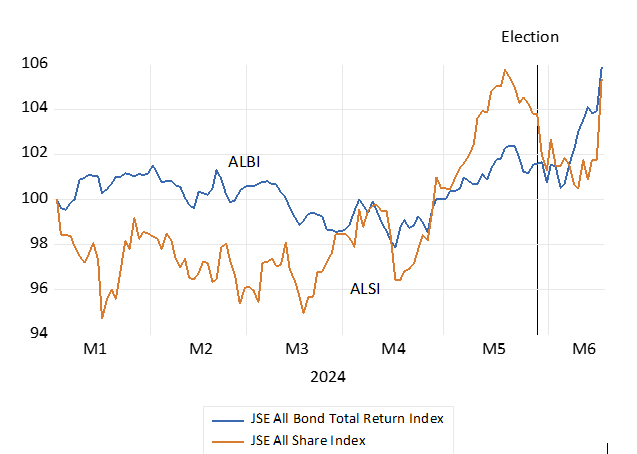

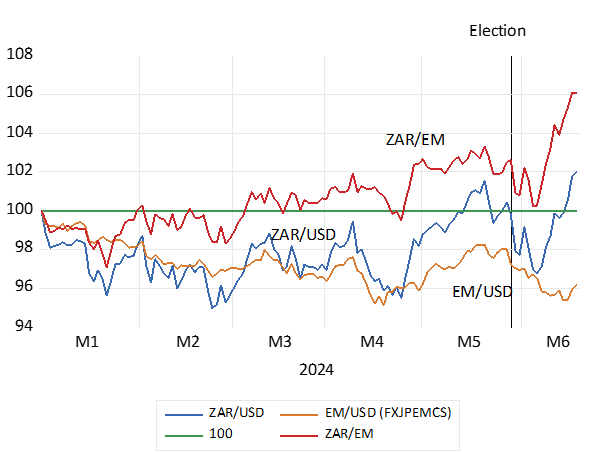

That the Government of National Unity would include the Liberal DA and exclude the EFF (extreme left or is it extreme right?) has been well received by investors. That this would be the new shape of government in SA was only known late on Friday 14th June after the markets were closed and that were only to reopen on Tuesday 17th June. The run up to the election had seen SA listed shares and bonds and the ZAR well up from their mid-April lows. On the presumption that the ANC would be able to do business as usual with the assistance, if necessary, of one or two minor parties. A sense of better the devil you know seemed to characterise market sentiment. That the ANC collected a surprisingly low 40% share of the votes cast, rather than 45-47 per cent expected, raised more uncertainty about the future course of economic policy. The markets in SA assets reacted typically to the new dangers by falling back from pre-election valuations.

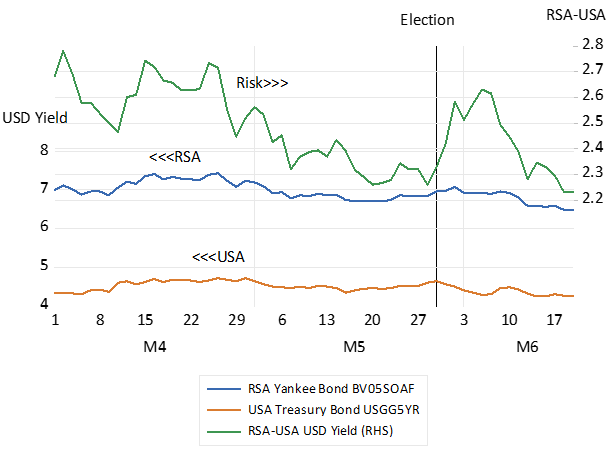

Early days surely yet the share and bond markets are now ahead of their immediate pre-election highs and have both gained about 7% in USD’s from the post-election aftermath. The ZAR has gained ground against the stronger USD and against the other EM currencies, the true measure of rand strength for South African, rather than US reasons. Of further encouragement is that the risks foreign investors attach to their SA assets have also narrowed. These sovereign or country risks are best measured by the spread between the yields on a RSA dollar denominated bond and those offered by a US Treasury Bond of the same duration. The spread between a five-year RSA Yankee bond had narrowed to 2.3% p.a. from 2.7% in the run up to the election. Then post-election the risk spread had widened to 2.6% p.a. and is now helpfully lower at about 2.2%. A good first impression but much more is called for the move the markets higher (see the charts below)

South African Stocks and Bonds in 2024. Daily Data to June 18th (January 2024=100)

Source; Bloomberg. Investec Wealth&Investment

The ZAR in 2024. Daily Data to June 18th January =100

Source; Bloomberg. Investec Wealth &Investment

Interest Rates – Dollar denominated Five Year RSA’s (Yankees) and US Treasury Bonds and the Risk Spread. Daily Data; April to June 18th 2024.

Source; Bloomberg. Investec Wealth &Investment

The DA will now carry a heavy responsibility for realising faster growth. Will the party and its leaders and followers be up to the task? Will they be able to manage change in an environment where the support of senior officials may not be fit for purpose? And when time spent in parliamentary debate and on the hustings may not have been the best possible preparation for expertly and vigorously executing the tasks at hand?

What specific government departments will be allocated to the DA members of the cabinet remains to be revealed. The DA should not be at all shy in coming forward to serve and be accorded a heavy responsibility for executing economic policy. There is apparently agreement on the initial economic policy reforms to be pursued, not surprisingly, given the weaknesses of government departments obvious to those who have sat for so long on the opposition benches and in parliamentary committees.

The Treasury and its Budget is in safe hands and can be supported by the DA in cabinet. It is the other economically vital Ministries that offer great scope for much improved governance and in executing policy and delivering value for the sacrifices taxpayers make to fund their government. The management role to be played by the Ministers to be held responsible for Mining, Industry, Energy, Transport Water and Municipal Services, in and out of Parliament, will be all important promoting economic development. That is the essential growth stuff to truly add value to SA capital from which all South Africans will benefit, those in and out of work.

Will the new appointments be up to the task? Businesses in South Africa can surely be a source of managerial talent. And a source of technical and financial advice to help fashion public-private partnerships to attract the necessary and available capital to revive the infrastructure. The best and brightest will be needed and will not be found wanting. A government that regards SA business as a partner in progress rather than a threat to its power and privileges will be a huge asset value and growth promoter.