small magnitude. But there is no evidence of any feedback or so called second round effects effects. That is more inflation expected leading to more inflation. This has not happened perhaps because the theory is faulty but much more obviously, because inflation in SA follows the exchange rate and does not lead it. ( See Below)

South Africans have been called upon to make sacrifices in the form of slower growth for lower inflation or at least inflation in line with inflation targets that in the light of our recent monetary history make no sense at all. A new narrative for SA monetary policy is long overdue. This does not have to mean more inflation or more inflation expected. This would neither be desirable or inevitable. If the narrative explains the facts of the matter that inflation is dominated by exchange rate movements, over which SA has little predictable influence, and monetary policy was set accordingly, it would mean faster and more sustainable rates of growth. This faster more sustainable and predictable growth would attract more capital to South Africa to fund this growth. This would mean a stronger rather than weaker rand over the long run- and so less rather than more inflation over the long run.

But this narrative would mean recognizing that inflation targeting for South Africa- given the openness of its financial and currency markets to unpredictable global forces – has not been a sound basis for monetary policy.

Retail inflation- led by import prices – a mix of global prices and exchange rates – heading higher