A large threat to the long-term growth prospects of the SA economy is the loss of essential skills to emigration. Such losses have been a continuous drain on the growth potential of our economy both pre and post our democracy. That Trump saw fit to take the back of white South Africans could be even more damaging to South Africa than he imposing higher tariffs or denying aid. What if the US decided that badly treated South Africans with skills and the right aspirations would be very welcome in the US? A drain of emigration could become a flood. A severe potential loss that could be avoided by seeking the friendship and support of the US rather than so gratuitously incurring its ire and enmity.

How could this be done to the great benefit of South Africa and its growth prospects? I would suggest by doing in SA what Trump aspires for the US. That is for SA to become a truly colour blind and meritocratic society and economy. Which it is not. Our policies have focused on restitution for a black South Africans rather than stimulating growth. Understandable perhaps but self-defeating- making growth that would benefit the many so hard to realise.

Growth rates would surely be greatly enhanced by unfettered competition for jobs and for contracts to supply the State and its agencies. A process that would be particularly helpful to the least advantaged poor of South Africa. In the form of many more well-paid jobs and indirectly in the form of better education and health care that only a prosperous and competitive economy could afford. BEE clearly does not benefit them. There must come a time when the highly educated and talented black elite of South Africa are willing to compete on their own considerable merits with all the competition for the commanding heights of the economy and its governance. The sooner the better for growth and our international standing.

Faster growth may not reduce inequality and moreover, should not be expected to do so. To them that have may well be given. And be resented accordingly when it has a racial or ethnic connotation. But envy should not be allowed to frustrate the realisation of the greater good as it has to date. Higher incomes earned fairly by providing superior service to customers and employers should be applauded not resented. Growth is a positive sum game.

How badly has the South African economy been doing? According to the recent extensive Survey of Income and Expenditure and Income (PO100) of 19,940 SA Households conducted by Stats SA so much worse than could ever have been imagined. It has come up with a literally unbelievable estimates of household income and expenditure and their distribution by race. These estimates of household expenditure and income are also widely different from the national income estimates. And should be rejected.

Between 2006 and 2023, inflation adjusted household consumption expenditure of all SA households is estimated to have declined absolutely by a real 1.9%. Real Black household expenditure, with a 62% share of all spending, is estimated to have risen by an impressive 36.2% over these years. While the household spending of increasingly poor white SA households is estimated to have declined by 21%. Households headed by those with a tertiary qualification did even worse- they apparently saw their expenditures decline by 29.2% between 2006 and 2023. No case for envy here if it were so.

The income story told is less depressing. Black headed households are estimated to have seen their incomes rise by 46% between 2006 and 2023. While white incomes declined by only 7.7%. All household incomes are estimated to have grown by 5% since 2006. Suggesting a completely implausible and unobserved increase in real household savings – the difference between incomes and expenditure.

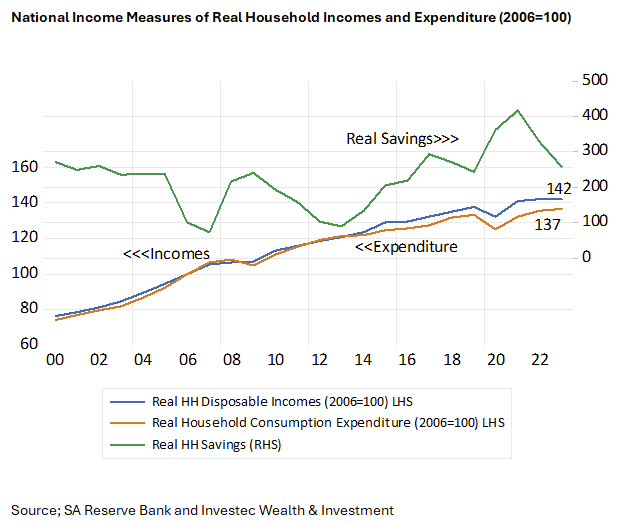

By contrast the National Income Statistics record that real household disposable income rose by 42% between 2006 and 2023, while real household consumption expenditure increased in line by 37% over the period (see below) Such inexplicable differences in the measures of income and expenditure need reconciliation. And what does it all imply for the reconstruction of the weights in the CPI that depend on the Survey? And for our measures of inflation?