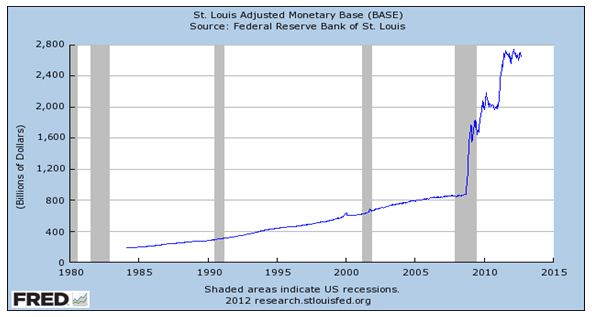

The scale of QE3, that is of further money creation in the US, the promise of an extra injection of US$85b into the US monetary system each month for as long as it takes until the unemployment rate normalises, is impressive indeed. It comes after QE1 and QE2 that has seen the US money base increase enormously from about US$800bn before the financial crisis to nearly US$2.6 trillion today.

The money base, adjusted for reserve requirements, is dollars in the form of greenbacks issued by the Federal Reserve System held by the public and the banks, not only in the US, but all over the world and in the form of deposits held by US banks, which are members of the Federal Reserve System, at their Federal Reserve Banks. Almost all of the extra deposits held by these banks are in excess of the requirement to hold a certain ratio of cash as required reserves. US banks that held no excess cash reserves before the crisis are now hoarding well over $1 trillion of excess reserves.

Fed chairman Ben Bernanke would much rather have these banks reduce their excess cash by making more loans or buying more assets in the market place. This would be good for the US economy, which suffers from too little demand to engage all its available resources, especially potential workers, many of whom have withdrawn from the labour market and no longer seek jobs. Pumping money into the system is meant to encourage more lending and spending. As may be seen in the figure below, the money base, despite all the prompting it has had, stopped growing in mid year. Hence the case for still more cash – cash that costs the Fed almost nothing to create and might yet do much good.

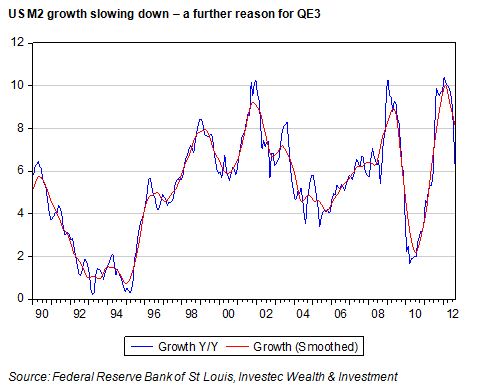

The injections of cash into the banking system have not been without impact on the broader definition of money, M2, which incorporates almost all of the liabilities of the banking system (mostly deposits with retail banks), and which has been growing strongly. This has been helpful for spending growth. However M2 growth also appears to have peaked and is tapering off. This too would concern Bernanke.

Creating cash is intended to increase the supply of money and bank credit (which it has done) but a faster rate of growth would be better under current circumstances. A further reason for QE3 would be to encourage M2 and bank credit growth to accelerate rather than decelerate (see below).

Bernanke will be doing all he can and he has considerable power to issue cash without limit: he can thus keep interest rates down all along the yield curve. This is until and maybe beyond the time that the Fed is confident the economic recovery is gathering strong momentum and unemployment normalises. What he will also be considering is to no longer offer the banks interest on their deposits with the Fed. This might encourage the banks to use rather than hoard their cash. The markets will to judge when rapid growth in central bank cash starts to succeed too well in preventing deflation and in stimulating economic activity and becomes inflationary (as history teaches it always does).