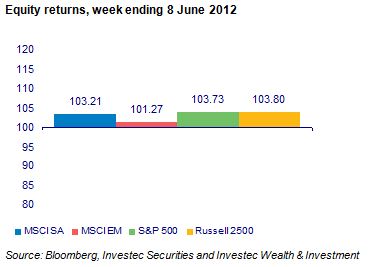

Last week was very kind to global equities. The S&P 500 was up nearly 4% as were US small caps represented by the Russell 2500. The SA component of the benchmark MSCI emerging market index was up over 3% and also did better than the average EM market last week.

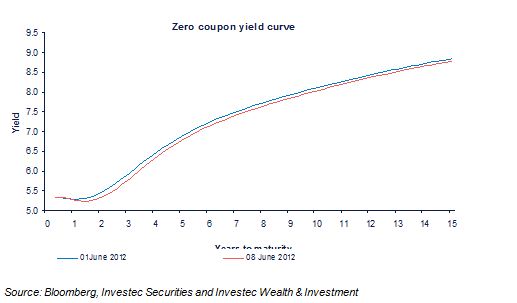

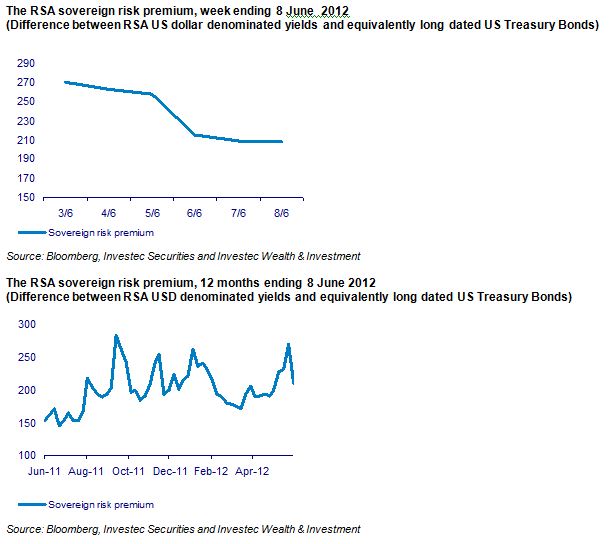

It was also a very good week for investors in RSA bonds, of both the rand and US dollar denominated variety. The spread between RSA Yields fell across the term structure of interest rates.

Yankee bonds and their US Treasury Bond counterparts declined by over 60bps in the week – strongly reversing wider spreads that had opened up recently with heightened global risk aversion.

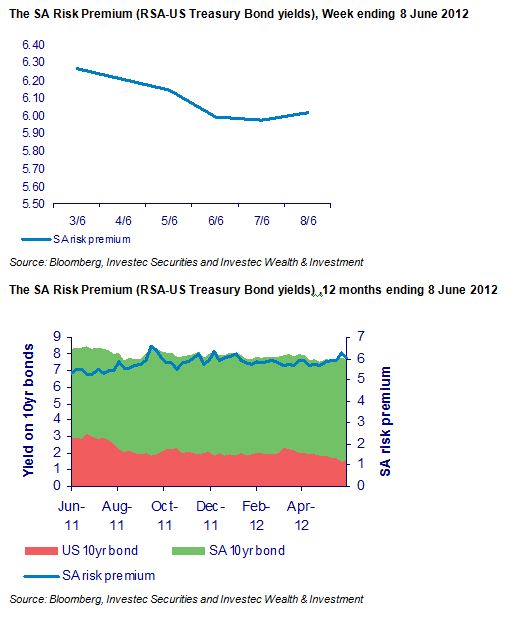

The good news in the RSA bond market meant that the spread between RSA 10 year bonds denominated in rands and US Treasury Bonds yielding US dollars, also narrowed by about 20bps. This spread may be regarded as the total SA risk spread offered to offshore investors with the difference in 10 year yields representing the rate at which the rand is expected to depreciate against the US dollar over the 10 years. Should the rand weaken as expected over the next 10 years, that is at an average rate of 6% p.a, it would make little difference to borrow or lend rands or US dollars. What is gained or lost on the exchange rate leg will be made up or given up on the interest rate spread.

Sometimes known as the interest parity condition, these interest rate differences will also reveal themselves in the premiums paid for US dollars to be delivered against rands in the future, that is the premium paid for forward cover. Last week insuring against expected rand weakness became a little cheaper. If risk tolerance should improve further, both the spot rand/US dollar rate should benefit and interest rates in SA decline relative to those in the US. Brian Kantor