Grim news from the shop keepers

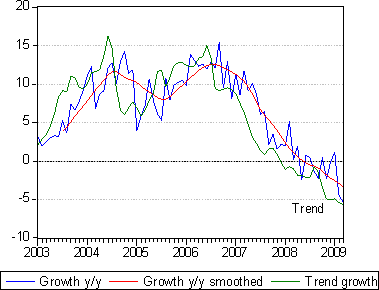

Retail sales statistics were updated yesterday 13 May. The state of the retail sector in March 2009 provides no comfort at all about the state of the SA economy. The statistics indicate that sales adjusted for inflation are still falling at an accelerating rate. Interpreting retail activity is always complicated by the Easter holidays that may come in March or April, as they did this year. We will need to wait for the April numbers to fully adjust for Easter.

The retail activity cycle

Do we believe the retail inflation numbers?

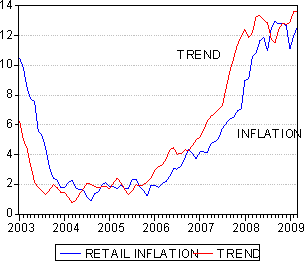

Furthermore the numbers indicate not only very high rates of inflation of retail prices (12.2% pa) but that the retail inflation rate is accelerating rather than slowing down in the face of producer prices that have turned significantly lower. These inflation numbers also seem much higher than the major retailers have reported in their trading and results updates. So it may not be quite as bad on the retail trading floors as it appears from the statistics (See below).

Inflation at retail level

The economy is not only about retail activity – but what exactly is going on?

Activity at retail level cannot tell the whole story about the state of the economy. Household spending, which accounts for over 60% of GDP, is by no means all with retailers and in SA spending on vehicles and transport, including on fuel, is not included in these retail statistics. A further problem is that the statistics that would tell the full story about the state of the economy are only released well after it all has happened. We are now well into May and we are struggling to interpret retail activity in March.

The economic authorities charged with managing the business cycle with interest rate settings are obliged to look over their shoulders as are the businesses making decisions that have to anticipate sales and costs. Investors making judgments about the revenue and earnings prospects of companies have the same difficulty in interpreting the state of the economy and predicting the actions the central bank will take.

Calculating the business cycle; is this a recession?

The official business cycle is called long after the economic events. It is comprised of a very large number of economic time series and when more than half of them point higher or lower the economy is in an expansion or contractionary phase. In the US this task is conceded to the National Bureau of Economic Research. In SA the economists and statisticians at the Reserve Bank call the business cycle.

We have yet to be told that we are in recession and it will be some time before we are told. Though by another measure – two consecutive quarters of falling GDP – we will know soon whether the economy has been in recession when the GDP statistics for Q1 2009 are released later this month.

The Reserve Bank however does publish indicators of the state of the SA business cycle, a coinciding, leading and lagging indicator of the business cycle itself. The coinciding indicator, based on a sub set of seven economic time series, including statistics for employment and capacity utilisation as well as value added outside of agriculture, is however only updated to January 2009. This is therefore very little help in determining the state of the business cycle in May 2009.

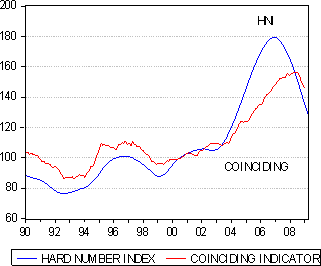

Reviving the Hard Number Index of the SA economy

At Investec Securities we have calculated a much more up to date indicator of the state of the economy. We have called this the Hard Number Index (HNI). It is based on two equally weighted statistics that are available within a week of the end of every month. These are vehicle sales and the notes issued by the Reserve Bank adjusted for Consumer Prices – that is the real note issue. As may be seen below our Hard Number Index tracks the Coinciding Business Cycle Indicator of the Reserve Bank very closely in magnitude and more closely in direction, though as mentioned the Hard Number Index (HNI) is updated to 30 April 2009.

Both indicators of the SA economy are pointing firmly lower. The HNI was pointing lower – indicating that growth was slowing down in Q3 2007, long before the Coinciding Indicator turned down in Q3 2008. If the HNI is a reliable updated indicator of the state of the SA economy the economy is well into a new contractionary phase of its business cycle. It would seem clear from this economic evidence that interest rate settings were not at all helpful in 2007 and 2008. Interest rates were pushed to far and kept up far too long- long after it was clear that economic activity was slowing down sharply.

Indicators of the SA Business Cycle

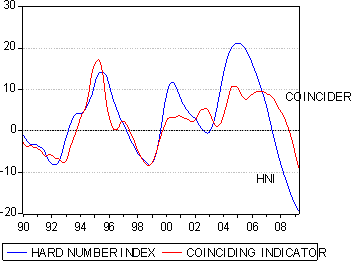

The rate of change of these two indicators is very closely aligned as we also show. This encourages us to believe that the HNI is a very useful leading indicator of the SA business cycle. These series may be regarded as the second derivative of the business cycle – the direction of the rate of growth – or whether growth itself is accelerating or decelerating.

The rate of change of the HNI indicates that not only is the economy in decline but that this decline in economic activity may well be gaining momentum.

Aggressive action imperative and irresistible

The conclusion that has to be drawn is that the SA economy needs all the help it can get. Any complacency about the defensive qualities of the SA economy is surely not encouraged b these statistics. These defensive qualities have yet to be demonstrated. We have long called for significantly lower interest rates. We have recently called for quantitative easing to get the SA banks to lend as normal. If the Hard Number Index is a reliable indicator of the state of the economy the grim facts about the economy cannot be ignored by the Reserve Bank.