Author: Brian Kantor

Turbulence on the Nile – ripples elsewhere

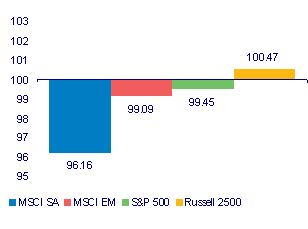

The likely fall of an Egyptian Pharaoh, after a very long reign, added uncertainty to global markets last week. Exposure to equities was reduced and share markets retreated with most of the weakness experienced on the Friday. A weaker rand made the JSE an underperforming Emerging Market in USD. The weak rand furthermore did not spare the Resource stocks that are regarded as riskier than most. (See below)

Global Equity markets Weekly USD returns; January 23rd= 100

JSE Weekly Rand returns; January 23rd= 100

Earnings: The trend is your friend – but which trend?

Continue reading today’s Daily View here: Daily View 26 January 2011

The building cycle: When a plan comes together

There are increasing signs that the global economic recovery is building momentum, and is very strong in many instances. We saw this last week with Chinese GDP numbers for the fourth quarter, which grew at an annualised 12.7%. But even in the developed world the signs are looking promising, with good business activity survey numbers out of Japan and Germany, and a promising set of jobless claims numbers out of the US last week.

Continue reading the Daily View here: Daily View 24 January 2011

Minding the Gap

The Monetary Policy Committee (MPC) of the Reserve Bank opted to keep the repo rate unchanged at 5.5% yesterday, in a move entirely in line with market expectations. Perhaps of more interest was the MPC’s outlook for inflation, which it upped to 4.6% for 2011 (from 4.3%) and 5.3% for 2012 (from 5.8%). We discuss the monetary stance of the MPC elsewhere in Daily View, but there has certainly been more talk in recent weeks of higher inflation later this year, as a weaker rand and rising commodity prices take their toll.

Continue reading the Daily View here: Daily View 21 January 2011