The Competition Commission has prohibited Grand Parade (GP), a JSE listed company, from selling its assets and obligations in the Burger King franchise to a private equity company. The reason why the transaction was prohibited was, to quote the media release, “ …the Commission is concerned that the proposed merger will have a substantial negative effect on the promotion of greater spread of ownership, in particular to increase the levels of ownership by historically disadvantaged persons in firms in the market as contemplated in section 12A(3)(e) of the Competition Act. Thus, the proposed merger cannot be justified on substantial public interest grounds” Grand Parade has a large 68% historically disadvantaged body of shareholders (HDP’s) , ECP Africa Fund IV has none.

The qualification substantial public interest grounds, not just prohibited on an unqualified and damaged public interest is revealing. The problem with public interest arguments is that the public is inevitably made up of a variety of private interests some of whom will benefit from a particular agreement and others who may be harmed. For examples common to the modus operandi of the competition authorities in SA, one can refer to cases of M&A activity that are only approved, subject to the acquirer not reducing the numbers employed in the merged operations. Clearly a restriction in the limited private interest of those who would not lose their jobs that they might otherwise have done. But one that makes the merged operation less efficient and competitive than it would otherwise have been, given the cost saving synergies of a merger, which would be its essential justification in the broad public interest.

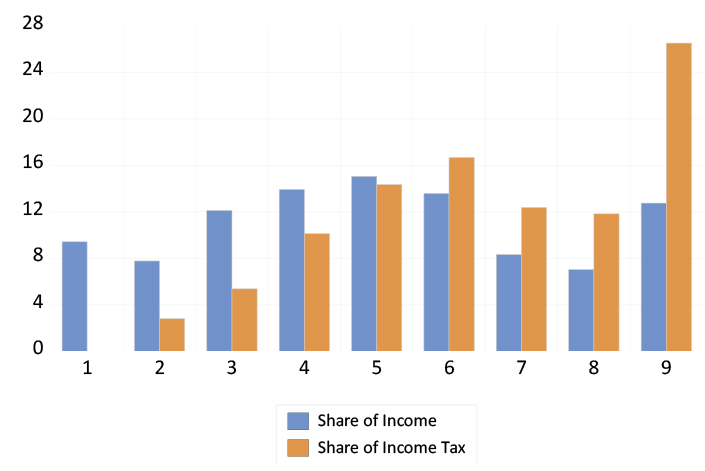

Any lack of efficiency is clearly not in the interest of many consumers who may have benefitted from lower prices or better quality or more convenient locations that a more competitive business might have offered its many customers. Suppliers of goods services or credit to the less efficient operation and their employees would also have been compromised by a less capable business to engage with. And restrictions on cost savings would be obviously unhelpful to its shareholders who may be many and include historically disadvantaged persons (HDP’s) who are quite likely to be members of collective investment schemes with widely spread ownership claims increasingly exercised by HDP’s through retirement plans. Does the competition commission look through to the members of pension and other collective investment schemes to establish their racial composition? Or are the only empowerment interests recognised by them and the government more widely, are those held directly? Which is to conveniently understate the numbers of beneficial owners of SA businesses of all races and open-up the opportunity to do more deals to empowerment entrepreneurs, who are small in number, influential and politically important, but hardly representative of the public at large.

The winners and losers in this deal prohibited by the commission are obvious enough. The losers are the owners of GP, heavily and genuinely empowered, who are prohibited from realising part of their risky investment in GP. Their shares lost 60 cents on the news and with 430 million shares in issue this was a damaging loss to them of the order R300m. Surely not a sacrifice they would willingly make in some vague public interest. Another case of expropriation without compensation through regulation. The chances of their realising the same value with another deal, with a company similarly broadly enough empowered to satisfy the commission, is surely remote.

As indicated by the commission there are very few if any such broadly constituted and empowered groups of shareholders around. The shareholders and managers of GP are in effect compelled to do nothing but hold on to their investment in Burger King which may well end up destroying all of their investment.

But are such sacrifices forced on the shareholders of GP likely to promote similar such widely owned enterprise in the public interest? Denying risk taking investors the fruits of their risk taking, or the ability to mitigate their losses, which is the case with this transaction, is surely setting a very discouraging precedent for further broad-based empowerment. It suggests that HDP’s can take the risk of investing their savings in a broadly based and empowered venture but you are prohibited from cashing in on its success or from reducing your potential losses. Hardly an enticing prospect.

Because you will only be allowed to sell assets or the company to a very restricted number of buyers- presumably then at a knockdown price. Surely not a restriction any business with current or prospective empowerment credentials would welcome.

The logic of the competition commission therefore defies me. Even if such interventions in agreements willingly reached, by parties fully capable of recognising their own self-interests that have no implications for competition, can ever be against the public interest – which I seriously doubt. The commission should protect competition and efficiency and the genuine public interest in well-functioning markets they are set up to protect. The public interest in competitive markets is not the same as a political interest interfering in them. One that is usually narrowly defined to supporters and sponsors of a party and best left to the politicians and the voters to pursue.

nd Investec Wealth & Investment

nd Investec Wealth & Investment