I read with some astonishment, (BD Dineo Faku 22nd September) about the court action taken by shipping company Maersk to overturn the award by Transnet of the Durban Container Port Tender to the Philippine Company International Container Services (ICS) On the grounds that the ICS tender should have been disqualified because it, only it, used its share market value rather than its book value to calculate and report its “solvency ratio”

It would seem obvious that a borrower is solvent when the value of its assets, should they have to be realised, is expected to exceed the value of debts it has incurred. And the closer the ratio of market value to debt the greater the danger that the company would be forced to wind up. If the company is listed its market value is clear and explicit and continuously available. The book value of a private company might be the best initial and readily available estimate of what the assets might realise. If the accountants for the firm have following recommended good practice and have been consistently marking the books to market.

As I write the market value of shipping giant Maersk is 25.9 billion dollars with total debts of 16.7 billion US dollars ( 1.6 times) and that of ICS with a market value of 15 billion dollars, with total debts of 4.16 billion dollars. (3.6 times) The earnings before taxes to interest paid ratio is similar for the two companies 4.5 times for Maersk and 4 times for ICS.

There is a rigorous test of Corporate Default Risk applied to any listed company anywhere, more than 65000 of them, including Maersk and ICS. A test no further away than your nearest Bloomberg Terminal. A click or two calling up the company and the DRSK model will give you an immediate probability of default. And one that will be closely allied with the conventional ratings provided by the debt rating agencies. The Bloomberg model easily downloaded is adapted from the original financial economics of Nobel laureate, Robert C Merton, and is very well known in financial economics. The theory as adapted by the Bloomberg team in 2021 is elegant and is very well tested by the evidence presented of its predictive power. Science, that is theory with predictive power for a large sample is at work here.

The Bloomberg model uses the market value of the assets of a company as the basis of its assets to debt ratios. But with an important proviso. The market value of a company in the model is adjusted for the volatility of its share price . The market value is estimated as a “down and out” call on the assets with a maturity date. Hence providing a highly realistic estimate of what you might realise the assets for. The more volatility, the less predictable the share prices and the less the company may be expected to fetch

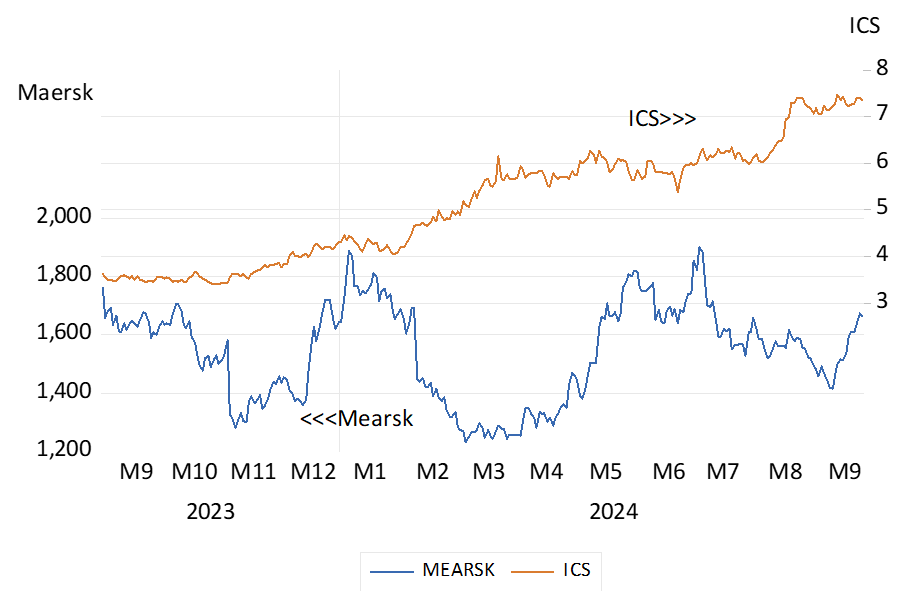

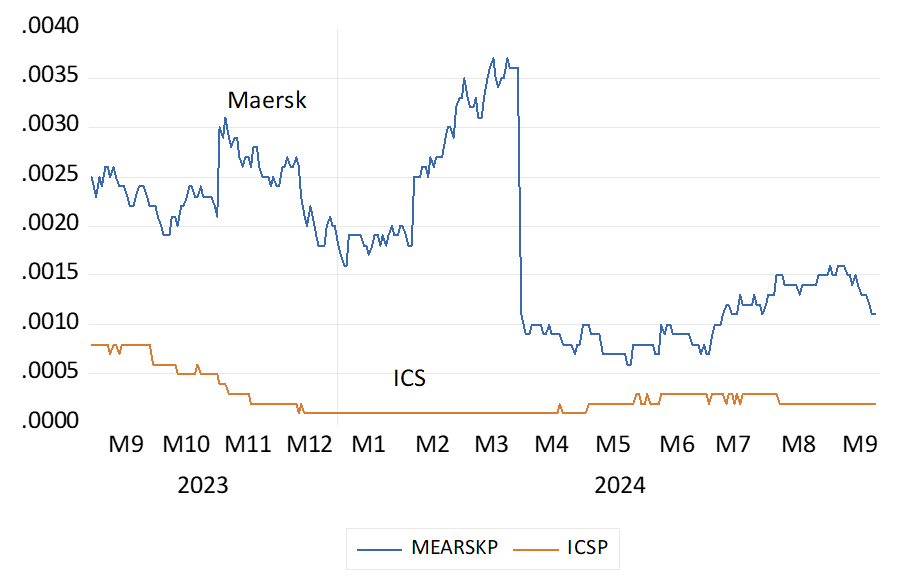

The Bloomberg model gives very similar measures for the very low probability of either Maersk or ICI defaulting over the next twelve months. (see below) Both companies, as predicted by Bloomberg, would enjoy a comforting Investment Grade rating. The market value of ICS has risen strongly over the past twelve months while that of Maersk has changed little. The volatility of the two share prices- until recently higher for Maersk, is now very similar. The improved value of ICS may well have much to do with winning the tender. It clearly is a valuable contract worth fighting over.

The Maersk and ICI share prices. Daily data (2023-2024) US dollar value.

Source. Bloomberg and Investec Wealth & Investment

Maersk and International Container Services. Probability of Default; over the next 12 months. %

Source. Bloomberg and Investec Wealth & Investment

A South African Case Study Pick N Pay (PIK)

Underperforming companies raising more debt do not necessarily go broke when the market value of their assets approaches the barrier of debt. They may be rescued by shareholders willing to subscribe additional equity capital. When shareholders prove unwilling to provide support a company will go under. Hence the market value of a highly indebted company, close to default, will always reflect the chances of a rescue.

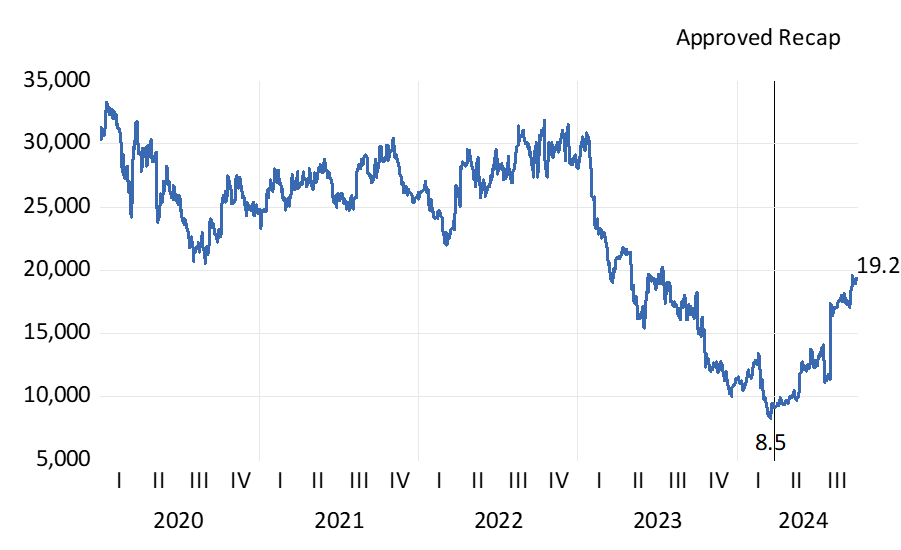

South African retailer Pick ‘n Pay (Pik) has provided a very clear example of the benefits of shareholders coming to the rescue with additional share capital necessary to avert the dangers of a default. The operating performance of the company had deteriorated significantly in recent years. A drain of cash had been funded with much additional debt. Net debt had increased from R3.8 billion in August 2023 to R7.2 billion by January 2024. As the market value of Pik declined from 28.02 billion in January 2023 to R11.48 billion by year end 2023 with elevated daily volatility.

A recapitulation of the business had become essential for the survival of the business and was announced in January 2024. The plan was to raise R4 billion from existing shareholders in the form of a rights issue. To be followed by the listing of and an offering of shares in its profitable subsidiary company Boxer. Bankers also agreed to modify their debt covenants in February 2024.

On the 27th February 2024 the company announced the approval of the capital raising and debt reduction scheme. At which point in time the market value of Pik bottomed out at R8.5b. The rights issue when concluded on July 30th raised the number of shares in issue by as much as 51%.

The market value of Pik is now approximately R19b. Thus, the capital raise of R4 billion must be regarded as having added much value for the shareholders subscribing the extra capital. The value of Pik is now up by approximately R10.7b (19.2-8.5) March 2024 after an investment of R4 billion That is for the initial subscription of R4 billion the shareholders have gained R6.7b. (10.7-4)

Source; Iress and Investec Wealth & Investment

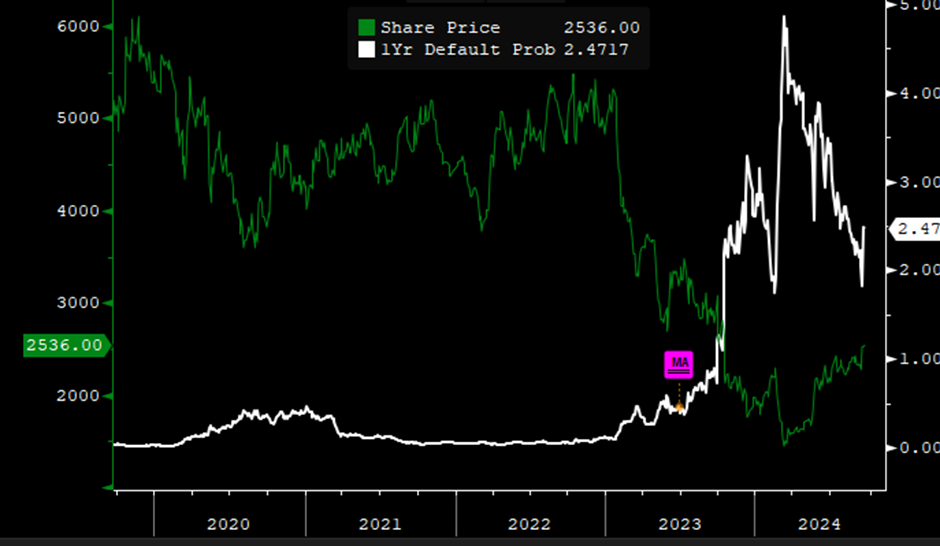

The recent history of Pik – its share price and probability of default as calculated by the Bloomberg model – is shown below. As may be seen the probability of default rose sharply as the share price fell away with heightened volatility. The probability of a default in 12 months has now receded sharply placing Pik debt if it were to be rated in the High Yield category. (see below)

Pick ‘n Pay Probability of Default and Share Price. Daily data

Source; Bloomberg