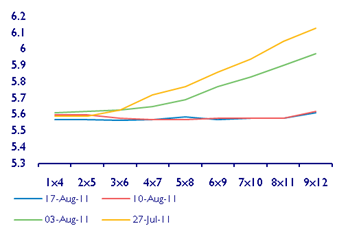

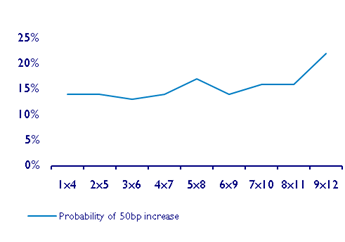

There have been dramatic developments on the SA interest rate front over the past two weeks. The money market, having confidently predicted an increase in short term rates this year or early next year, now very confidently expects short term interest rates to stay on hold for 12 months or more. The figures below tell the story of how the prediction of slower global growth has influenced the outlook for the SA economy and so interest rates. The case for lower interest rates in SA, one we have made for some time, has become even stronger and might in turn become reflected in a negatively sloped rather than flat short term yield curve.

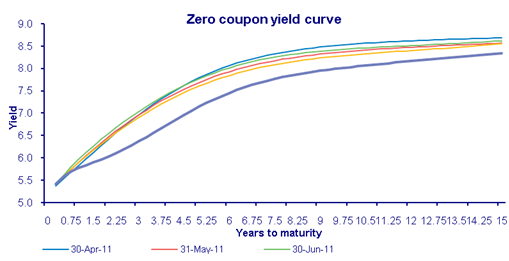

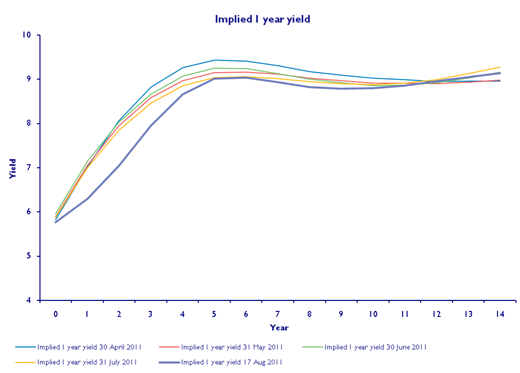

The long term yield curve has also flattened significantly in response to the outlook for lower short term rates. The slope of the long term yield is still positive, indicating that short rates are expected to rise rather than fall in due course. However the one year benchmark interest rate is now only expected to move above 7% in three years’ time. As may be seen in the charts below, the one year rate is now expected to flatten out below the 9% rate in about six years.

The question then arises as to what might cause the yield curve to flatten or steepen in the year to come. Were the global economy to grow faster than is now expected, this surely would be associated with strength in emerging market equities and therefore also in the rand. The outlook for SA growth would improve in these circumstances while the outlook for inflation (given rand strength) would not deteriorate. The yield curve might then shift lower at the longer end and there would be downward market pressure on short rates (which the Reserve Bank might choose to resist).

Were the outlook for the global economy to deteriorate further, there would be additional downward pressure on short rates. The yield curve might well turn negative, should short term rates be expected to decline given slower growth. However the rand is unlikely to be well supported in such circumstances and so the outlook for inflation may not improve if we were to see a combination of a weaker rand and lower global commodity prices, including a lower oil price. These opposing forces (slower global growth plus a weaker rand) will restrain any fall in inflation or inflation expected over the long run and so limit the fall in long term rates. A flat to negatively sloped yield curve might then prevail until the outlook for the global and SA economy improved.

Clearly the combination of faster global growth without more inflation (shielded by a stronger rand) is much to be preferred. However there is one great consolation, should the global economy not help the SA economy along: the danger of an increase in short term rates has passed. The money market is confirming this and the Reserve Bank will indicate as much in due course.