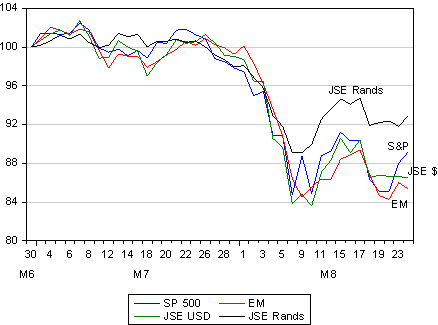

The JSE has continued to take its cue from global equity markets as has the rand. In recent days emerging market equities have lagged behind the S&P 500, with the weaker rand adding some rand value to the JSE.

The rand itself has continued to closely follow the direction provided by the emerging equity market Index. As we show below, the rand, if anything, is a little stronger rather than weaker than might have been predicted, given the level of emerging equity markets.

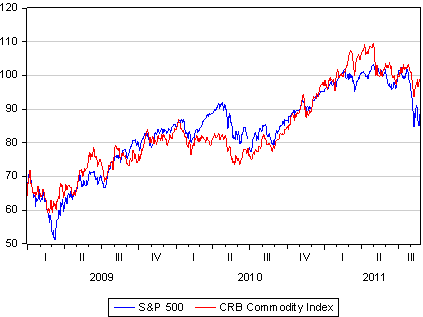

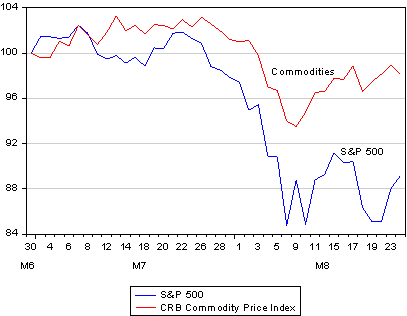

The relationship however between equity and commodity markets has not proved so regular over the past few weeks. As we show below commodity prices have held up much better than equity markets. The anxieties that infected equity and debt markets have not damaged commodity markets to anything like the same extent as occurred during the financial crisis of 2008. As we also show below, commodity prices and equity values have tracked each other closely since 2008 as both sets of prices reflect the growth in global economies. These unusual recent trends in commodity prices relative to equities hopefully indicate that the outlook for global growth has not deteriorated as much as feared by equity investors. If so, the demand for equities may also come to be encouraged, as the demand for metals and commodities has been, by extraordinarily low interest rates.