The financial market reactions to the US CPI news on 13th September provides an extreme example of how surprising news plays out in the day-to-day movements of share prices, interest and exchange rates. The key global equity benchmark, the S&P 500 lost nearly 5% of its opening value after the announcement that inflation in August had been slightly higher than expected. Implying that the Fed that sets short term interest rates in the US would be more aggressive in its anti-inflationary resolve, making a recession inevitable and more severe.

By the recent trends in GDP the US economy was already in recession despite a fully employed labour force. Recession without rising un-employment would have been unimaginable before the Covid lockdowns. The Fed failed to imagine the inflation that would follow the stimulus it, and the US Treasury, had provided to the post covid economy and this has become the problem for investors and speculators required to anticipate what the Fed will be doing to protect the value of the assets entrusted to them.

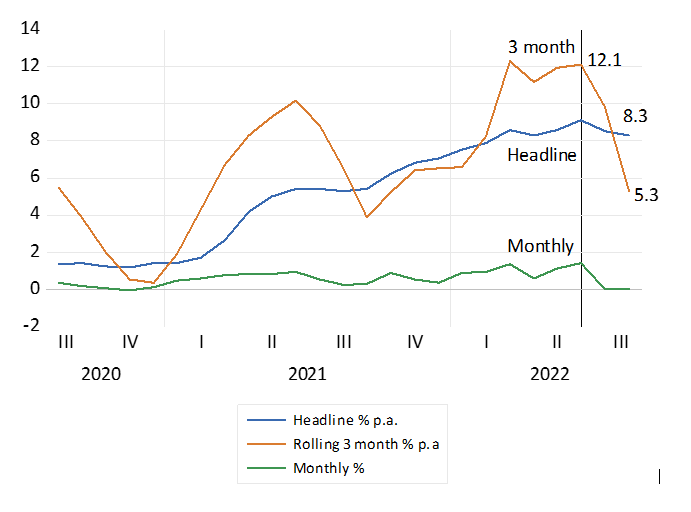

Yet it should be recognized that the US CPI Index in fact is no longer rising – average prices fell marginally in August as it had done the month before. But perhaps not as much as had been expected. The headline inflation rate- the rate most noticed by the households and the politicians had reached a peak of 9.1% in June and has since fallen to 8.3% as the CPI moved sideways. The increase in prices over the past three months was lower – 5.3% p.a.

Inflation in the US. Headline % p.a. Monthly % and three monthly % p.a.

Source; Federal Reserve Bank of St.Louis, Investec Wealth and Investment

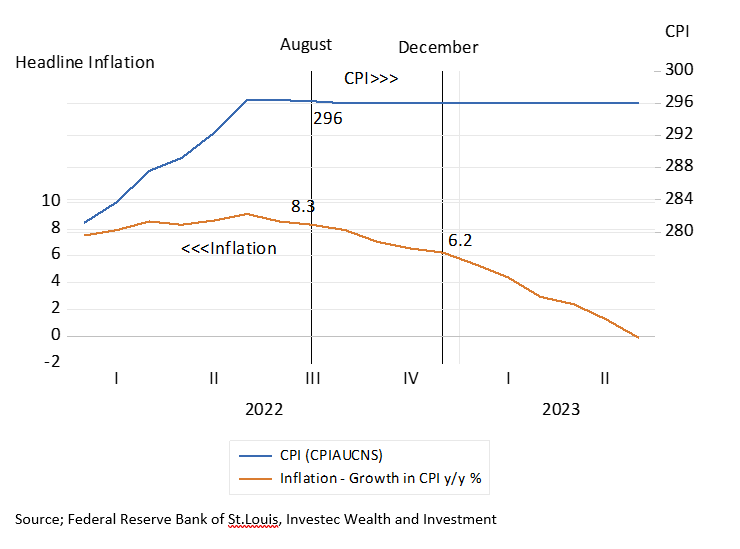

Yet even if the average prices faced by consumers stabilized at current levels until June 2023 the headline rate of inflation would remain elevated- at 6% p.a. by year end and could return to zero only by June 2023. One wonders just how realistic are the Fed’s plans to reduce inflation rates in shorter order. Patience is called for

The outlook for Inflation if the US CPI stabilized at current levels.

Source; Federal Reserve Bank of St.Louis, Investec Wealth and Investment

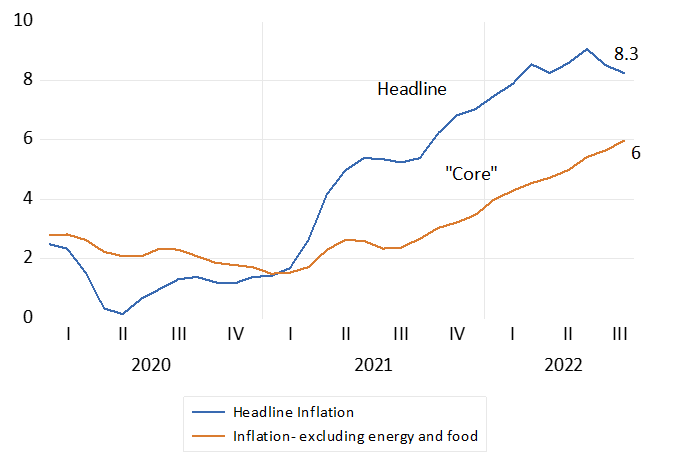

The true surprise in the inflation print was the trend in prices that exclude volatile food and energy prices. It was these supply side shocks to prices that had helped to drive the index higher and they are reversing sharply. However, the inflation of prices, excluding food and energy remains elevated. They are now 6% ahead of price a year ago. The Fed is known to focus on core rather than headline inflation.

Headline and “Core” inflation in the US

Source; Federal Reserve Bank of St.Louis, Investec Wealth and Investment

The largest weight in the US CPI Index is given to the costs of Shelter. They account for over 32% of the Index of which 28% is attributed to the implied rentals owner occupiers pay to themselves. The equivalent weight in the SA CPI is much lower – 13%. Where house prices go – so do rents – and the implicit costs – rather the rewards – of home ownership – and inflation. But surely the reactions of those who own more valuable homes are very different to those who rent? Higher explicit rentals drain household budgets – and lead to less spent on other goods and services- and are resented accordingly as are all price increases. Higher implicit owner-occupied rentals do the opposite. They are welcomed and lead to more spending and borrowing. House price inflation in the US has been very rapid until recently- and rents may be catching up- meaning higher than otherwise inflation rates.

Prices always reflect a mix of demand and supply side forces. But ever higher prices- inflation – cannot perpetuate itself unless accompanied by continuous increases in demand. It is the impact of higher prices on the willingness and ability of households to spend more that is already weighing on the US economy. Incomes are barely keeping up with inflation. And the supply of money (bank deposits) and bank lending in the US has stopped growing further constrains spending. If inflation is caused by too much money chasing too few goods the US is already well on the way to permanently lower inflation. The danger is that the Fed does not recognize this in good time – and as the market place fears.

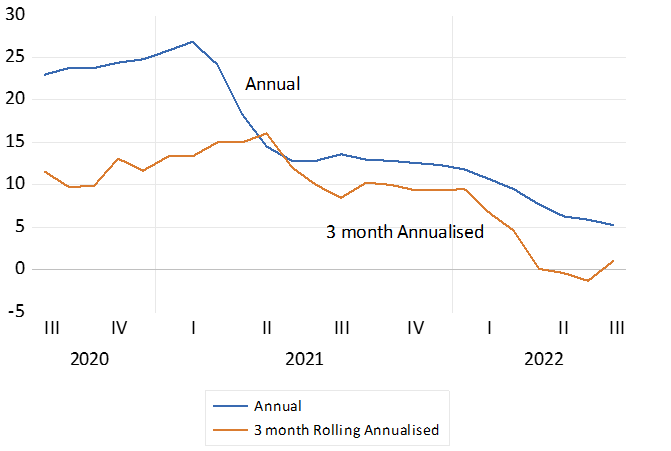

US Money Growth (M2 seasonally adjusted)

Source; Federal Reserve Bank of St.Louis, Investec Wealth and Investment