The pace of technological and scientific change is both rapid and accelerating. Robots controlled by powerful computers have invaded factory floors, warehouses and distribution centres with great effectiveness.

A common modern refrain in response to the challenge of the robots is: where will all the workers go? Will they go into other jobs or into unemployment? And, if the cohort of the unemployed is to become a much larger one, how will society cope with the assumed failure of an economy to employ most of those who seek work?

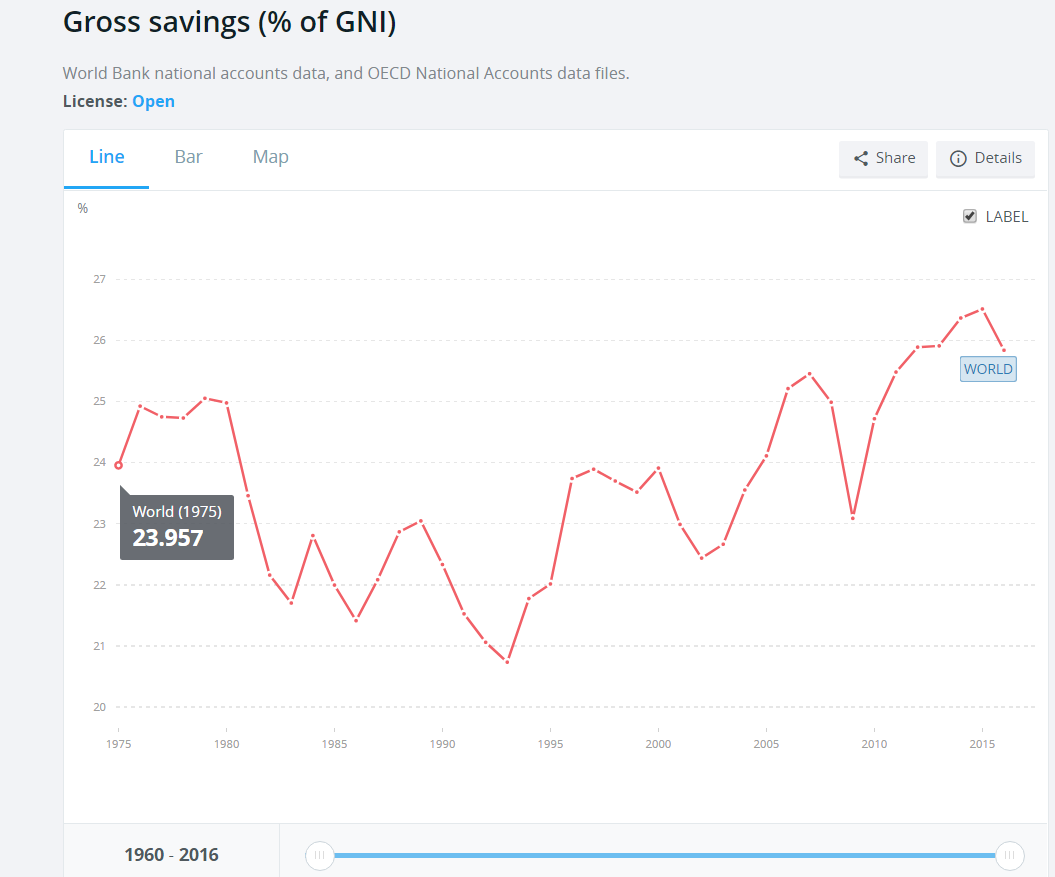

The increased production of goods and services enhanced by ever more productive machinery of all kinds (medical equipment included) has been accompanied by consistent advances in the average standard of living and life expectancy, as well as the rapid growth in population. The world’s population has more than doubled since 1970, increasing from 3 billion souls to more than 7 billion today. On average, we numerous humans are better supported today by higher levels of production of the essentials for life: food, shelter and medical care. We are provided for with more of the luxuries of life, including more time off work.

These increases in incomes and output represent impressive and consistent economic progress (compounding growth in output and incomes) made over the past 300 years. Yet there is much more to be done to raise average living standards to the levels now realised by those in the upper quintiles of income distribution in the most economically developed economies. This appears an attainable prospect given the record of past economic performance.

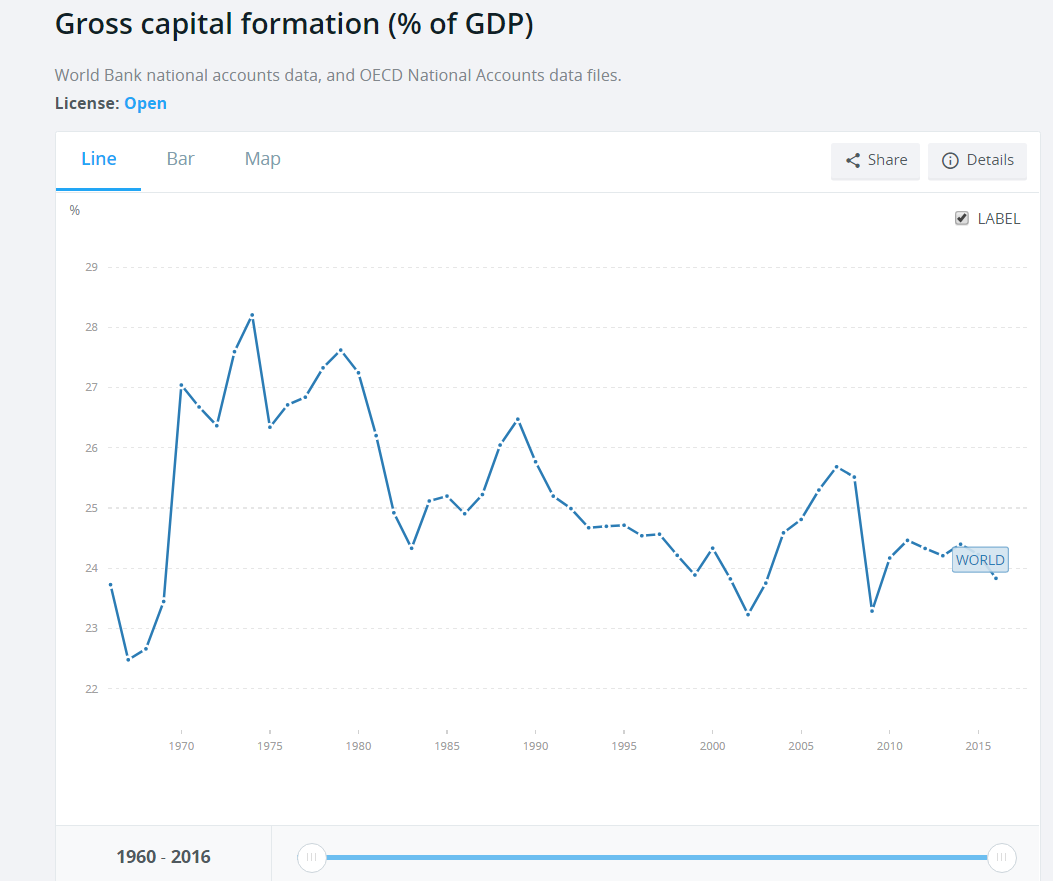

Output per person employed and, as a result, total output will rise with the application and utilisation of these new wondrously productive machines. Production – the output of goods and services produced with the aid of capital equipment, including what we now describe as robots of one kind or another – may grow even faster and more continuously than in the past.

This productivity provides society with opportunities and challenges. The challenge, as always, will be to maintain order and stability. A growing economy will surely provide the opportunity to satisfy competing interests, particularly those that come with unequal rewards – if only relatively.

Will machines become substitutes for, rather than complements to, human action?

The same displaced workers may be unable, for want of relevant skills, to find alternative employment building and servicing the ever more numerous robots. Or, they may be capable of providing service to those earning higher incomes from owning, designing, managing, building and maintaining the robots, given competition from the increasingly dexterous robots.

Humans will adapt, as they always do, to changing circumstances

Those who thrive with the help of robots are likely to choose more leisure and the services that accompany time off work. Empathetic humans may have great advantages, compared to inhuman robots, when supplying the services that accompany leisure. This could include, for example, walking the dogs and looking after the cats and birds of the affluent. In particular, if alternative employment and income earning opportunities in the production of goods (rather than services accompanying leisure) are lacking, humans may try harder to serve, and so help keep the robots at bay. Robots, it might be added, help avoid the drudgery and danger of many kinds of work that workers do not regard as any more than a means to the end of earning a living.

Humans, as we are well aware, are highly adaptable to changing circumstances. This is why we have become the pre-eminent species and there are so many more of us commanding the planet and consuming more.

We may have enough time to adapt to competition from robots and the opportunities they open up, including becoming more skilled teachers, with the aid of robots. Computers may (at last) help teachers become capable of adding rapidly to the skills of their students, as they have done for chess players, thereby improving their own skills, productivity and employment prospects as they improve the skills and employment prospects for their students.

The scope for redistributing what is produced more abundantly will increase

This is a process that is strongly encouraged by the less economically advantaged, and to which their elected representatives will respond. The ability to respond materially and perhaps sufficiently to calm the disaffected will be governed by the growth in the economy. The more that is produced by the economy, the more that can be redistributed without seriously damaging the process of growth itself.

The relatively poor and the unemployed could thus continue to look to an improved standard of living if society is productive enough and the tax base large enough to make more welfare pending feasible. We can expect more of this compulsory taking and giving to happen should our economies become more productive and should not all share equally in its advance, as is bound to be the case.

The interdependence of welfare and work, and of income and its growth

Thus, welfare benefits of all kinds will tend to reduce the supply of potential workers and, perhaps unintentionally, increase the employment benefits of those still in work. As technology continues to improve, as total output and the tax base of the economy rises, unemployment benefits are likely to improve compared to the wages offered to the less skilled. If so, fewer and fewer people will remain part of the workforce and they will be given welfare benefits to be at leisure.

A highly productive society will be able to afford to support the relatively poor and the unemployed generously. But will it do so generously enough to avoid violent resentments of the better off? Resentment and opinions may well lead to a set of policies that put a brake on invention and innovation and risk taking – the true source of economic progress.

Those not working because society can afford to support their leisure – given a lack of skills and adaptability – may create a whole other set of problems. Society, under pressure from increased structural levels of unemployment, will be required to find ways to make not working a psychologically meaningful state, and to make such arrangements acceptable to the fewer taxpayers as well as those receiving benefits.

Compulsory work, while perhaps helping less fortunate humans and improving the environment in exchange for welfare, may become a component of the adjustment to growing affluence made possible by the robots. Families may be prevented from having as many children as they might prefer as part solution to the problem of too many people and not enough work for them.

What if the robots delivered true economic abundance and solved the economic problem for us?

If robots replaced all workers, the only income earned would be from owning robots who produced all the goods and services supplied to an economy – that is to the people who make up the society. But there would be an overwhelming abundance of goods and services for humans to consume.

It should be recognised that if and when the robots are enabled to take over all the work, the economic problem of scarcity will have been resolved. The difficulty of society having to determine what should be produced and who should benefit from the production would have been overcome by the advancement of the robots. Trade-offs between those who produce and others who also benefit from their production will no longer be relevant. The perhaps unimaginably productive robots will be providing more than enough goods and services so that no person will be short of anything to accompany their leisure.

Since there would be no work for humans to engage in, there would be no income from work to be sacrificed for leisure or to be saved for consumption in the future. The only source of capital to replace and produce new and better robots would then be the savings made out of income received from owning robots.

Abundance solves not only poverty but inequality of incomes as well

Collective ownership of the means of production will take over from the individual wealth owners without any of the usual dire consequences, because incentives for individuals to produce and save more will have no further purpose. Permanent abundance will have been secured for all humans by the robots.

Adam Smith’s hidden hand that turns private interest into public benefits will have done its work. The unequal rewards that we now have to offer to talented, risk-loving humans so that they will deliver the goods will have become redundant.

Self-interest becomes irrelevant in the midst of abundance: everybody has more than enough of everything and has only to decide how to allocate their time. So, owning anything, aspiring to wealth through saving that is intended to be a source of future income, and encouraging wealth creation will make no sense. Protecting rights of ownership (property rights) to encourage savings and investment will also have served its function.

The now all-embracing collective – the state as owner of all the abundant means of production (the robots) would spread the equivalent of the abundant free cash flow generated by the robot-owning state-owned companies equally to all the population. That is, the state as owner would spread equally all the surplus (cash) around that has been generated by the productive robots – after capital has been reinvested in new and better robots and in the social infrastructure that supports the leisure of all not working.

For example, the supply of roads, swimming pools and sports stadiums has to be determined and the balance distributed as income to the population. It should be understood that in these circumstances of robot-supplied abundance, the robots would be programmed (by other robots) only to meet the full and satiable demands of the leisure class – that is, the entire population.

Robots will just do what other robots programmed by robots tell them to do and they will produce more than enough to keep us at comfortable leisure and out of work. They will be productive slaves without any preferences of their own to get in the way of maximising output. AI and robots will, therefore, have replaced intelligent humans in the production of everything. There would be no differential rewards of spending power to breed resentment. Full equality of incomes is a logical consequence of superabundance.

A different world would mean the evolution of a different species

The economic logic of robot-supplied abundance that demands no sacrifices from humans in the form of work or saving, would be a very different world. It would be essentially inhuman as far as we understand the human condition. That is, the harsh world we now inhabit that demands sacrifice (work and savings) and the acceptance of unequal rewards for unequal effort and sacrifice.

This acceptance of inequality of outcomes as the means to increased abundance for all has proved very difficult for many, particularly intellectuals and academics whose rewards are not well correlated with their IQs.

It is the envy of the presumed undeserving but economically successful, who deliver mere stuff to the masses and even more to the boring bourgeoisie, that inspires so much of the postmodern critique of a productive system at work.

The attack from the critics of society after abundance and full equality of incomes has been achieved (despite their worst efforts to slow the process down) would presumably be on the failures of many to consume the finer things in life.

Instruction on the art of life itself, as Keynes put it, might become but another popular but entirely voluntary and charitable activity. A further benefit of abundance is that the taxpayers would no longer have to fund their critics who advocate their elimination. There would be no taxes to be paid and no stipends of any kind for writers or artists and musicians. They will all do what they love to do without monetary rewards.

Abundance, however, would require that humans evolve as a very different species. Humans would be back in the Garden of Eden. Perhaps then, as with the first time around, having to start all over again, learning about what became the unfortunate necessity of work and sacrifice. Perhaps abundance is a frightening, unwelcome prospect for many. But would it be wise to stop the advance of the robots that promise to eliminate poverty and therefore even work itself? Choosing abundance (or rejecting it) will be a collective decision made by those humans in the way of the marching robots.