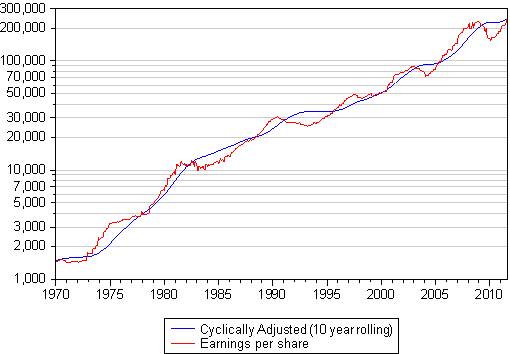

JSE Index earnings per share in current prices have now regained the previous record levels attained before the global financial crisis and the subsequent global recession, which caused earnings to decline very sharply. As we show below, real JSE earnings, adjusted for rising consumer prices, have also recovered very strongly (though are not yet back to pre crisis levels). This should be regarded as a very encouraging signal about the quality of the companies listed on the JSE.

In the figures below we also compare these earnings to what we measure as cyclically adjusted earnings. These are earnings that attempt to look beyond current earnings and the current state of the economy to establish the long term trends that should drive long term valuations. In current price terms JSE earnings per share by end August 2011 have regained their long term trend (a trend that factors in the post financial crisis decline). In real terms JSE earnings per share have a little way to go to regain their long term trend but are well set to do so.

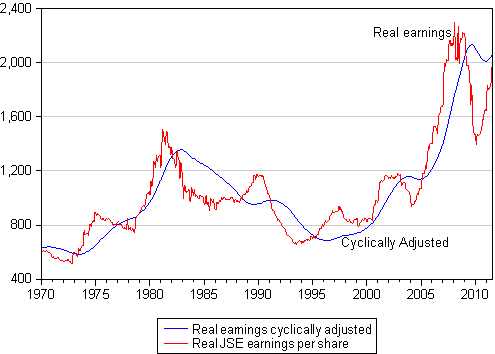

The real earnings series pictured above deserves close attention. It should be noticed that in real terms JSE real earnings per share only regained their 1980 levels as late as 2005. This recovery in real earnings that began only in 2000 and continued to 2008 represented an extended period of exceptional growth. It was a huge boom in earnings and dividends for shareholders, which was closely linked to higher metal and mineral prices that had suffered from an extended period of deflation since the early eighties. The role of Chinese and Asian growth in stimulating demand for commodities has been crucial for the surge in commodity prices and the earnings of resource companies that account for close to half of all JSE earnings.

The important question that was asked at the end of the earnings boom in 2008 was whether or not earnings in real terms could ever recover their 2008 levels. Or in other words, could the surge in JSE earnings between 2000 and 2008 (that extended to all sectors of the JSE) form a new base from which JSE earnings could grow further in real terms?

The recent recovery in real JSE earnings, that are now almost back to their previous record levels, provides impressive support for the view that JSE real earnings have indeed established a new higher base. This is testament to the global reach of the companies listed on the JSE that are much more exposed to the global economy than the SA economy.

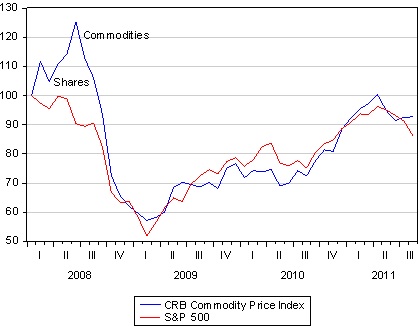

The outlook for JSE earnings in real or US dollar denominated terms will continue to depend upon the global economy from which commodity prices, equity valuations and the rand itself will take their cue. The global economy has recovered from the recession of 2009 and commodity prices have recovered accordingly. We show below that global commodity prices suffered even more than did equities from the financial crisis. However recently commodity and metal prices have held up better than equities, helping to support the view that global growth will not turn markedly weaker.

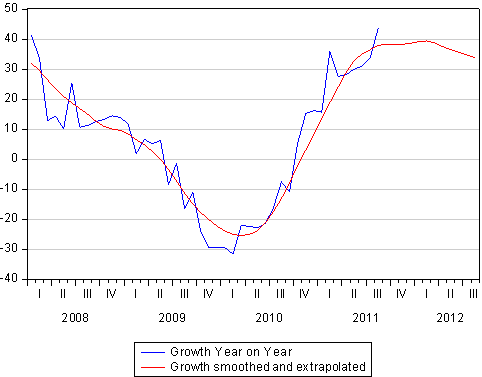

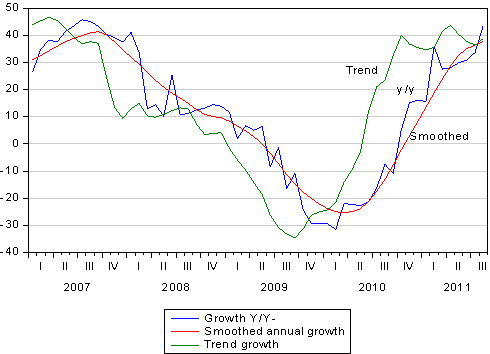

We show below that the JSE earnings cycle by end August 2011 (with many of the first half earnings reported) has realised growth rates to date of about 40%. As may also be seen the trends in this growth rate has not declined but appears to have stabilised at these levels. Thus if recent trends are maintained, helped essentially by stability in commodity prices, further growth can be expected. When we extrapolate recent trends it suggests that significant further growth in earnings per share may well be realised.

If this were to be the case for JSE earnings per share (as mentioned such earnings outcomes would have to be supported by sustained growth in the global economy) the JSE would be very well and further supported by very good earnings fundamentals.