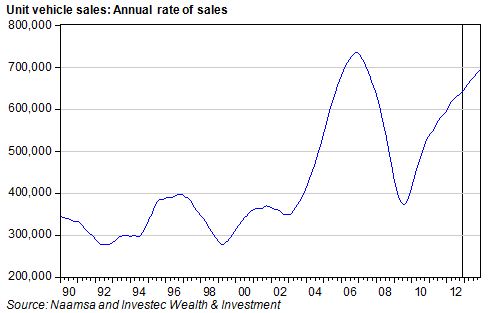

The first indicators of economic activity in November 2012 are now to hand, in the form of new vehicle sales and the value of Reserve Bank notes in circulation. Unit vehicle sales in November were marginally down on October sales, when adjusted for seasonal influences. Unit sales, seasonally adjusted, appear to have stabilised over the past three months at about the 53 000 per month rate, equivalent to about 645 000 units sold annually. When monthly sales are annualised, smoothed and extrapolated, unit sales appear to be still on an upward path and are heading for 695 000 units in 2013 compared to sales of about 645 000 in 2012.

This, if achieved, would represent growth of about 7.5%, and would take domestic unit vehicle sales close to their record levels of 2006. This would be regarded as highly satisfactory in circumstances of generally subdued spending growth. What with built up exports picking up strongly, to over 28 000 units in November (well up on the pace achieved earlier in the year), the sector involved in manufacturing, assembling and distributing new vehicles is a source of growth for the economy. Lower interest rates have probably helped and will continue to do so.

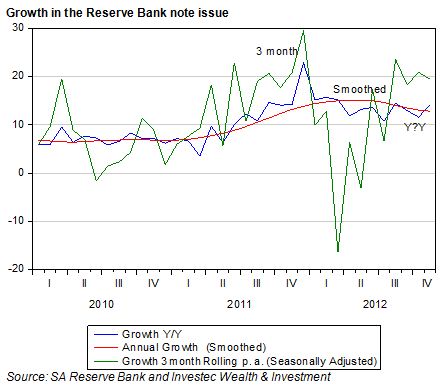

The supply of notes issued and demanded in November 2012 – a very good indicator of household spending intentions in the crucial month of December – continued to grow very strongly. As we show below, growth in the note issue, on a three months seasonally adjusted basis, has maintained the strong recovery that began in the second quarter of 2012. On a smoothed basis, annual growth in the note issue is running at about 13% p.a, indicating continuing strength in household spending.

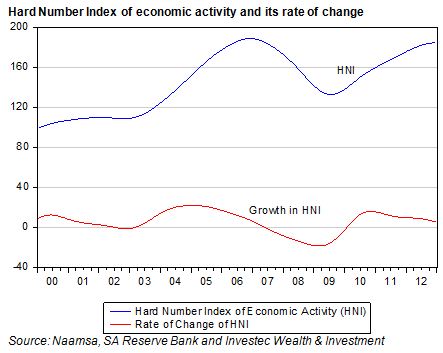

We combine the note issue with unit vehicle sales to form our very up to date Hard Number Index (HNI) of the state of the SA economy. Our HNI for November indicates that the SA economy continues to move ahead at a more or less constant speed. Numbers above 100 indicate growth while the second derivative of this measure of the business cycle – the rate of change of the HNI – indicates that the pace of growth is slowing down but only very gradually (see below).

This up to date news about the state of the SA economy in November 2012 should be regarded as encouraging. The strong demand for cash at November month end indicates that the tills will be ringing loudly this December, given that spending in December at retail level is 36% above average spending month. The demand for new vehicles suggests that households and firms have not given up their taste for big ticket items. Rumours of the death of the SA consumer may well be exaggerated. Brian Kantor