The Trump Triumph demonstrates why inflation in the US and in much of the developed world is persistently low. Inflation is unpopular- it can cost you the next election – especially when the growth in incomes of the workers, wage and salaries, lag the increase in prices. Which they have done in the US until recently, despite the high levels of employment.

The recipe for controlling inflation is well known and usually well practiced. Simply put it requires that the increase in the demand for goods and services be closely matched to the increase in the real supply of goods and services that are the source of all incomes. If demand appears to be growing too rapidly in ways that add to the ability of firms to easily raise their prices, the remedy is to raise the cost of credit – raise interest rates to discourage borrowing to spend more. Actions not beyond the with of a modern, data dependent and politically independent central bank.

A temptation not generally avoided in the persistently high inflation economies, Africa provides many examples, of a central bank and its cohort of retail banks, to fund a large proportion of additional government spending. Then consistent increases in the supply of money ( of bank deposits) and bank lending, stimulate demand for goods services and assets and continuously higher prices, inflation persistently in the high teens, are the inevitable rationing mechanism.

Yet this was the classic way inflation ran out of control in the US post the Covid lock down shocks to supply and incomes. The spending of the US government rose dramatically and generously to compensate workers for their enforced idleness. With the strong backing of the Fed and its willingness to buy the extra government bonds being issued, on a huge extra scale. It was classic money creation and a burst of inflation – more demand and less supplied- followed.

Seemingly, unforgivingly, to the surprise of the Fed who then had to play catch up with much higher interest rates that naturally were very unpopular with potential house and car buyers. The flow of money into financial assets raised their prices and were much welcomed by the minority of wealthy Americans who have enjoyed a massive improvement in their balance sheets. US household wealth is up by over 50 trillion since Covid. US household incomes have barely increased since then- and are barely highr when adjusted for inflation.

But there is now every reason to expect US inflation to stay down around the 2% p.a level it is falling towards. Even should Fed Chairman Powell be replaced. The political case for low inflation has been reinforced. Ironically what the responses to Covid took away from the second Trump campaign- gave it all back in the third.

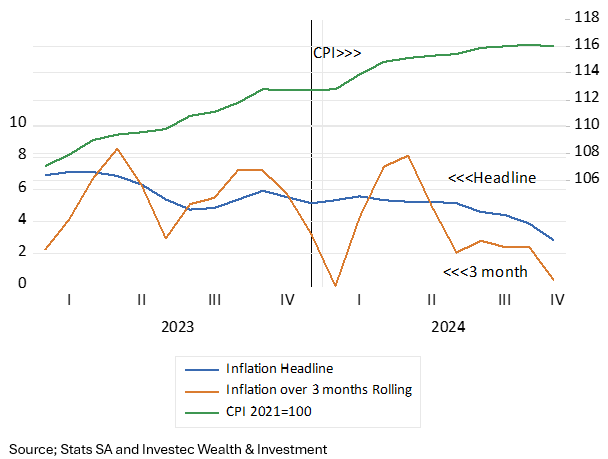

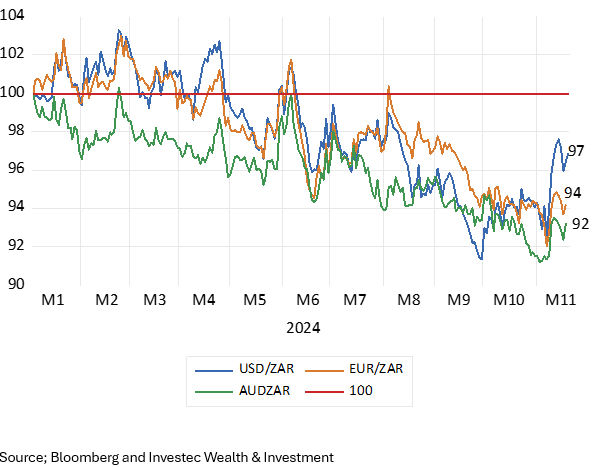

The South African authorities, especially its independent central bank would like to aim at lower, developed world type inflation rates. South Africans would welcome such outcomes. But is it a realistic objective? The inflation outcomes will depend critically and unavoidably on the path of the exchange rate. If for example, the ZAR more or less retains its exchange value with the Aussie dollar- as it has been doing lately – SA could enjoy similarly low Australian type inflation and interest rates. It would then be a very smooth ride to lower inflation.

But the ZAR is clearly not under the control of the Reserve Bank. It is determined by SA politics and the outlook for SA growth. It is the political risks to the growth outlook for the SA economy and the ability to fund government spending without money creation that drives exchange rate weakness and generally higher prices. Too much spending has not been the reason for SA inflation. The exchange rate shocks for our very open economy have driven prices higher and inflation expectations higher. Limiting demand to counter these forcers acting on prices has meant less growth and not much less inflation.

We must hope that the new political dispensation gives SA more growth and more exchange rate stability. If it does persistently low inflation will follow painlessly. If not chasing the inflation tail will just add to economic misery.