The Monetary Policy Committee of the Reserve Bank (MPC) as expected left the Reserve Bank repo rate unchanged yesterday. While the rate was unchanged the tone of the MPC statement and of the answers to the questions posed by journalists at the media conference was very different, in our estimation, from the previous meeting. Interest rate increases were clearly very far from the minds of the MPC. The pause button on short term rates remains very much in place. The focus of the statement and the subsequent discussion was clearly on the risks to the growth and employment outlook for the SA economy rather than the risks to the inflation outlook. This was despite the inflation forecasts being revised upwards in response to higher oil and fuel prices on global markets: these are expected to approach the upper band of its 3-6 percent inflation target band.

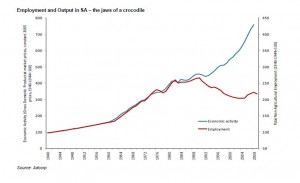

The money market and bond market will have to revise its view of the timing of the next increase in short term rates and was in the process of doing so yesterday. Higher policy determined interest rates will be postponed until the outlook for the economy can be predicted with greater confidence and the economy is operating much closer to its potential. We regard this evidence of Reserve Bank restraint as entirely appropriate and very encouraging for the outlook for the real SA economy. Most importantly from our perspective is the explicit recognition that these price pressures are of the cost push variety rather than of demand pull variety. To quote the MPC statement: “Since the previous meeting of the Monetary Policy Committee, the risks to the outlook for domestic inflation have increased on the upside, mainly as a result of cost push pressures. The domestic growth prognosis has improved, and the recovery is expected to be sustained, although not at rates sufficient to make appreciable inroads into the unemployment situation in South Africa.

“…….At this stage there are no discernible inflationary pressures coming from the demand side of the economy….”

And in concluding remarks:

“…The MPC is of the view that the risks to the inflation outlook are on the upside. However, these risks and underlying pressures are mainly of a cost push nature…”.

To further quote the MPC:

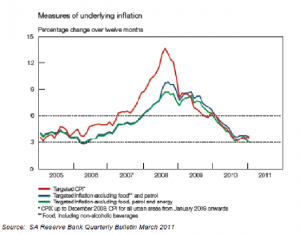

“The trajectory of the CPI forecast of the Bank has changed somewhat since the previous meeting of the Monetary Policy Committee. Nevertheless, inflation is still expected to remain within the target range over the entire forecast period. Inflation is now expected to average 4,7 per cent in 2011 and 5,7 per cent in 2012. This represents an upward adjustment of approximately half a percentage point in both 2011 and 2012. Inflation is expected to peak at 5,8 per cent in the first quarter of 2012 before declining to 5,6 per cent in the fourth quarter. The upward adjustment is mainly due to revised assumptions regarding the international oil price over the forecast period.”

What monetary policy can’t do

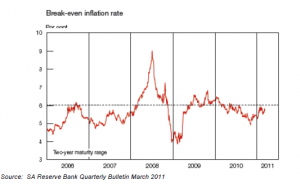

Presumably the Bank has referred to cost push rather than demand pull forces on the inflation rate because monetary policy and interest rates can do little to influence cost push pressures on prices in the short run or over the relevant forecast period. This important distinction was not one easily made by the MPC before when it would refer to the danger to inflation itself of inflationary expectations themselves. Such references were happily absent this time. It has always seemed to us an argument not at all well supported by the evidence. That is inflationary expectations, as surveyed, or inflation compensation made available at the longer end of the bond market, have been largely impervious (almost always about 6% pa) to the direction of inflation itself: this has moved sharply in both directions over recent years.

The only time when inflation compensation in the bond market (being the difference between yields on conventional government bonds and inflation protected yields) moved sharply lower and then higher was at the height of the global financial crisis when risk aversion and deflation, rather than inflation itself, became the primary concern of investors.

The MPC has become anxious about the global economy and therefore the dangers of what it regards as an increasingly uncertain global economy for the SA economy where a modest recovery is now under way. The troubled sense of the MPC view of the world and of the dangers this represents for the SA economy is well captured by the following observations made in its statement: “The global economic recovery, although uneven, is expected to continue, led by a strong performance in global manufacturing. However significant downside risks remain, due to the confluence of shocks that have the potential to stall the nascent recovery. Growth in emerging markets remains robust, but Asian economies in particular may be negatively impacted by the recent developments in Japan. The global growth outlook may also be dependent on the extent to which the authorities in China manage to slow their economy down.

“….Domestic growth prospects appear to have improved moderately. Real gross domestic product grew by 2,8 per cent in 2010, and at an annualised rate of 4,4 per cent in the fourth quarter. The forecast of the Bank has increased somewhat since the previous meeting of the MPC, with GDP now expected to average 3,7 per cent and 3,9 per cent in 2011 and 2012 respectively. These growth rates, while an improvement, are still too low to have a significant impact on the unemployment rate which measured 24,0 per cent in the fourth quarter of 2010….. There are indications that although consumption expenditure growth will remain relatively robust, it is unlikely to accelerate to excessive levels in the short term…..The various house price indices all indicate that house prices are either falling or increasing at very low nominal rates. This, combined with the recent decline in equity prices, may contribute to a moderation of the impact of wealth effects on consumption.”

We welcome the emphasis the MPC is placing on the state of the economy and on the absence of demand side pressures on the economy. There is much more than inflation at risk for the SA economy and the Reserve Bank has made this very clear. This represents good news for the SA economy and we are confident that what we would regard as a change of heart of the Reserve Bank will be well received in the market place, including the currency market. Initial reactions in the bond and currency markets were positive and they are likely to remain constructive. Brian Kantor