A defining recent feature of the JSE and other stock markets this year has been the very good performance of the defensive stocks, especially those with attractive dividend yields and balance sheets to support growth in dividends. By contrast, the performance of the cyclical stocks – especially mining companies – has been very poor both absolutely and relatively, when their performance has been compared to the defensives.

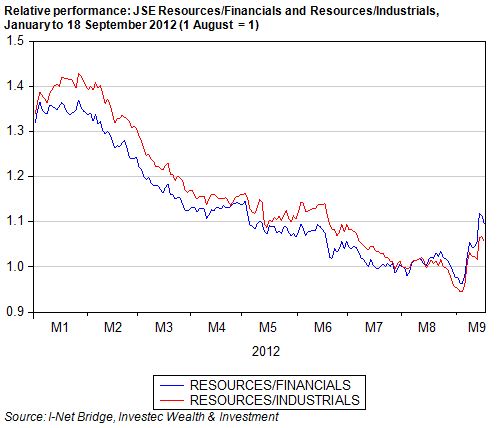

We show below the relative performance of the Resource, Financial and Industrial Indexes between 1 January and 18 September. As may be seen, in 2012 the Financials and Industrials on average have gained about 30% on the average Resource counter listed on the JSE.

Such outcomes are very understandable in a world of exceptionally low interest rates, coupled as they are with grave doubts about the strength of any global cyclical economic recovery (from which metal and mineral prices and the profits of mining companies would stand to benefit).

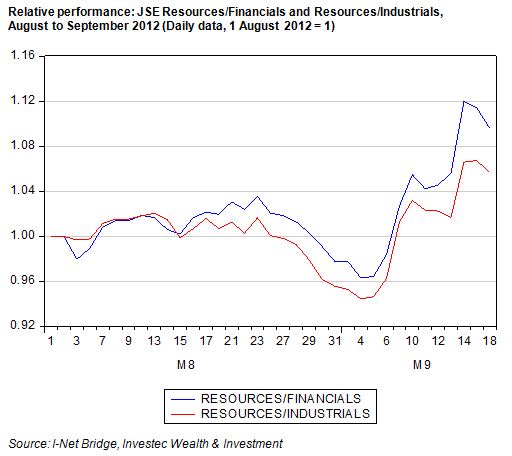

This outperformance was reversed on 13 September when Fed chairman Ben Bernanke and the Federal Open Market Committee announced QE3. The Fed plans to inject an additional US$85bn of cash into the US monetary system each month through additional purchases of mortgage backed securities and US government bonds. The intention is to keep interest rates as low as possible for as long as it might take to revive the US economy and employment or at least until 2015.

The question therefore is not whether or not the Fed will achieve its objective of low interest rates. This it will surely do thanks to its freedom to effectively create as much cash as it deems appropriate and also to twist the yield curve accordingly, that is borrow short and lend long if necessary, to hold down long rates relative to short rates (which are close to zero and will surely remain so for some extended time). The question is whether continued low interest rates can stimulate a more robust economic recovery. If they can then the underappreciated cyclical stocks would especially stand to benefit.

The stock markets on Thursday and Friday last week reacted as if it was truly time for the cyclical stocks. They gained materially against the Financials and Industrials. There also appeared to be some rotation on the JSE away from the Industrials and Financials. On the Monday these trends were partially reversed as we show below.

Our own view, expressed on the day after Bernanke fired his bazooka, was that the promise of a further extended period of low interest rates would continue to make secure dividend yields well above money market rates still appear attractive, given the absence of any assured cyclical recovery. Playing defence, we thought, might remain the best policy in these new circumstances. It seemed clear to us that pumping money into the system would be helpful to asset prices generally – but perhaps not especially helpful to the cyclicals. Still more highly accommodative monetary policy might not, we surmised, provide the quick fix for the global economy. It has not done so to date. The jury will remain out on this for some time we think – or until a global cyclical recovery appears much more likely.