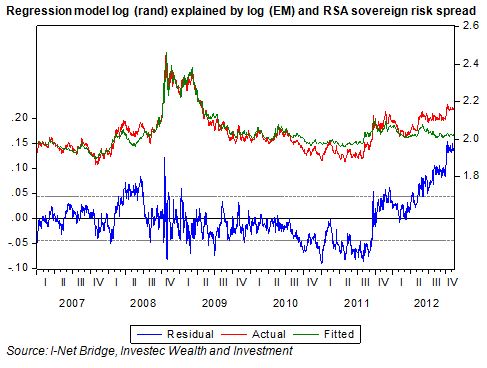

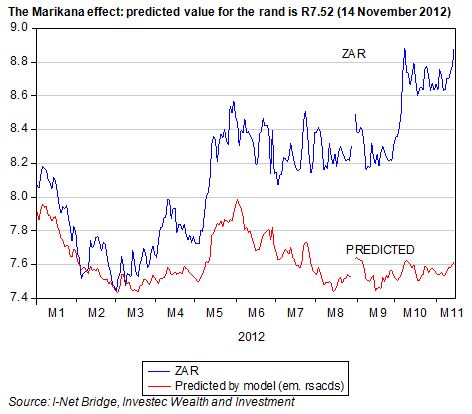

The troubles on the mines and now the farms of SA have hurt the rand. The rand is now significantly weaker than would have been predicted given the behaviour of emerging market equities and RSA sovereign risk spreads.

These two factors provide a very good explanation of the rand/USD exchange rate on a day to day basis. As we show below, the rand is about 12% weaker than predicted by this model of the rand.

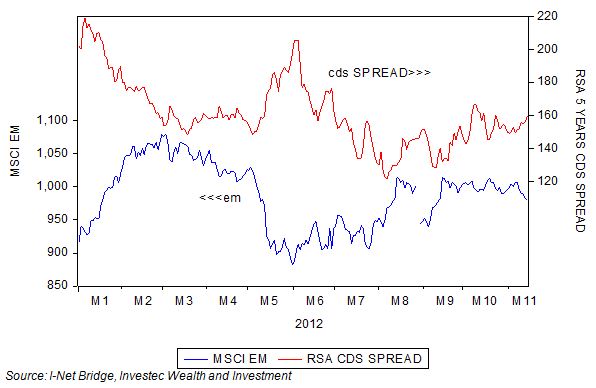

As may be seen below, the MSCI emerging market index has held up over recent months, as has the cost of insuring against a default on RSA foreign currency denominated debt with a five year credit default swap.

However, as may also be seen, RSA debt has derated in recent months. Compared with Turkish, Russian. Brazilian or Mexican debt, the costs of insuring RSA debt has become relatively more expensive.

Yet compared to the past, the SA risk spread remains very low by its own standards, at 150bps above the returns on US five year debt.

The exchange value of the rand will continue to be driven by global economic forces, as revealed by: the value of emerging market equities, the risks associated with SA (shown in the debt markets) and now also by SA specifics in the form of strike action. The markets will assess not so much the incidence of strike action, but its expected impact on the economy, notably exports and domestic economic activity. The challenge for the SA government is to reform its system of labour relations to make strike action less likely and less violent; and employment growth more likely. Brian Kantor