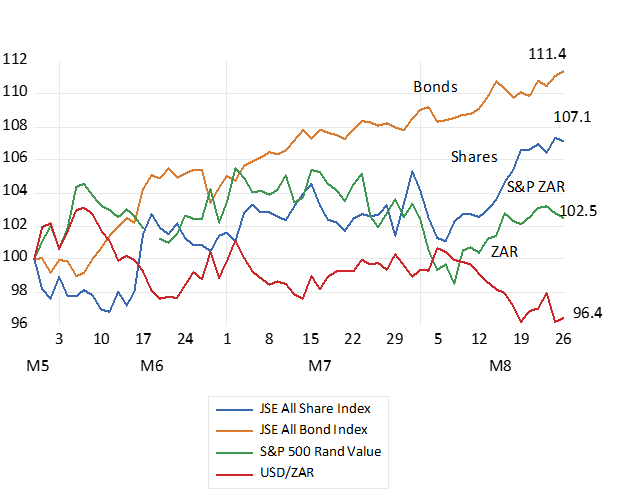

The financial markets have welcomed the Government of National Unity (GNU) The reactions in the bond market have been particularly favourable. The JSE All Bond Index on August 26th was up by 11.4% since the election of May 2029. The share market was up by 7.1% while the ZAR has gained 4% vs the US dollar and vs other EM currencies. Given the importance of equities and bonds held by SA households in unit trusts and pension plans (some 15.2 trillion rands worth at year end 2023) representing 85% of all the assets held by SA households) such market moves have already had a very significant impact on the wealth of South Africans.

The promise of faster growth has added close to 10% or over 5 trillion rands mutual funds to the SA household balance sheet. Extra real money indeed and helpful for stimulating additional household spending, of which SA has had too little of for many years now. [i]It is not only the supply side constraints that have held back the economy. Demands from households and the firms that serve them have been insufficient to drive growth above an immiserating 1% a year.

The importance of the judgments of the global capital market of SA economic policy for the average South African, their hopes for employment and a comfortable retirement, for which they sacrifice heavily, cannot be underestimated.

Post election movement in the Financial Markets. Daily Data – May 29th – August 26th 2024. May 29th=100

Source; Bloomberg, Investec Wealth & Investment.

The strength of the ZAR is particularly welcome. It brings with it lower inflation and lower short-term interest rates essential for a recovery in the economy. The positive link between the outlook for growth and the behaviour of the ZAR has again been emphasised, (more growth stronger rand and vice versa) as has the link between a stronger rand and inflation.

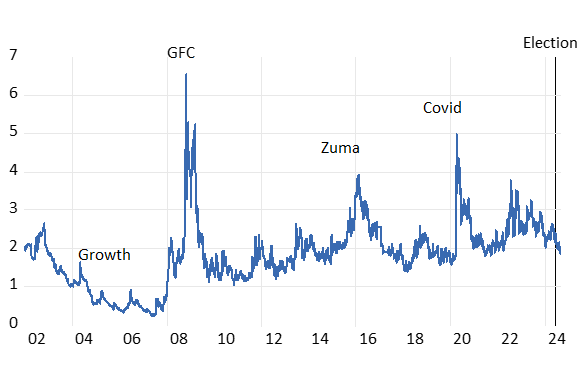

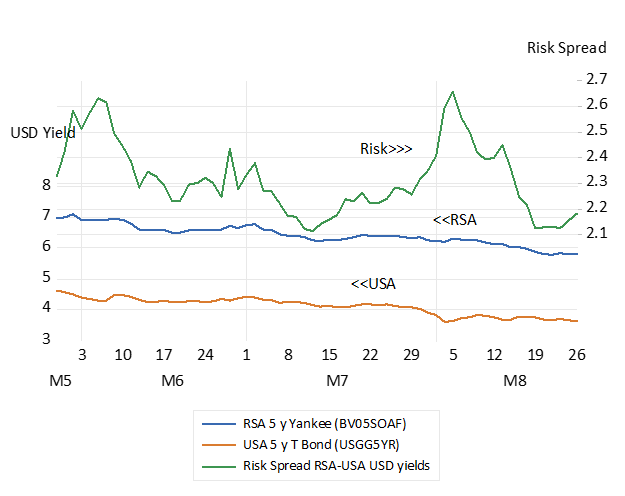

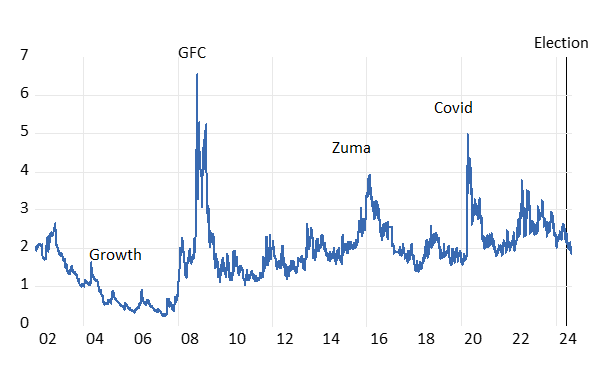

There is no room for complacency. The status of RSA debt has improved, but interest rates and the cost of capital remain elevated. Our credit rating remains significantly weaker than it was between 2002 and 2008 when our economy did grow at close to 5% p.a. (see below)

The RSA Credit Rating. The CDS spread between the yield on RSA 5 year USD Denominated Bonds and a 5 year US Treasury Bond

Source; Bloomberg, Investec Wealth & Investment.

There is much room to further impress investors. By taking economic policy decisions now, that by promising faster growth over the longer term, could immediately further strengthen the bond and currency market.

The National Health Initiative, now being actively promoted, does the opposite. It promises more of the same fundamental weaknesses that have infected all the State directed enterprises to date. The direction of health care reforms should also be one of seeking partnerships with the private sector- with private hospitals and practitioners. It calls for experimenting with the private control and management of hospital services. Hospitals currently funded by the State that perform so poorly on all metrics, including the costs of supplying inferior service.

A helpful positive note was offered by the Transnet CEO. Michelle Phillips who said yesterday that “…the entity’s move to maintain run and invest at Ngqura and the 670km container corridor would be reworked after potential bidders complained that the conditions attached to the tender were too stringent and costly for the private sector to fully participate..” (BD August 28 Thando Maeko)

The public sector in SA, in all its guises, needs to come to realistic terms with the potential providers of private capital and skills that are essential to our economic purpose. Their managers need to fully understand how to deal with potential private sector partners who operate globally. Such knowledge applies to plans for ports and railways and refineries, for the supply of water and the transmission of electricity. And for bringing minerals, oil and gas to the surface. And to recognise the terms and conditions, no more or less than internationally competitive terms, that would bring potentially abundant and truly economic game changing offshore gas, onshore. Offering credible deals of this kind would be enough to move the markets. And so immediately, with lower interest rates and a stronger rand and less inflation, would help realise the growth in incomes and employment necessary to re-elect a GNU in 2029.

[i] I am drawing on a recent comprehensive analysis of the SA balance sheets by J.Makoena and K Setshedi published in the SA Reserve Bank Quarterly Bulletin, June 2024. The study shows how very well developed are pension and retirement savings in SA (120% of GDP) are compared to other emerging economies. And so the importance of investor sentiment for SA wealth owners.