On Thursday Mario Draghi spoke and the markets liked what they heard about the outlook for Europe. The judgment was that taking on more risk in the markets might well be rewarded. On Friday we saw a most unlikely set of outcomes in response to a healthier appetite for risk taking. That risky currency, the rand, gathered strength. Resources on the JSE benefitted particularly, despite (or rather because of) the rand strength associated with strength in underlying metal and mineral prices that are linked to an improved outlook for the global economy.

As we have noted often before, resources only benefit from a weaker rand or are harmed by a stronger rand when this occurs for SA specific reasons. Only then do they behave as rand hedges. Ordinarily they are rand plays – doing best when the rand strengthens – for global growth reasons.

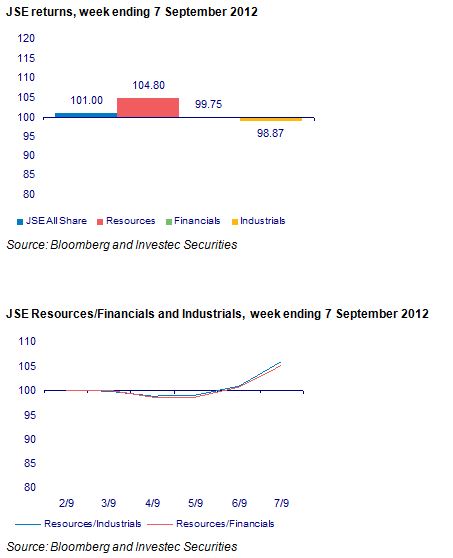

SA financials are also mostly rand plays – doing better when the rand strengthens and the outlook for lower inflation and interest rates improves with rand strength. But surprisingly on Friday SA Financials lost ground. While JSE Mining was up 3.75% on the day, the JSE Fini15 lost 0.8% of its value. Financials and banks offshore had a very good Friday by contrast, as we show below:

Given the improved appetite for taking on risk, the large losers on Friday were the globally traded, highly defensive counters. These are the shares that have been coveted for their dividend yields and prospects of special dividends in a world of very low interest rates. For example British American Tobacco lost R14 or approximately 3% of its opening value on Friday. On the FTSE the stock was down 1.5%.

These developments on Friday helped reverse a long running saga on the JSE of underperforming resource counters and strongly outperforming producers and distributors of consumers goods with strong balance sheets paying dividends that are likely to be sustained.

Investors globally on Friday clearly rotated away from demandingly valued defensives to cyclically dependent stocks and financials that appear undervalued by their own standards. Why SA financials should have failed to benefit from this switch and rand strength may be regarded as something of an anomaly. Is this the start of something potentially very big – the reversal of the defensive trends that have dominated market performance over the past 12 months, or merely a minor correction of such trends? Our position has been to maintain a moderately risk on exposure to equities generally with a bias in favour of defensive dividend payers. A few more days like Friday would help concentrate our minds, perhaps leading us to a somewhat different, more risk-on conclusion. Brian Kantor