Brian Kantor, 7th March 2024.

Lenders demand compensation for expected inflation with higher interest rates and borrowers are willing to pay more when higher prices are expected to erode their real borrowing costs. Interest rates, after inflation, therefore reveal the real rewards for saving and the real cost of issuing debt. Real interest rates in SA have remained elevated, even as inflation has receded. Since 2000 the real income owning a RSA 10 year Bond has averaged 3.7% p.a. while a US Treasury has offered on average less than 1% p.a. The current RSA-USA 10 year real yield gap is a large 6% p.a.

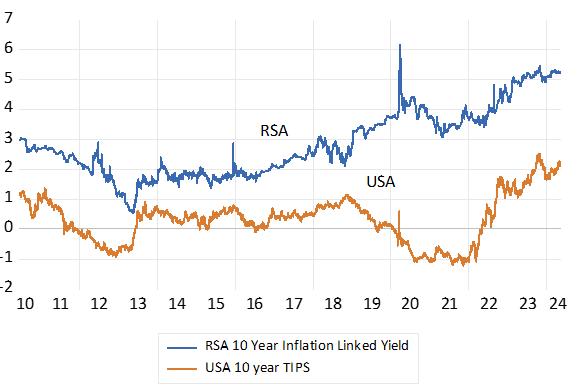

Real (after inflation) Long term Interest Rates in SA and the USA

Source; Bloomberg, Federal Reserve Bank of St.Louis, SA Reserve Bank, Investec Wealth & Investment

With the advent of inflation protected government bonds, lenders can now avoid exposure to uncertain inflation. They can buy a bond with a guaranteed real return. That is receive an initial yield to be augmented by actual inflation. Since 2010 the RSA ten-year inflation linker has offered an average real 2.84% p.a. compared to an average 0.32% p.a. for the US equivalent. This real yield gap has widened significantly as RSA real yields have risen. The RSA inflation linked ten-year bond currently offers an imposing 5.3% compared to 2.1% for the US TIPS- a real spread of over 3% p.a. Capital is really very expensive in SA and discourages capex.

Real Inflation Protected Yields in South Africa and the US. 10-year Government Bond Yields

Source; Bloomberg, Investec Wealth & Investment

Why has this high 5.3% p.a. real yield not attracted more investor interest and a higher value? It is a rand denominated bond with no default risk- and no inflation risk. To which the equivalent vanilla bond is subject to – and at worst should inflation accelerate – to the effective expropriation of wealth tied up in a bond. The current yield on an equivalent vanilla bond is now about 12% p.a. Time will tell whether it delivers a real return in excess of the certain 5.2% on offer from the inflation linker.

All the RSA bond yields are connected and elevated by expectations of rand weakness. That reduces the expected dollar returns for any foreign investor. The weaker expected course of the rand is revealed by the positive difference between RSA and USA interest rates over all durations. This carry, or equivalently, the actual or potential cost of hedging or compensating for exposure to the rand, reduces the actual or expected dollar returns on SA debt held by foreign investors who are an important source of capital for the RSA. It is expected returns in dollars not rands, even inflation adjusted rand income, that guides their investment decisions.

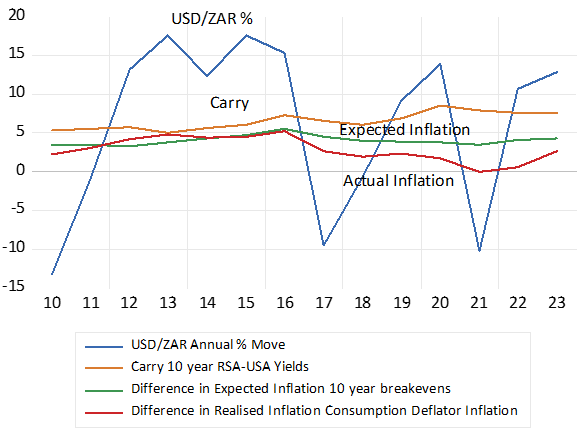

This carry, is moreover consistently wider than the difference in actual and expected SA and US inflation. One might surmise that movements in exchange rates equilibrate differences in inflation between trading partners, to help level the foreign trading field. But this has not at all been the case. Since 2010 the highly volatile USD/ZAR has weakened on an annual average rate of a 6.3% p.a. The comparatively stable ten-year carry has averaged 6.53% p.a. while the difference between expected inflation in SA and the US, has averaged a consistently lower 4% p.a. While the difference in realised inflation in SA and the US has averaged a mere 2.9% p.a. Persistently lower SA inflation will therefore require not only less inflation but also less expected exchange rate weakness, that is a narrower carry.

Interest and Exchange Rate Trends. Annual Data

Source; Bloomberg, Federal Reserve Bank of St.Louis, SA Reserve Bank, Investec Wealth & Investment

A stronger rand and a stronger rand expected, can only come with faster real growth. The Reserve Bank has limited influence on growth enhancing supply side reforms including any predictable influence on the exchange rate with its interest rate settings. It should manage the demand side of the economy, so that demand, under the influence of real short term interest rates, does not exceed potential local supplies, nor fall short of them, to put avoidable domestic pressure on prices and incomes. The Bank could now help growth and the foreign exchange value of the ZAR by reducing what are very high nominal and real short term interest rates that have throttled domestic spending.