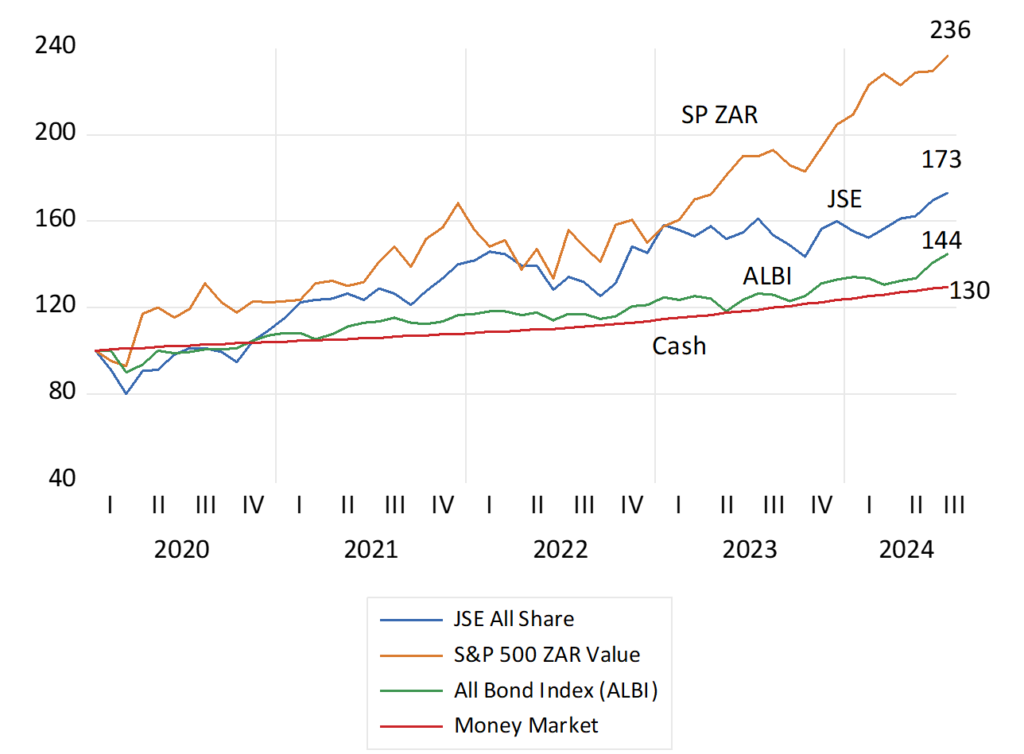

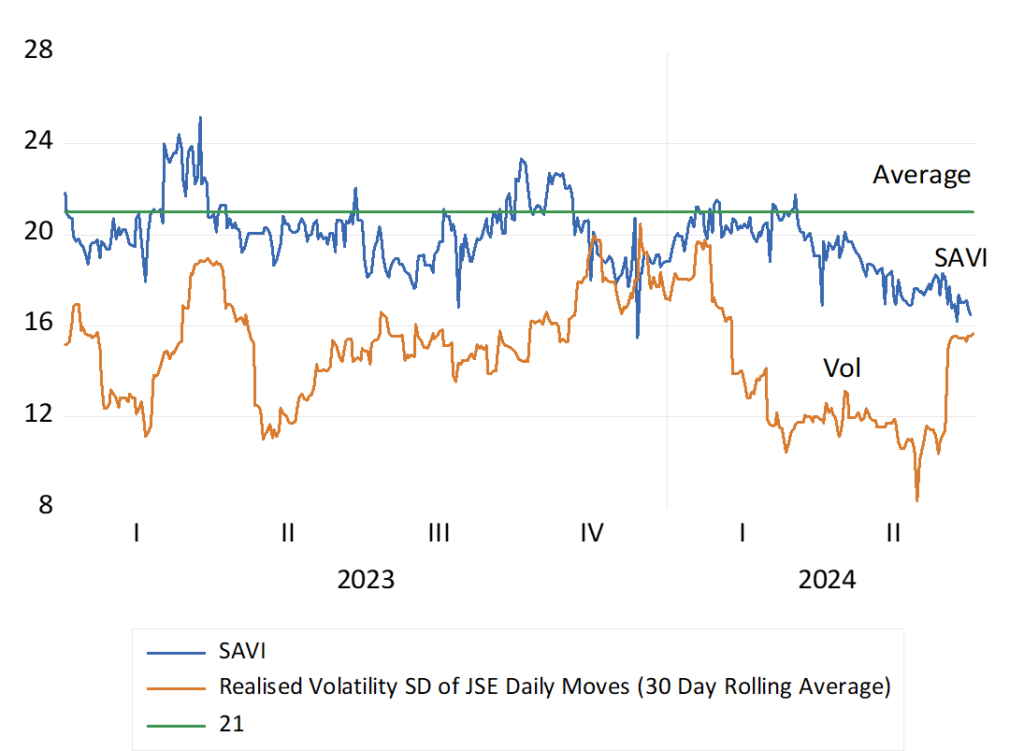

You might have expected more volatile markets, in this election year. The evidence however suggests otherwise. Investors on the JSE and the New York Stock Exchanges have coped comfortably well with the potential dangers. Daily volatility on both share markets, the scale of daily ups and downs in average share prices, has been unusually subdued, and well below long term averages in the US. Electing a scoundrel or a cognitively challenged US President has not made much of a difference to stability in the US markets The coalition outcome in SA proved welcome but not much of a surprise, again as judged by volatility trends. The Volatility Index for the S&P 500 – the VIX- also known as the Fear Index- has averaged 13 this year well below a daily long-term average 2000-2024 of 19. The equivalent construct for the JSE, the SA Volatility Index (SAVI) – with a similar long-term average of 21, has also trended lower this year.

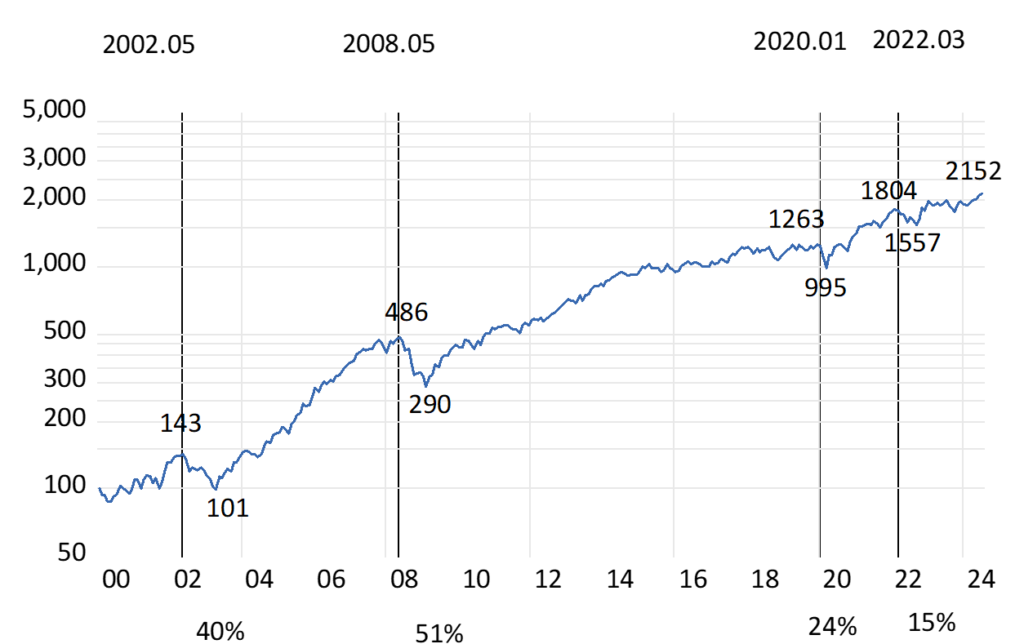

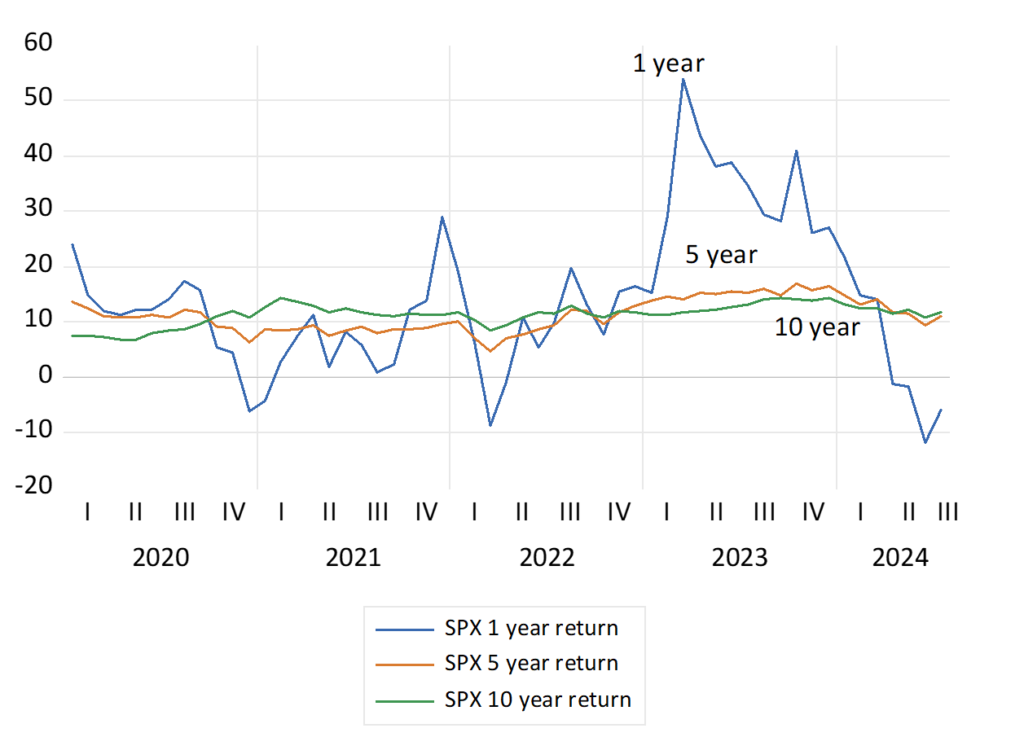

As may be easily observed the chances of an Index or any well traded share moving higher or lower on any day are about the same. The pattern is thus of a random walk, of ups being matched by downs of roughly the same average magnitude. Yet happily for shareholders these movements have come with a slight upward bias, above a daily average of zero, to provide shareholders with positive returns over the longer run. If they stayed invested in the share market the end result has been strongly positive annual returns over five or ten year periods rolled back each month.

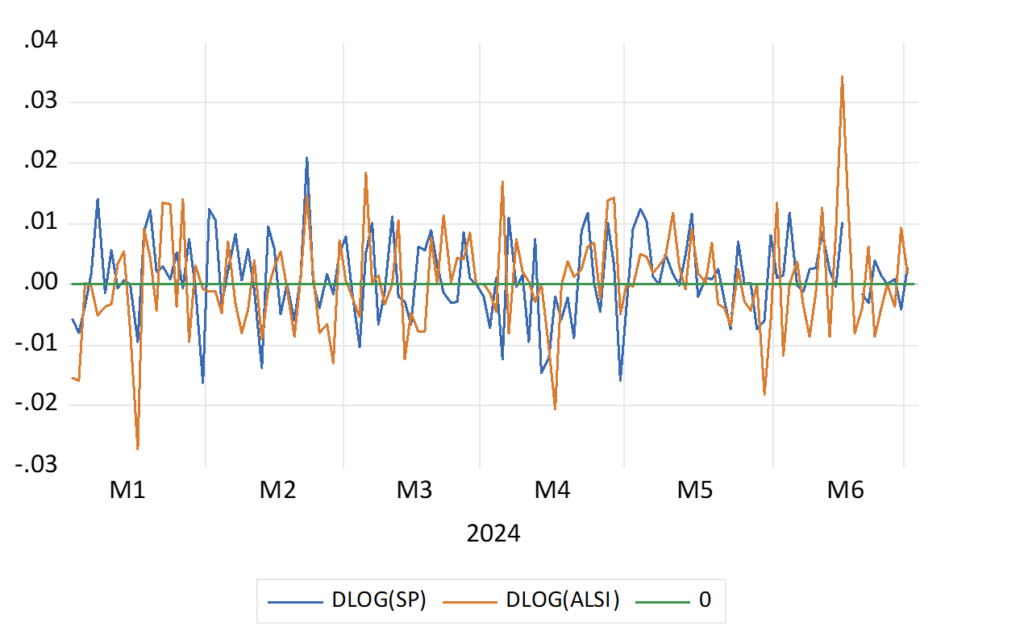

(See below the daily moves of the S&P 500 and the JSE All Share Index in 2024. We also show the Daily SAVI in 2023-24 as well as actual volatility of the JSE – calculated as the rolling 30 day Standard Deviation about the Daily Average Share Pirce Move)

Daily % Share Index Movements on the JSE and the S&P 500 in 2024

Source; Bloomberg and Investec Wealth & Investment

Daily Moves in the SA Volatility Index (SAVI) and Volatility Measured as the Standard Deviation of the JSE (Annualised as a rolling 30-day average)

Source; Bloomberg and Investec Wealth & Investment

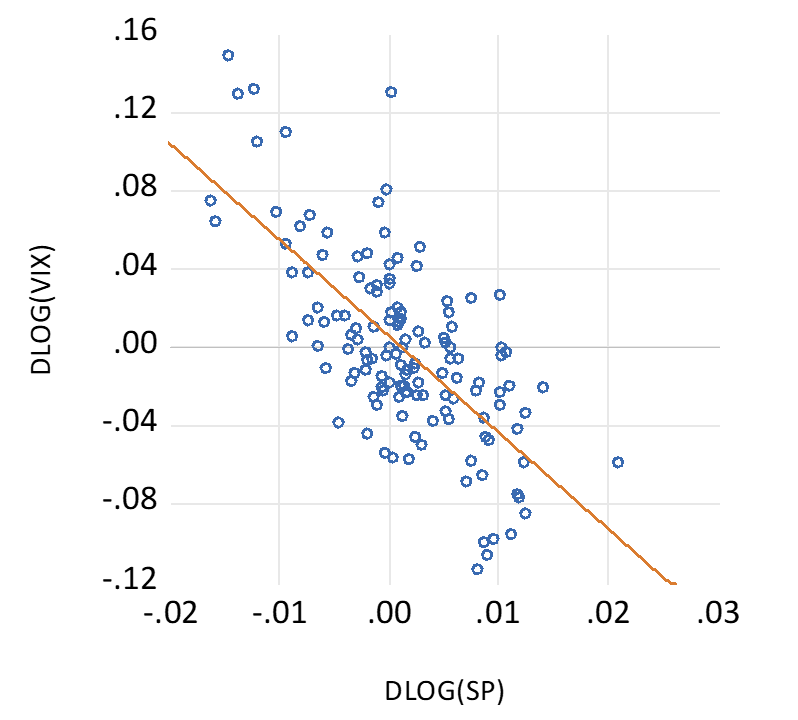

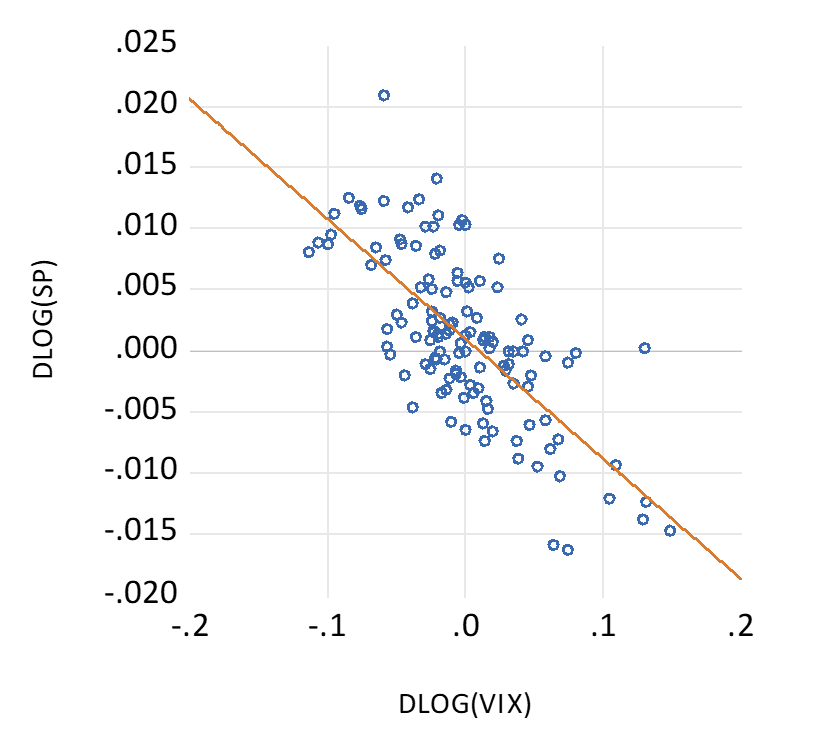

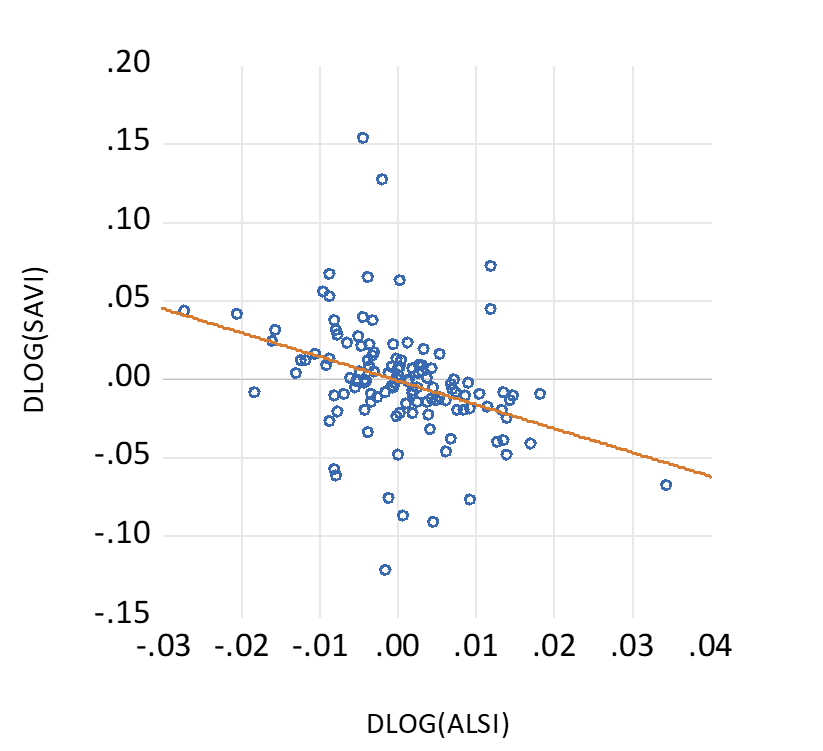

When daily volatility is more elevated, share prices will change consistently in the opposite direction. When the VIX or SAVI goes up share prices go down most days. They do so to improve the chances of higher risk adjusted returns- off a lower entry price- to compensate for more risk incurred. And vice versa. In 2024 it has been vice versa in the US and in SA- risks have fallen and values have improved. Extra risk comes with more returns and vice versa as nature intends. (see below)

The average move for the JSE in 2024 in the six months to June 2024 was an encouraging 0.27% per day. The S&P did only half as well- providing an average gain of 0.11% per day.

Daily % Changes in the VIX and the S&P 500 in 2024. Scatter Plot

Source; Bloomberg and Investec Wealth & Investment

Daily % Changes in the SAVI and the JSE in 2024. Scatter Plot

Source; Bloomberg and Investec Wealth & Investment

It is the quality of economic policy, more than the presumed certainty of such policies, good bad or somewhere in between, that will matter much more for financial markets in the long run. Any willingness of investors to accord a SA facing business an extended economic life will also add to present values. Provided the Return on Equity (ROE) exceeds the opportunity cost of capital, faster expected growth for a longer term, can explode the current present value of a share and market multiples. Price over Current Earnings or Cash flows and Market to Book ratios.

An accompaniment of lower ROE’s and a lower discount rate attached to future surpluses would also add much additional market value to SA companies. And to their willingness and ability to undertake and fund growth enhancing capex and employment. Faster growth if realised will add to an extra flow of cash to the government, bringing less risk to the fiscal outlook. And be reflected in lower interest and discount rates across the board and in higher share prices.

Extra wealth created in the bond and equity markets, is a game played by all with formal employment and retirement plans, and not only the richer few. The capital markets will provide an objective measure of the performance of the government of national unity (GNU) The score will be continuously kept and updated. While investors have not been frightened by the GNU, they have still to give approval. Over to the GNU.