In years to come the 2023-24 years will be recognized as very special ones for share owners. Something to toast over what may prove to be an equally special Grand Cru. One that, thanks to the exceptional draw up in market values, has become more affordable to the patient investor. A case of what the wine cognoscenti might describe as linearity- from much extra wealth created to the wine cellar. Though why a straight uncomplicated line from lips to throat, should be regarded as an attribute of a fine wine escapes me. I thought one pays up for complexity in wines, never simply described.

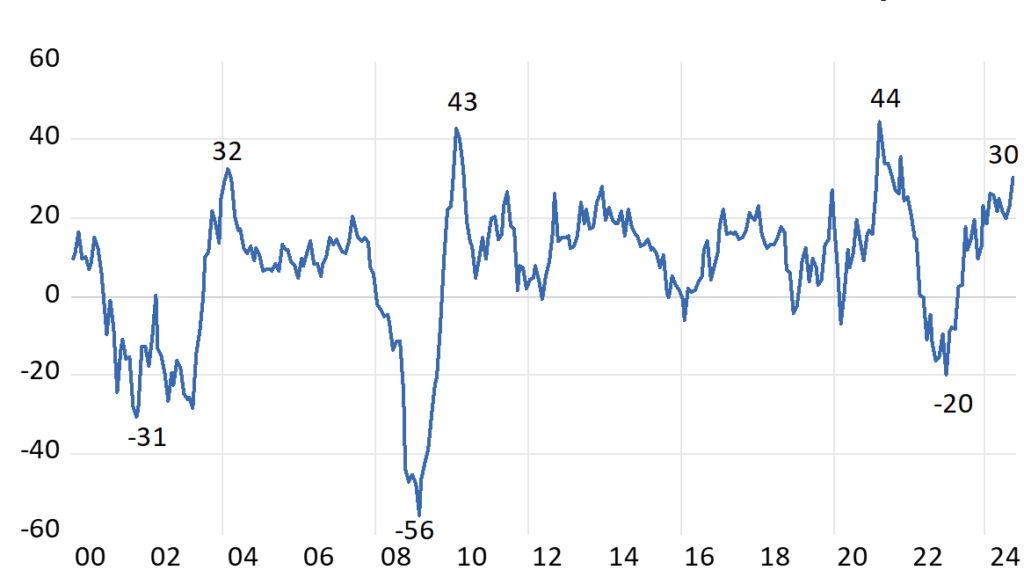

This past year the S&P 500 delivered the best annual returns this century. Comparable to the recovery from the panic drawdowns of 2008 (GFC) or 2020 (Covid) The Index, up 30 % in the twelve months to September 2024 was very generously valued a year ago -at 21 times earnings. It is now even more expensive and valued at 25 times reported earnings. The average S&P P/E since 2000 has been 19.7 times. Unusually It has not taken a draw down to lead a strong recovery. This time has been different. Strength on Strength.

The S&P 500 Index Annual Returns – calculated monthly 2000-2024

Source; Bloomberg and Investec Wealth and Investment.

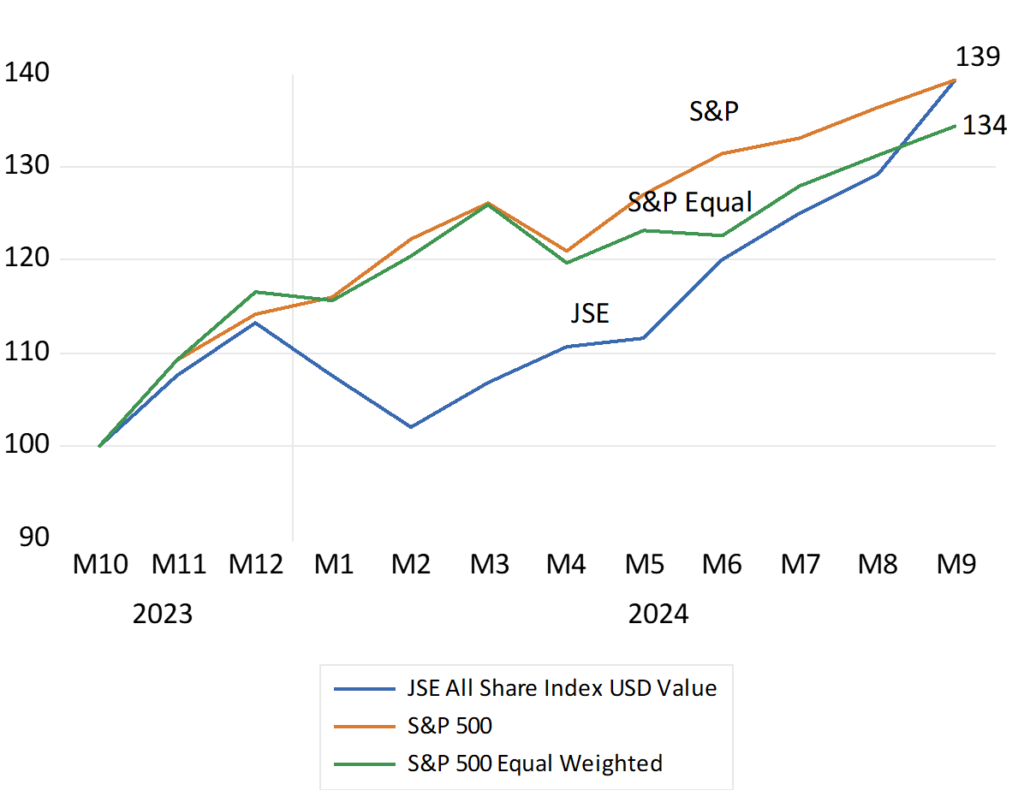

The upward direction of the S&P Index recently has been dominated by a few stocks- the so described magnificent seven- making the Index unusually concentrated, less diverse and therefore more risky than usual. The top three by market value Microsoft Corp., Apple, Inc., and Nvidia Corp., constituted 20% of the S&P 500 this year, while the top seven stocks accounted for 32%.

Yet while the S&P 500 is up 22% this year to September, the equal-weighted S&P 500, the average listed company, is up by less – a mere 14.9%. During the first half of the year, the S&P 500 rose by 15.2%, and by 5.9% in Q3, while the equal-weighted S&P 500 increased by only 5% over the same period. This greater than 10% performance gap between the weighted and unweighted indices was the widest in nearly 30 years. Only about a quarter of S&P 500 stocks kept pace with the market’s overall return during the first half of this year, with over a quarter experiencing negative returns. If you did not own the very largest stocks and own them in size, you likely underperformed the indices. Risk (less diversification) and return were as usual well correlated.

The “magnificent seven” and so the market are valued for the prospective growth in the demand for artificial intelligence that they supply the backbone for. But their investment case so strongly appreciated will only be fully revealed over time. This makes their valuations less dependent on near term earnings and so on the essentially short-term business cycle. They are valued much more idiosyncratically than your average value company on their own recognizances. They have also grown earnings and cash flows at well above the average rate to date. These super growers with impressive track records are allocating truly massive volumes of internally generated cash flows to supplying the essential facilities that the average firm will be drawing upon and hopefully paying up for. They also have the financial strength to pay dividends and buy back shares. In contrast, the average S&P 500 company is valued more heavily on the short-term outlook for the U.S. economy. About which there has been and perhaps will always be considerable uncertainty.

The S&P 500 Index, the equally weighted S&P Index and the JSE All Share Index. Total returns to October (2023=100) USD Values

Source; Bloomberg and Investec Wealth and Investment.

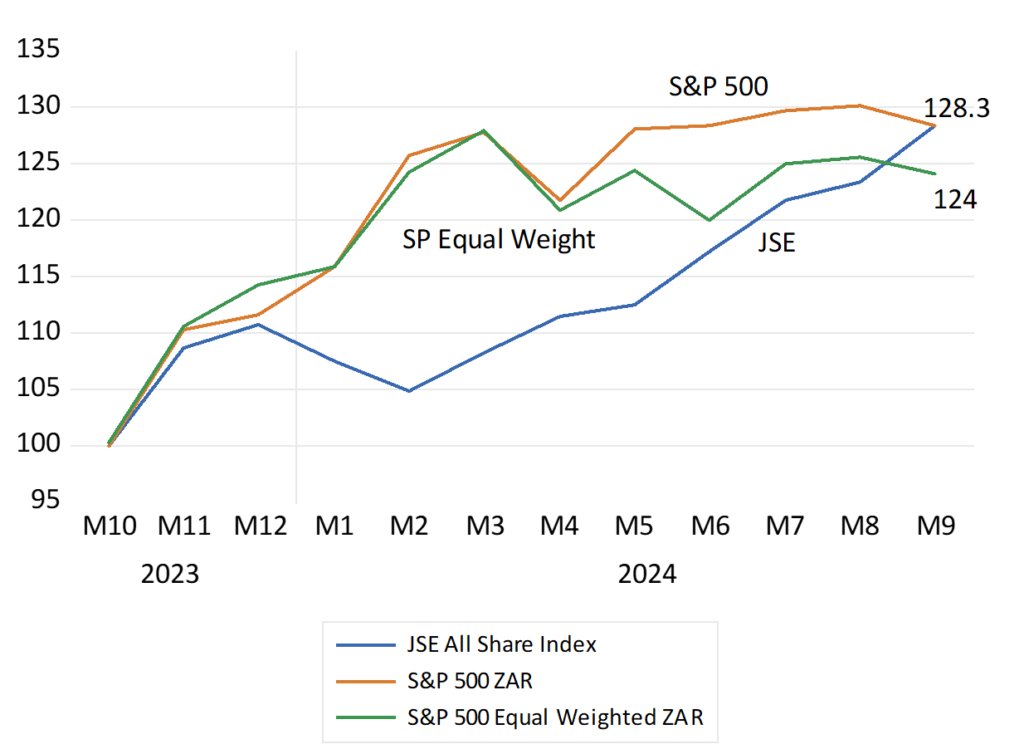

The JSE has also enjoyed a very good year. Up by as much as the S&P since October 2023. 40% in USD and still impressively 28% higher in the mighty ZAR. The JSE All Share Index measured has added as much to SA portfolios as would have holding the S&P Index. A wealth adding outcome for old-fashioned reasons. The prospect of faster growth has fired up the share market and the value of RSA bonds and the exchange rate. Less inflation, lower interest rates and faster growth in GDP and government revenues has been very heady stuff. Enough perhaps to add to the prices bid at the Wine Guild Auction and deserving of an early toast to the GNU.

The S&P 500 Index, the equally weighted S&P Index and the JSE All Share Index. Total returns to October (2023=100) Rand Values

Source; Bloomberg and Investec Wealth and Investment.