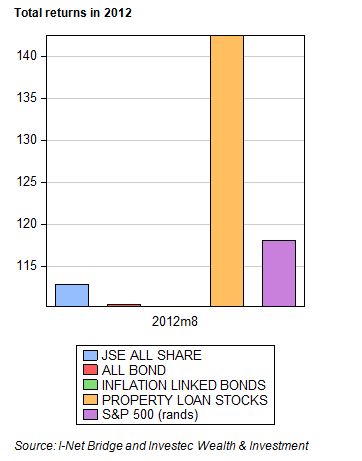

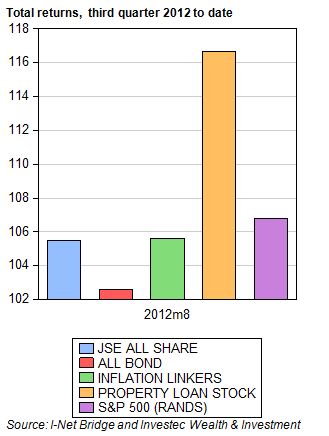

The Property Loan Stock (PLS) Index has again performed outstandingly well this year to date, realising returns of over 40%. It has also enjoyed an exceptionally good quarter to date with returns of over 16%. The Index has moreover significantly outperformed the bond market as may be seen below.

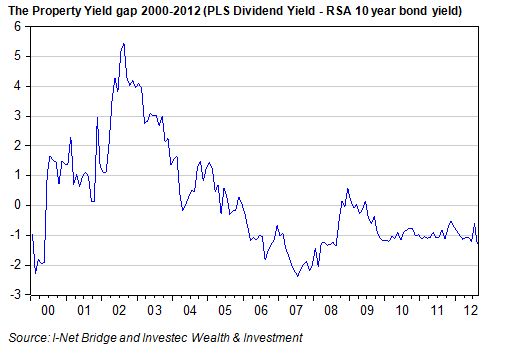

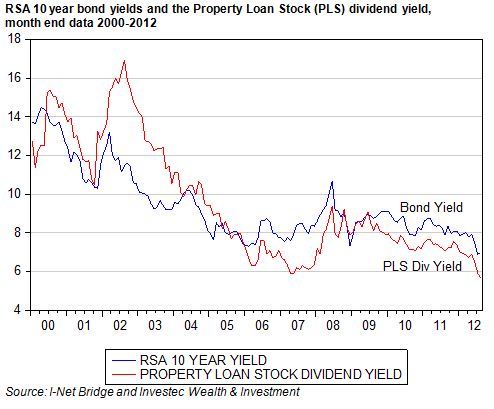

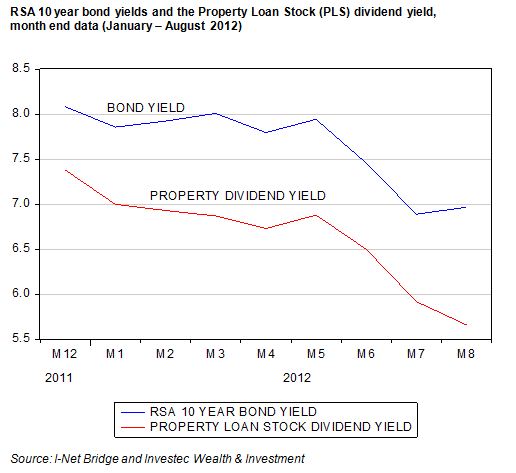

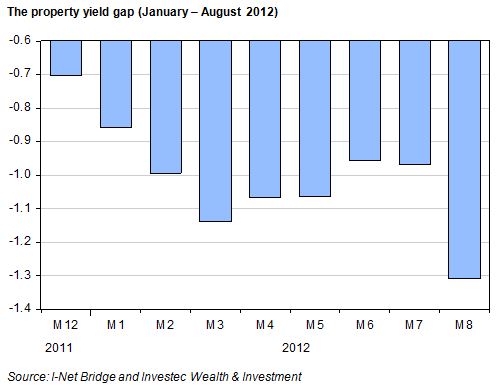

The gap between RSA bond yields and the trailing dividend yield on the PLS Index may be regarded as a way to rate the listed property market. One can presume that the lower this difference in yields (currently negative), the superior the rating enjoyed by the property stocks. Presumably also, the lower the trailing dividend yield on the PLS Index, then the faster the dividends paid are expected to grow.

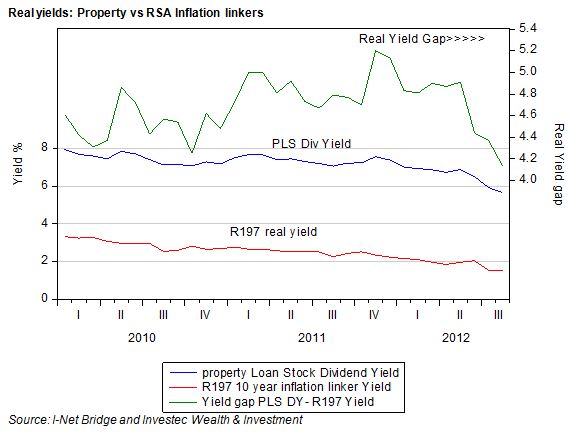

As we show below the yield gap between RSA bond yields and the initial trailing property dividend yield has narrowed markedly over the years. This yield gap stabilised at about a negative one per cent per annum after 2008, indicating very little of a rerating until very recently, when over the past month, the yield gap narrowed sharply (that is became distinctly more negative) to the advantage of PLS valuations.

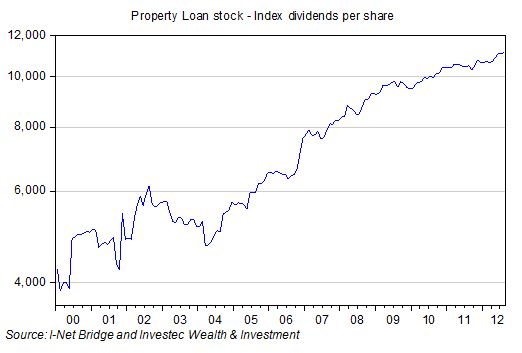

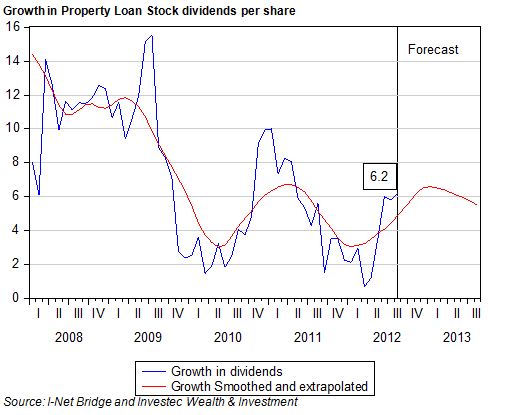

In the figures below we show the performance of the PLS in the form of index dividends per share as well as the growth in these distributions. These dividends have grown consistently and continued to increase through the recession of 2008-2009. Their growth was particularly rapid in 2008. Growth in dividends fell off in 2009 and has since managed to keep pace with inflation. Real CPI adjusted PLS dividends have stabilised since 2008 and are expected to continue to do so. Nominal dividends are currently growing at about 6% per annum – compared to inflation (currently about 5%) and is expected by the bond market to average about 6% over the next 10 years.

The current PLS trailing dividend yield of 5.66% represents a record low. Should PLS dividends continue to match inflation (as they are confidently expected to do at least for the next two years) this would correspond to a real yield of the same 5.66%. We have long argued that a real yield of 5% should be regarded as appropriate for the sector, given its risk character.This real 5% would represent an expected risk premium for investors in the PLS Index of about 2% over inflation linked government bonds that normally could be expected to offer about a real 3%.

Current RSA inflation-linked yields have however fallen far below the 3% real yield that might be regarded as a normal real return on a default free, inflation risk free government bond. The yield on the 10 year RSA197 has however fallen to a record low 1.53% real yield.

Compared to a certain real 1.53%, a prospective 5.7% real yield from the PLS Index may still appear attractive. If dividends distributed keep pace with inflation, this initial 5.7% converts into a real 5.7%. This prospective extra real return over and above the return on the government inflation linked bond (currently about 4%), may still seem be more than enough to cover the risk that PLS dividends will not be able to keep up with inflation. This extra 4% real risk premium is still well ahead of the 2% risk premium (5% less the normal 3%) that we have argued should be sufficient to the purpose of attracting funds to the PLS sector.

The conclusion we come to is that until real interest rates on the long dated inflation linkers in SA normalise towards the 3% p.a rate, the PLS counters (that promise a real return of over 5% per annum) may still appear attractive. Brian Kantor