The financial markets have been roiled by the prospect of recession in the US. The market makers fear that the Fed, having allowed prices to explode in the US will now reverse course abruptly enough to bust the economy. They are right to worry.

Managing the level of demand in an economy well enough to exercise the full potential of an economy – and to avoid continuous increases in the price level, inflation, or its opposite deflation, is a central bank ideal. The more stable the environment, the more accurate become the plans of business, the more predictable their earnings and their values- and vice -versa.

The reality is often very different. The proclivity of central banks to exaggerate the swings of the business cycle is a constant danger to businesses and investors. In some senses the fear of recession may be more disturbing than recession itself. Were a recession to seriously threaten the US economy any time soon, policy determined interest rates in the US would not rise as much and soon go into sharp reverse and equity and bond valuations would rerate on improving prospects. Sell the rumour (of recession) – buy the facts (a recession itself) might well be an appropriate strategy for turbulent times.

The intention of central bank policy interventions should be to smooth the business cycle, avoiding booms and busts – while containing inflation. Central banks can hope to do this by anticipating and then influencing aggregate spending- over which they claim influence. And to ignore temporary supply side shocks (exchange rate or food or energy price shocks for example) that may also cause prices to rise and fall.

Policy settings should not add higher interest rates to the downward, recessionary pressures on demand when prices have risen temporarily. Or vice versa when the supply side of the economy (lower prices) are stimulating demand to lower the cost of credit to push spending still higher. Navigating successfully between supply side shocks- with a temporary impact on the price level – to be ignored – and actions that could cause continuous rises in prices, permanently excess spending- to be actively countered is the true art of central banking. Highly relevant also for the SA Reserve Bank that wrongly believes temporary price increases lead to permanently higher inflation.

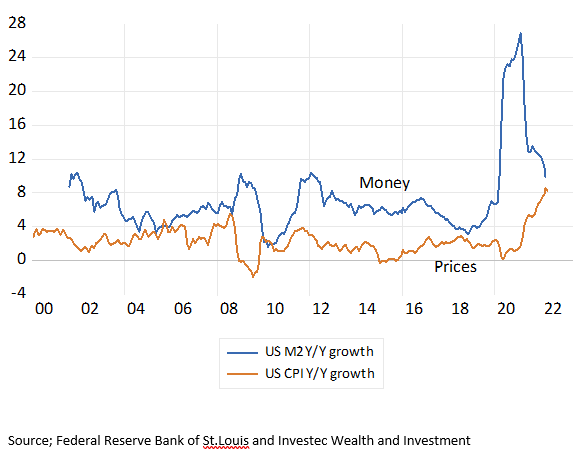

The impact of an extraordinary surge in demand to counter Covid on prices, led by an even more extraordinary increase in the money supply, should not have been anything like the surprise it was inside and outside the FED. The growth in the money supply (M2) peaked at an mind blowing 27% in early 2020. Any sense of monetary history would have regarded much more inflation as inevitable.

The Fed and market watchers had been lulled into ignoring the growth in the money supply and bank lending by years of modest and declining growth in the money supply since 2010 – with declining rates of inflation. Though this record is not without serious blemishes. The run up in money and bank credit growth prior to the GFC should surely have been avoided- as should the abrupt decline in money growth that exaggerated the post GFC recession.

US Money Supply (M2) growth and inflation 2000-2022

Source; Federal Reserve Bank of St.Louis and Investec Wealth and Investment

The Fed should be paying the closest possible attention to the current trends in money supply and bank credit growth and set its interest rates accordingly. It should be aiming to stabilize money supply growth at about 6% a year- consistent with average inflation of 2% a year as was the case to 2019. And to reach that goal – from the current 10 to 6 per cent p.a. growth – as gradually as possible. It should communicate clearly that both money supply and prices are heading in that direction. And that higher prices have already restrained the demand for goods and services.

The marketplace should be paying the same close attention to the growth in the money supply and in bank lending as a leading indicator of the state of the economy. Readings sharply below 6% p.a. growth in the money supply will give ample warning of trouble to come.

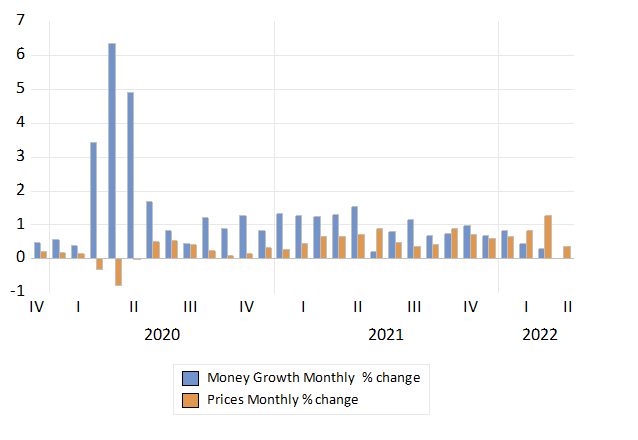

Monthly % Growth in US Money Supply (M2) and Consumer Prices