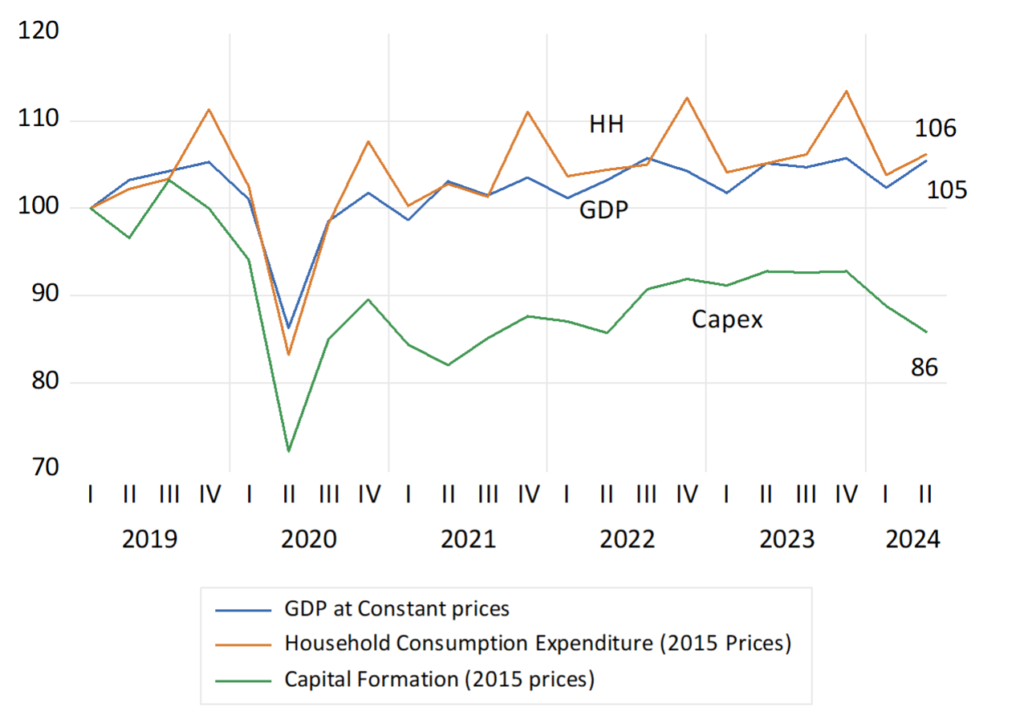

Looking back at the economy reminds how tough it has been in recent years for households and businesses dependent on the state of the SA economy. Since those pre-Covid days the economy has hardly grown at all. Compared to Q1 2019 GDP by June 2024 had gained a mere 5% over the five and a half years. (growth of less than 1% p.a) Households are spending but 6% more than they did then and capital formation is down by about 14% in real terms. How could such a deterioration be allowed to take place?

Vital SA Economic Statistics. Supply and Demand. (2019=100) Quarterly Data.

Source; SA Reserve Bank and Investec Wealth and Investment.

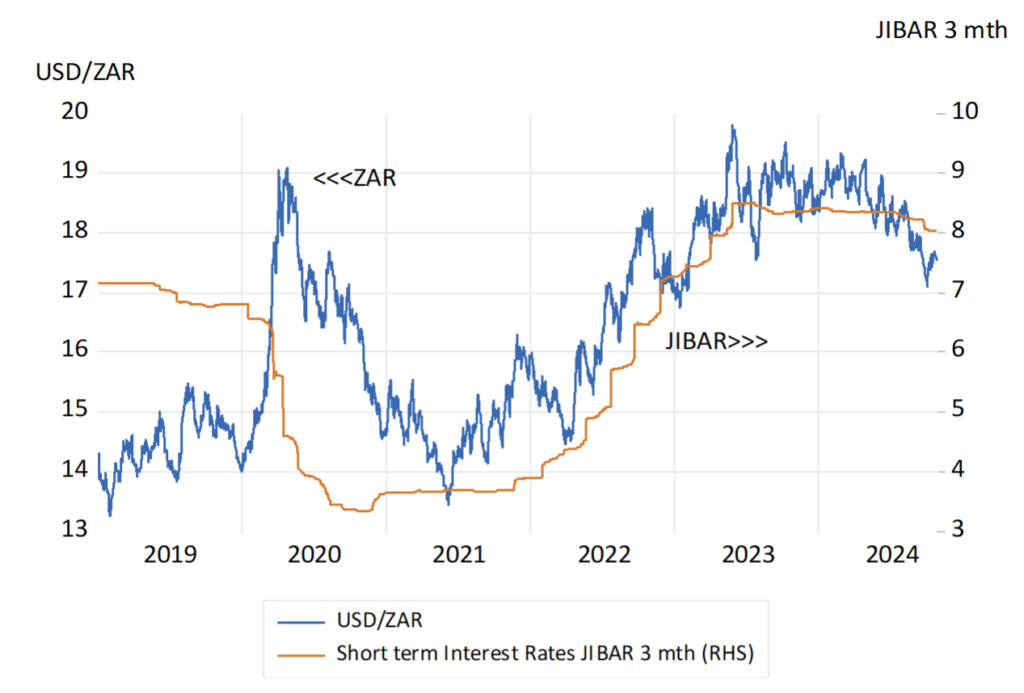

Clearly the supply side of the economy performed poorly – led by the well documented, confidence sapping failures of the State-owned enterprises and of government generally, including those of the provinces and municipalities. But demand management by the Reserve Bank can also be held responsible for at least some of the weakness. Much of the period since 2021 has been accompanied by much higher interest rates both absolutely and relatively to inflation. That is despite the grave weakness of demand for goods services and labour.

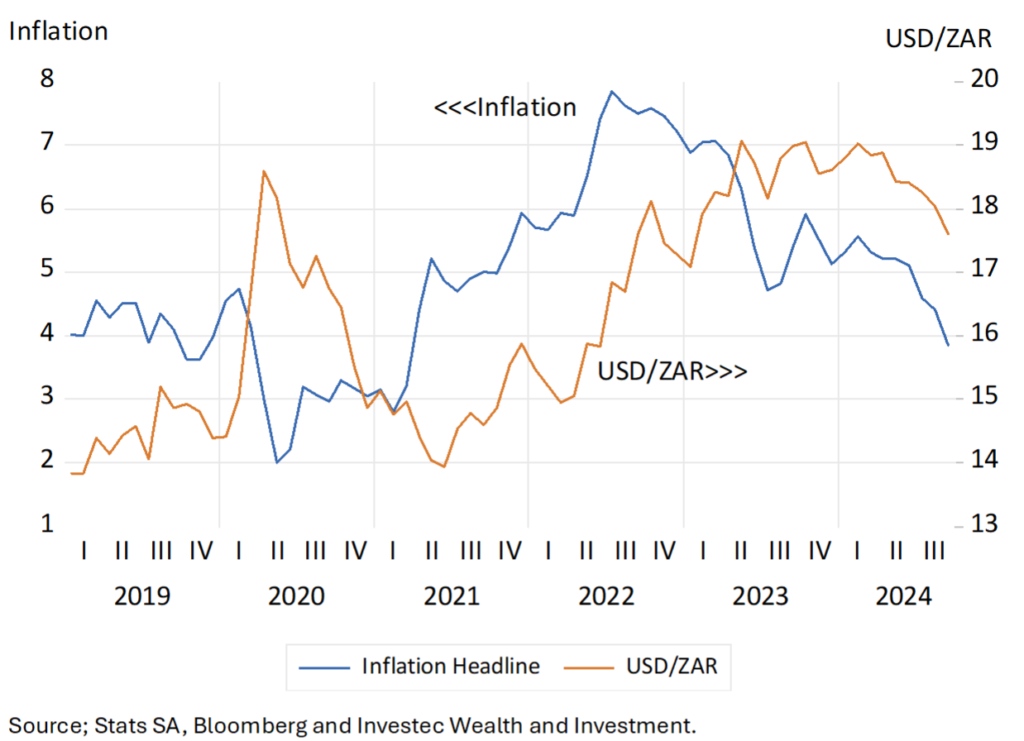

The Reserve Bank’s Monetary Policy Committee provides a full explanation on a regular basis for these interest rate settings. It has been fighting inflation and only inflation that rose after 2021 as the rand weakened so significantly after 2021. The idea of a dual mandate of the US Fed kind – low inflation and employment growth being the combined objective of monetary policy – has been anathema to our determined inflation fighters.

Shocks to the price level caused by exchange rate weakness – unrelated to immediate monetary policy settings and inflation trends – are clearly not ignored when interest rates are set. Yet such shocks- decidedly not of the Reserve Bank’s doing- lead inevitably to more inflation – then higher interest rates – and in turn still weaker demand – already under pressure from higher prices. Higher prices have their complex causes- but they also have (rationing effects) on the willingness to spend more- given minimal growth in income

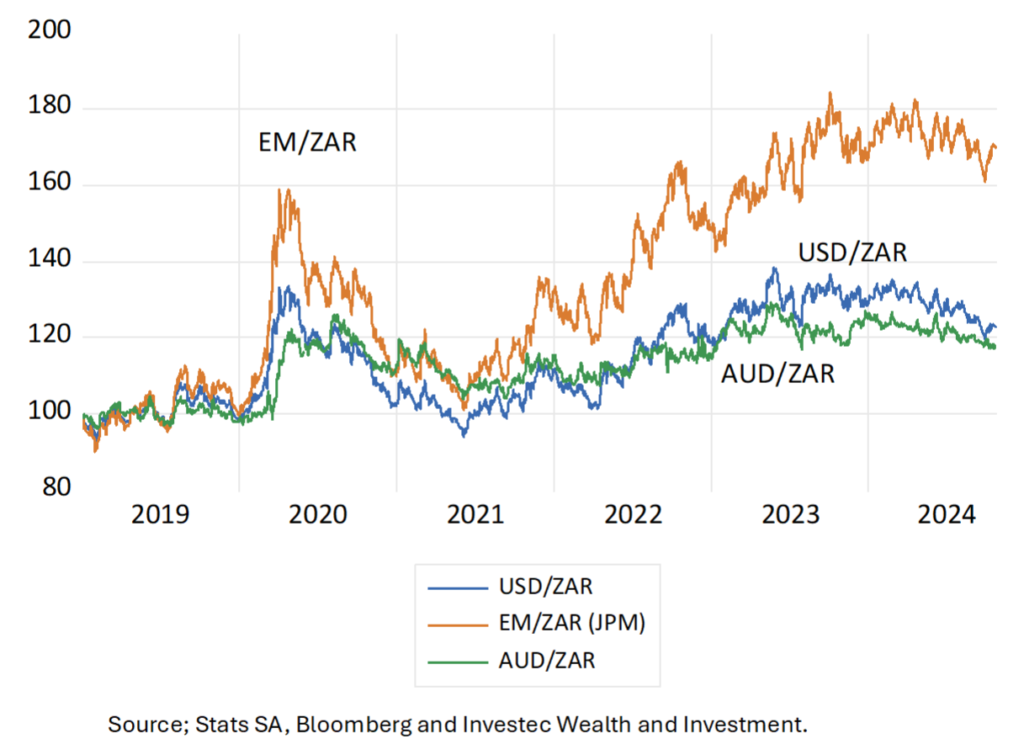

The problem for SA and the Reserve Bank was that the ZAR weakened decidedly after 2021- and weakened against not only the US dollar but also vs other EM and commodity currencies. It was SA specific in nature clearly linked to the failures of government and the failure of the economy to grow that added to SA specific risks. The USD/ZAR, as had the average EM/ZAR and AUD/ZAR had recovered well from the Covid linked risk aversion that brought pressure on the ZAR and the market in SA Bonds. SA appears particularly vulnerable to Global Risk aversion. It may be recalled that the USD/ZAR had recovered to as little as R14 in early 2021. But then the sense of South African failures to realise economic growth took over the currency and Bond markets . And the weaker rand inevitably forced prices higher at a faster rate. Given the MO of the Reserve Bank.

The ZAR Vs the USD, the EM Basket and the Aussie Dollar. Daily Data 2019-2024 (2019=100)

Source; Stats SA, Bloomberg and Investec Wealth and Investment.

Interest rates and the USD/ZAR 2019-2024. Monthly Data to September 2024

Source; Stats SA, Bloomberg and Investec Wealth and Investment.

The ZAR and Short-term Interest Rates. Daily Data (2019-2024)

Source; Stats SA, Bloomberg and Investec Wealth and Investment.

The connection between the foreign and domestic exchange value of the ZAR and the outlook for the SA economy has never been clearer. The GNU has raised the prospects for growth and the ZAR and the bond and equity markets have responded accordingly. Inflation is therefore on the way down. Over the past three months it has averaged but 2.4% p.a. Interest rates at the short end of the market have come down and will come down further provided the ZAR holds up. Not so much vs the US dollar, that may be getting a Trump boost, but also against the other currencies similarly affected by the USD. We should not expect the Reserve Bank to change its pro-cyclical approach. We should but insist and hope that the supply side weaknesses of the SA economy are well addressed. Raising the GDP growth rates to a modest 3% p.a. will not only promote economic and political stability, it will bring lower interest rates and less inflation.