What should investors wish of the companies they own a share of? Ideally their management is able to generate an (internal) rate of return on the shareholders capital they invest that is in excess of the opportunity cost of that capital. The larger the excess returns, the more capital the company would be encouraged to invest and the more the share market will approve of such growth over time.

This capital could be raised from operations, from issuing additional shares or by borrowing. As the company expands by undertaking value adding capital expenditure, it can be expected that the gap between the internal rate of return and the cost of capital would narrow. The potential value to be added for shareholders is a multiple of the amount invested and the spread between the internal rate of return from capital invested in working and fixed capital and the opportunity cost of that capital. The objective of the company should be to maximise the value add, not the spread between internal and required rates of return. We would suggest that the required rates of return would be about 4%-5% above the rate of interest on an RSA long dated bond. This is a lower risk premium for food retailers and higher for credit providing retailers.

SA retailers have proved highly capable of generating very high internal rates of return from their businesses. Returns realised on equity capital by listed retailers and their market-to-book values are impressively high. The share market has also registered its approval by raising the price to earnings (PE) multiples of listed retailers. The following table taken from Bloomberg indicates the range of outcomes for listed JSE retailers. Market price-to-book values range from over 9 times for Woolworths, Shoprite and Mr Price to under two times for furniture retailers. Return on book equity ranges from nearly 50% to about 20% and the PE multiples range from eight to 22 times reported earnings.

Clearly not all retailers are equal. Given the excess returns potentially available to retailers, those best able to undertake additional value adding capital expenditure for shareholders should be prized above others. If they lack such opportunities, the best they can do for shareholders would be to return capital to them either via the dividend route or through share buy backs.

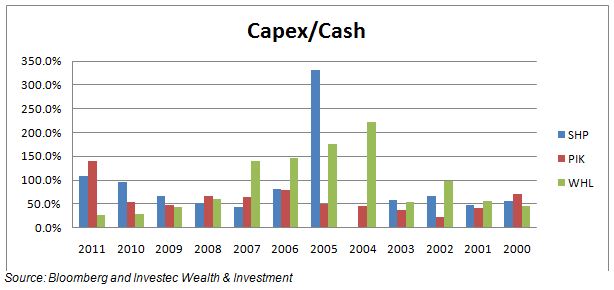

We have compared three leading retailers below. We compare and examine Shoprite (SHP) Pick and Pay (PIK) and Woolworths (WHL) on two dimensions: by cash flow over capital expenditure and sales; and by growth in capital expenditure. Ideally the more capex relative to cash flow the better it is for shareholders on the assumption that the returns will exceed the cost of capital. If cash flow exceeds capital expenditure then cash will have been used to pay back debt, pay dividends or buy back shares. These are signs that management lacks the confidence or the ability to realise value adding capital expenditure.

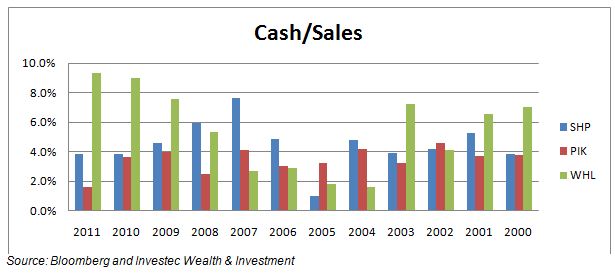

The cash to sales ratio indicates the ability of the respective retailers to generate cash from current operations and the growth in capital expenditure provides a leading indicator of future growth. At the operational level, SHP has generated significantly more cash per unit of sales than PIK over all years since 2000 except for 2005 and 2002, by a small margin. WHL has performed much better than SHP over recent years in terms of cash flow per unit of sales, though it lagged behind SHP between 2004 and 2007.

These three retailers seem generally unable or unwilling to undertake capex in excess of cash flow, with the notable exceptions of SHP in 2005 and WHL between 2004 and 2007, when capex exceeded 100% of cash flow. No doubt the improved operational performance of WHL in recent years has had something to do with the capex undertaken earlier. What may also be important is that PIK in 2011 increased its capex to more than 100% of cash flow – something that it conspicuously failed to do before.

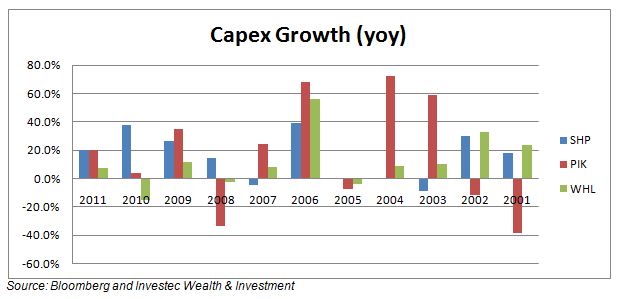

The growth in capital expenditure shows an uneven pace: SHP and WHL score better than PIK in this growth league.

It will be clear that SHP has been doing much more of the good stuff for shareholders than PIK. WHL has also been competing strongly with its expansion plans. PIK has lagged behind and is, by all accounts from management and its board, playing catch up (as it needs to do if it is to compete effectively).

The recent capital raising exercise by SHP, when it raised about 10% of its market value with new debt and equity, puts it in a strong financial position to fund growth. The share market is pricing all these retailers for strong growth, as indicated by current valuations, market-to-book and PE ratios. They will have to run hard and continue to grow fast to satisfy demanding market expectations. Thus having to raise additional equity or debt capital, rather than relying on internally generated cash, should be seen a positive rather than negative by shareholders. We will compare in a similar way other listed retailers in subsequent reports. Brian Kantor