The RSA can hope to raise tax revenues at a faster rate and reduce the pace at which government spending is growing to escape the debt trap. Reversing the direction of government spending and revenues is made very difficult by a stagnant economy. But there is also another way. That is to sell assets owned by the government. Not only could asset sales or leases be a source of extra income for government to replace extra borrowing and interest paid, but it could also be a most valuable exercise in the broad public interest. Regardless of how much the asset sales would fetch which after much neglect might need much maintenance and repair.

The assets would be made to work much better in private hands and with private business interests managing the outcomes for a bottom line- as private owners are empowered to do. The assets would come to be worth more and their owners and service providers, including employees, would increase their output. Incomes and taxes. Sadly the status quo, the well rewarded private interests of the managers, workers and especially those of the suppliers of services and goods to the state owned enterprises on highly favourable corrupted terms stand in the way of the pursuit of a broad public interest.

But there is another way. That is to sell assets owned by the government. Asset sales or leases could be a source of extra income for the government to replace extra borrowing and interest paid. Regardless of how much the asset sales would fetch, they would be made to work much better in private hands. The assets would come to be worth more and their owners and service providers, including employees would increase their output. Incomes and taxes paid.

Do the foreign exchange reserves managed by the Reserve Bank on behalf of the government fall into this category of assets that could usefully be sold down? It is possible to hold too much as well as too little gold and foreign currencies on the national balance sheet. They are held as a useful reserve against unforeseeable contingencies. That is a possible collapse of exports or capital inflows, or a flight of capital that would make essential imports unobtainable or foreign debts and interest unpayable.

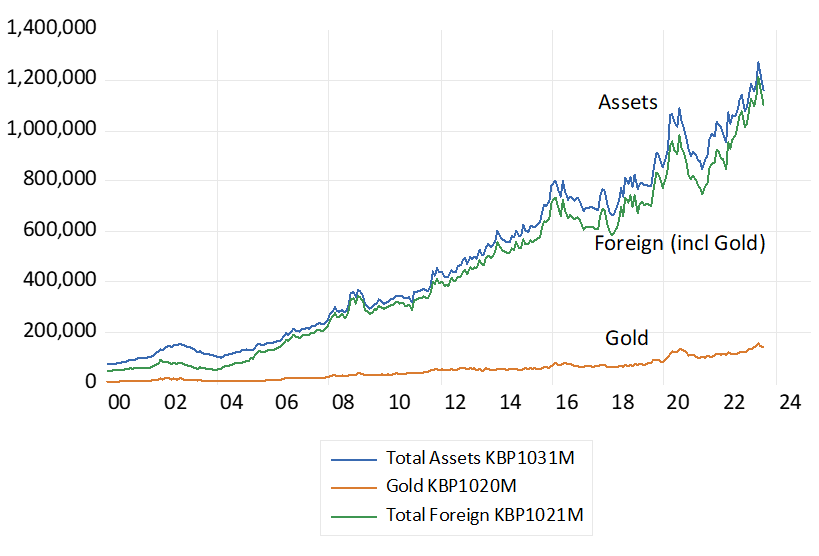

South Africa’s foreign assets have grown strongly over recent years, in current rand value. Since 2010 these reserves have grown from R299 billion to the current levels of approximately R1200b. But when these reserves when measured in foreign purchasing power, in US dollars, while they have doubled since 2010, they still only amount to 62b dollars. There are not many battleships or jet fighters you can buy with that loose change.

Much of the growth in the stock of reserves is the result of a weaker rand. Which is accounted for in the SARB books by mark to market value adjustments of their higher rand values. Which currently have an accumulated value of over R400b. They are described as the Gold and Foreign Asset Contingency Reserve and is recorded as a liability to the Government on the SARB balance sheet. On any consolidated Treasury and SARB balance sheets these assets and liabilities cancel out leaving only the market value of the forex reserves as a net government asset. As SARB Governor has pointed out, these reserves would have to be sold to realize any value.

The other R800 of foreign assets on the SARB balance sheet originally come from the positive flows on the balance of payments when the Reserve Bank buys dollars in exchange for deposits in rands at the Reserve Bank. The extra foreign asset held by the SARB is then held in the form of a dollar or other foreign exchange deposit in a foreign bank. The extra liability is a (cash) deposit at the SARB.

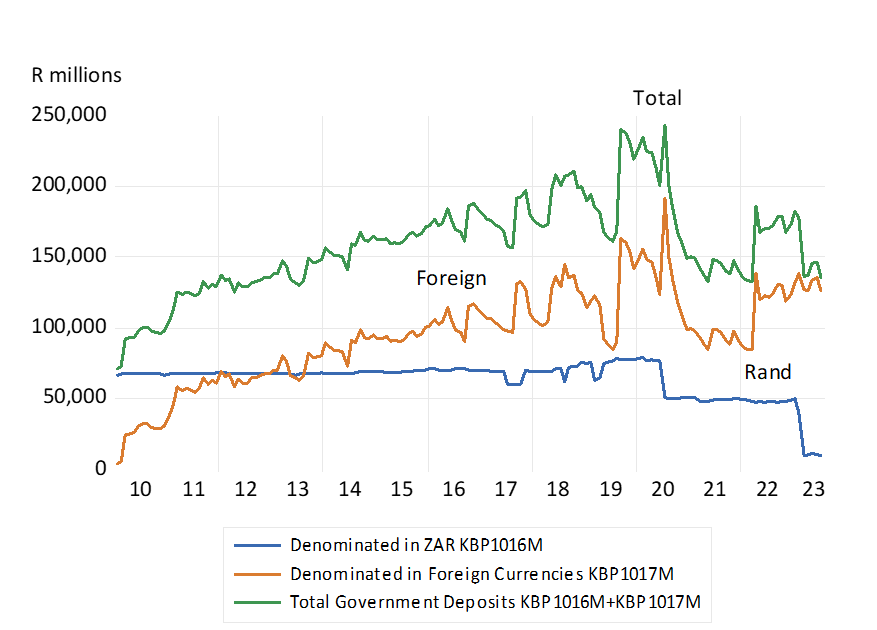

In recent years the source of extra dollars supplied to the SARB is very likely to have come from the Government Treasury rather than the private banks and their customers. A flexible exchange rate will have balanced the supply of and demand for foreign currency transactions that originate in the private economy. The extra dollars acquired by the Treasury will have been borrowed by the government offshore or have been the result of flows of foreign aid or concessionary finance provided SA. And then sold by the Treasury to the Reserve Bank for an additional credit on the Government Deposit Accounts with the SARB.

The Gold and Foreign Assets of the South African Reserve Bank. R million

Source; SA Reserve Bank and Investec Wealth and Investment

It is striking how rapidly the Government Deposits with the Reserve Bank, deposits denominated in foreign currencies and rands grew since 2010. Though these cash reserves peaked in 2020 at close to R250b and have been drawn down sharply in recent years. It may be asked why these cash reserves need to be as large as they are? Why expensive debt must be raised by the government to hold cash.

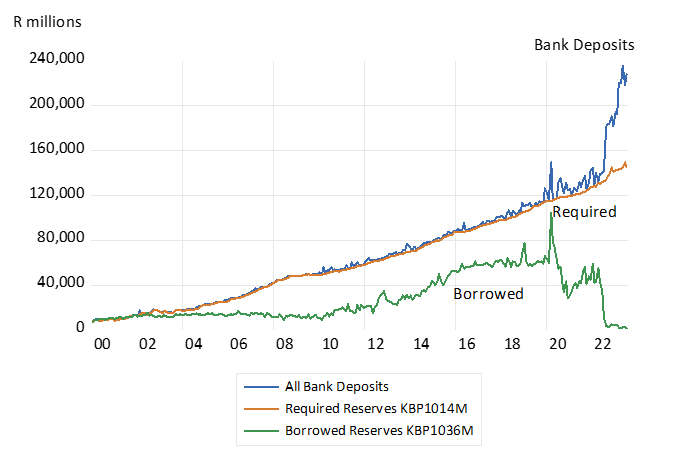

Yet running down the Treasury deposits to spend in SA increases the cash reserves of the banking system. The SA banks now hold large amounts of excess cash reserves- upon which they earn now high market related interest rates. Should however the banks turn the extra cash into extra bank lending the supply of bank deposits, the money supply, will grow rapidly and encourage inflation. It is a possibility that will bare close attention.

SA Government Deposits with the South African Reserve Bank

Source; SA Reserve Bank and Investec Wealth and Investment

SA Private Banks; Required and Actual Deposits with the Reserve Bank and Cash Reserves Borrowed (to August 2023)

Source; SA Reserve Bank and Investec Wealth and Investment