Earning an above average income does not make you well off or wealthy. The best one can do is to save and hope for the miracle of compound returns to give you the retirement you aspire to.

It is savings not income that makes you wealthy

Earning an above average income does not make you well off or wealthy. You might spend it all on the good things in life and have nothing left over when the income from work dries up – as it must at some point in time when age, infirmity or injury undermines your income earning capacity. It is not only the body but the creative mind that may give in prematurely. The profligate actor, artist, musician, writer or sports star may have a brief life in the fast lane and have nothing left to show for it other than some great stories, unless they put away some of their extraordinary earnings. Mick Jagger and his ever rolling stones would be a notable exception.

Save and hope for the miracle of compound returns to give you the retirement you aspire to

Wealth is gained by saving – consuming less than your income and by investing the savings in (hopefully) income earning assets and, most important , reinvesting rather than consuming this extra income your wealth is bringing (at least until you need it to sustain your life style in the hoped for accustomed manner). By accustomed we would mean being able to consume as much or almost as much as you did when you could rely on a more or less regular income from your work. A rule of thumb is that your wealth or capital should be sufficient to allow you to continue to spend at the rate equivalent to 75% of the real goods and services consumed before retirement. (The pattern of spending may well alter with age but the real volume of spending will ideally be well sustained). Sustaining this pre-retirement standard of living might require gradually drawing down capital to support these consumption demands.

Yet 75% of a low number may well remain a low number. Many would aspire to at least 75% of a large number rather than a small number. This means earning well, saving a good proportion of these earnings and perhaps, even more important, achieving very good returns on the savings made. High incomes, a consistently high savings rate and excellent returns on savings is the path to true wealth – it is a much steeper path than one that could lead to a comfortable retirement for the middle income earner.

How to get more than comfortable: that is, how to get rich

True riches, achieved by the relatively few, are when the wealth or capital that has been accumulated over a life time can provide for a very comfortable life style without the wealth owner having to consume any of that wealth. That is to say, a stock of capital that generates enough income to provide for both generous consumption demands and enable further savings to not only preserve, but indeed to add to the real value of the capital owned.

There are perhaps two obvious routes to conspicuous wealth (if not conspicuous consumption) for the self-made man or woman. The first is to establish and manage-own a very successful business. Success in this way will very likely mean not only the successful execution of a business model. It may require mortgaging the home to raise the initial funds to start the venture and then to sustain growth by reinvesting a high proportion of the cash flow generated by the enterprise. This process of saving income and reinvesting it in the successful business can realise a very high rate of return, making the owner manager very wealthy.

These returns on the capital invested will be measured by the increase in the market value (assets less debts) of the business plus the extra income earned that again may be mostly reinvested in the business. Such a high savings and investment plan by a owner-manager is inevitably highly risky – all the family eggs are in one basket and risk adjusted returns have to be high to justify the risks taken. When the value of the enterprise is well proven, the owner manager may wish to cash in by selling up or by selling a share in the company and by paying dividends that are then used to fund a more diversified portfolio of other assets.

Another path to riches may be climbing the slippery ladder of a well established stock exchange listed corporation. This would be one that enjoys growing appreciation from fund managers and is awarded a rising market value. Significant wealth for the top management will come with the increased value of their share options or the shares regularly awarded as part of remuneration and held by them. On retirement or resignation, these shares can be held or again exchanged for a more diversified, less risky portfolio of assets.

Options for the risk-averse family man or woman or professional.

The usually risk averse average salary man or woman and the highly successful partner or principal in a professional practice will typically take a different path to comfortable retirement or, possibly, great wealth if the income is high enough. They will have to save a proportion of their incomes and contribute to a pension or retirement fund. The tax advantages of such contractual savings schemes are considerable while there may also be opportunities for the higher income earners, the highly successful professional, to save and invest independently in the stock, bond or property markets.

It is investment returns more than the contribution rate that matters for the saver.

The more the salary man and professional save and the sooner they contribute to a savings plan, the more wealth they will accumulate. But as (or more) important will be the returns they earn on their investments. We will demonstrate and illustrate the differences it makes to the wealth outcomes between a low or higher real rate of return on a portfolio, especially when these returns are compounded over an extended period of time.

Doing the numbers – demonstrating the miracle of compound returns

In an earlier exercise of this kind published in our Daily View we considered a salaried individual aged 55 in SA in December 2001 expecting to retire 11 years later. By 2001 this individual was assumed to have accumulated assets of R5m and was earning a gross salary of R500 000 per annum and also assumed to contribute 15% of this gross salary to a no fee no tax pension fund. We also assumed that the salary would grow at 8% per annum. The Pension was invested fairly conservatively in a constant mix: 60% in the JSE All Share Index, 30% in the All Bond Index and 10% in the money market. We calculated the performance of this fund using realised returns over the period to April 2013 some 137 months later.

The results of this savings plan would have been very good indeed. The salary would have grown at an 8% p.a. compound rate from R500 000 to R1 165 813 while the value of the portfolio, worth R5m at the beginning of the period, would have been worth R23.952m in April 2013. The ratio of wealth to salary that was 10 times in 2002 would have increased to 20 times the final salary earned in 2013. This individual would have been able to support a life style much better than the equivalent of 75% of final salary. Consuming at a mere 5% rate of this capital – a rate likely to preserve real capital – would yield R1.19m in year one – slightly more than the final salary. At current interest rates in SA R1m of capital, to be consumed, can buy you about R80 000 of more or less certain nominal annuity income per annum or about R35 000 of inflation linked income at 65, for as long as you or your spouse survive.

Excellent past performance is not guranteed

The reason for these highly favourable outcomes for the saver retiring about now, was the excellent real returns realised by the equity, bond and money markets over the period. The JSE delivered an average 15.58% p.a. return over the period, the All Bond Index 10.55% p.a. and the money market 8.22% p.a. on average. Combining these asset classes in the proportion 60, 30, 10 would have given an average annual return of 13.3% p.a. over the period, well ahead of inflation that averaged 5.9% p.a. This average real return of 7.4% p.a. was well ahead of the growth in salary of 8% p.a. equivalent to a real inflation adjusted 2.1% p.a. Hence the increase in the ratio of wealth to salary from 10 to 20 times. Incidentally, had this salary earner in 2002 decided not to save any more of his or her salary after 2001, the outcomes would still have been highly satisfactory. The portfolio would have grown to R21.291m through the effect of compounding high returns and reinvesting income.

It would be unrealistic to expect real returns of this kind over the next 10 years.

A simulation exercise to guide future savings plans

We will show in a simulation exercise what might apply to future contributors to SA savings plans. We will demonstrate that the rate of compounding real after inflation returns – higher or lower – especially when sustained over a long period – will overwhelm the impact of higher or lower savings rates. The Excel spread sheet attached to this report can be used to demonstrate this point. It allows for a great variety of savings options and real return and inflation assumptions that readers, with Excel at their command can try out for themselves.

The model and the scenarios

The model assumes a starting monthly salary of R10000 and a working life of 40 years. This working life is broken into three stages: a 10 year phase followed by a further 20 year phase with a final phase of 10 years to allow for different assumptions about real salary growth, percentage of salary invested and real returns through the phases. The simulation exercise also allows for different constant rates of inflation over the 40 year period. Given the emphasis on real growth, the assumed inflation rate has very little influence on the real outcomes though it will affect the nominal rand values as will be shown.

Let us then demonstrate a few outcomes to help make the essential points.

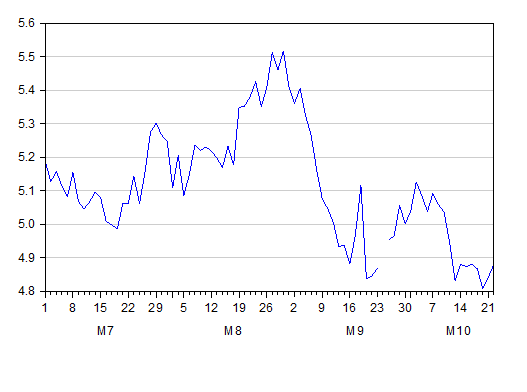

Scenario 1 may be regarded as highly, unrealistically favourable to the long term saver, assuming equity like returns of the kind realised by the JSE over the past 10 years, that is average real returns of 10%. It assumes a contribution rate of 15% over the full 40 year period and real, above inflation salary growth of 2% p.a. for the first 10 years of working life, 4% pa. for the next 20 years and 2% p.a. real growth over the final 10 years of employment. The assumed inflation rate is 6% p.a.

The results are shown below in two figures. The first tracks the salary and portfolio in money of the day (assuming 6% p.a inflation) and the second tracks the important ratio of wealth to final salary. A ratio of above 10 can be regarded as highly satisfactory with retirement in prospect. As may be seen, Scenario 1 leads to some very large numbers after 40 years: a final salary of R3.7m and a portfolio worth R92.7m – a highly satisfactory wealth to income ratio of 24.65 times.

Scenario 1: High returns

Source: Investec Wealth & Investment

Were the saver in Scenario 3 to only contribute a modest 7% of salary for the first 10 years to the pension plan yielding a satisfactory 6% real return, the final portfolio would have grown to R32.055m in 40 years or 8.5 times compared to the 10.4 times or R39.299m that would have been available had the initial contributions been at the 15% rate.

The implication of this analysis is that achieving a satisfactory wealth to final income ratio of 10 times is no gimme – even with the most favourable savings outcomes. Consistently saving 20% of gross salary for 40 years might not get you there unless real returns were well north of a real 3% p.a. These essential higher real returns are by no means guaranteed even if equity risk were taken on in large measure.

The advice to new entrants to the labour force would be to start saving early in a working life and hope for high real returns. Unfortunately what is in your control, raising your savings rate, will not compensate for low real returns. This conclusion suggests very strongly that the long term saver should have a strong bias in favour of risky equities from which higher returns can be legitimately expected. But such higher returns that might compensate for more equity risk cannot be guaranteed any more than can the returns on bonds or cash be estimated with any certainty.

Saving in addition to the pension plan

It would therefore be highly advisable to supplement a pension plan with home ownership. Paying off a mortgage bond over 30 years is a savings scheme that will give you an effective real rental return of the order of 5% p.a. It will give you the choice of consuming accommodation service in the style to which you are accustomed, that is by staying on in the house you own. Or by offering the choice of scaling down your consumption of house, moving to the smaller apartment or less expensive home in the country town, and converting some of the remaining home equity into other income producing assets. What should be strongly resisted is converting home equity into consumption before retirement. Forced contractual saving in the form of paying off the bond is a constraint worth accepting for the long run.

A further form of saving is early membership of a medical aid scheme. Initial early contributions to medical insurance cover more than the risks – later contributions by the older member typically do not provide cover. The excess premiums paid by the younger worker are a form of saving to be cashed in when old. Carrying full medical insurance is a very good way to save up for the medical bills that form such a large proportion of post retirement spending.

Please note that the attached spread sheet is based on an Investec Wealth & Investment model, according to the assumptions explained in the article: Click here to access spreadsheet