The differences in the value of residential property in Cape Twon and Gauteng – and in Durban and the upper market suburbs of all the other SA cities are most striking. I learn anecdotally of a modern multi-bedroomed home in a gated estate near Johannesburg, largely grid free, that is municipality free, that has been on the market for six months for an asking price of not much more than three million rand with no takers. The owner wants to move to Cape Town as do so many and the market is flooded with like homes. Palaces that would take R10m or more to build. The same 3 million would have difficulty in securing a well appointed two-bed roomed apartment in Sea Point.

The differences in property outcomes are easily explained. In the Cape property owners in the towns and suburbs get reasonable value for the wealth taxes and service charges they are forced to pay. This adds to rather than subtracts from property values. Unlike the abject failures of service delivery almost everywhere else that destroys demand for homes and valuations.

The sad news is that the hopes of many have been dashed. Those who have responsibly been saving, paying off their mortgages each month expecting that the growing equity in their homes would help fund their retirements when they downsized and cashed in. The expectation now is that the value of their homes has not and will not keep up with inflation.

I am informed by a leading property appraiser that on average commercial real estate in Cape Town is expected to increase in capital value by 6.5% p.a. – ahead of inflation expected – while equivalent property in Johannesburg is expected to gain but 3% p.a. Furthermore, the so-called capitalisation rate at which future rental incomes are discounted is lower for Cape Town property that a similar building in Johannesburg. A value adding 1.25% margin in favour of Cape Town discount rates is estimated.

Recent property transactions confirm this difference. The Table Bay Retail Mall was sold for an initial yield of 7.75% to Hyprop. The Mall of the South in Johannesburg was sold to RMB at a significantly higher initial rental yield of 9.5%. For landlords of residential property in Cape Town initial rental yields (net rents/Market Value) range from about 3% in the most favoured suburbs to about 5-6 percent where there is less competition. All consistent with expensive real estate.

It should be assumed that the total return expected by investors in real estate will be similar everywhere in SA. Flows of mobile capital make it so. But total returns come in two parts- an initial yield – in dividends or net rental income and in capital growth. Thus the more growth expected in net income the lower will be the initial yield for homes of similar quality. For cash strapped migrants relocating to the Cape it may seem easier to rent rather than buy- with expected capital growth conceded to the investor.

The good news for our cousins in the North is that their cost of living is dramatically lower than ours in Cape Town. The bigger and better the home the more consumption power it delivers and such delivery comes much less expensively in Joburg.

The opportunity to live in an inexpensive palace rather than a crowded bed-sitter for the same modest outlay, either in rentals paid or sacrificed by owner- occupiers, should surely be an attraction not to migrate. And enough of a saving to help owner-occupiers go off grid and behind gates. And to run a four by four to negotiate the potholes when off to their bushveld retreats.

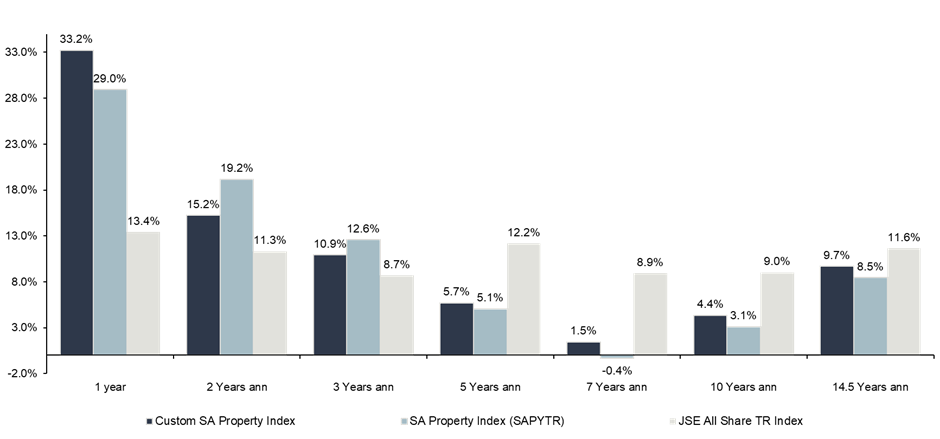

My New Year advice therefore is to buy more of what is cheap. To house up and take advantage of the bargain basement offers. And hope that all the bad news about service delivery is in the already low prices. The best performing asset class in SA in 2024 has been listed property. Residential property might just enjoy a similar rebound should service delivery unexpectedly improve rather than deteriorate further. (see below)

Total Return To end Dec 2024. Property Vs The All Share Index

Source; Bloomberg and Investec Wealth & Investment