Month: November 2023

Sticking to the fiscal guns.

The short fall in government revenues of R56.8 billion reported in the Budget Review of 2023 came as no surprise to observers of the monthly tax returns. It represented a moderate miss in volatile circumstances – equivalent to 3.1% of the revenues expected in the February 2023 Budget of R1787.5 billion. A very large number and equivalent to 25% of GDP. This real tax burden (Taxes/GDP) is not expected to change over the next few years. Underestimated company tax, lower by R35.8b and net revenues from VAT down by R25.6b, accounted for much of the revenue shortfall. Weaker metal prices and massive investments in alternatives to Eskom power were largely responsible for both declines. Personal Income Tax grew as expected by 7% in line with some growth in real wages and salaries for those employed in the formal sector. The shortfall will be fully covered by raising additional loans of about R54b.

The higher ratio of national government expenditure to GDP, currently 29.1%, is estimated to decline to about 28% of GDP over the next three years. Still leaving scope for a positive Primary Balance of 0.3% of GDP this year and 1% next year. Raising revenues to exceed expenditures, net of borrowing expenses, is the first and necessary step to reducing the burden of National Debt to GDP-now about 74%, though predicted to decline to about 71% of GDP in three years. National government expenditure, is estimated to increase by an average 4.6% p.a. over the next three years, including servicing our debts, currently over 20% of all revenue that will cost the taxpayers about R400 billion this year. That would represent a decline after inflation.

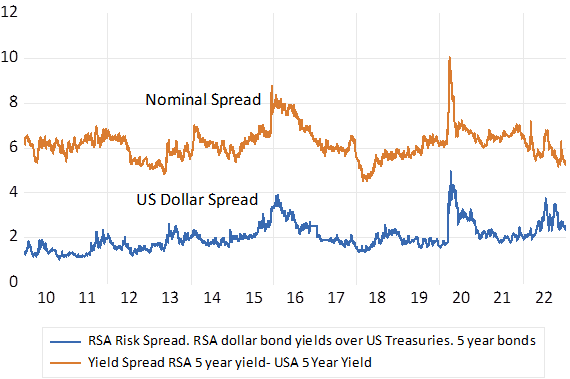

The SA government is still practicing fiscal conservatism despite persistently slow growth that weighs so heavily on revenue. And inhibits expenditure. And raises persistent doubts about fiscal sustainability. That is the willingness of the government to avoid money creation, that is a heavy reliance on its central and private banks to fund its expenditure over the long run. Which raises the risks of more inflation and is already well reflected in high borrowing costs. Risks incidentally that have not trended higher in the run up to the Budget Review. Encouragingly the debt and currency markets reacted positively to the statement itself. The rand strengthened to improve the outlook for inflation and long bond yields declined by about 15 b.p.to help reduce debt service costs.

Source; Bloomberg

South Africa; Risk Spreads- Differences in borrowing costs. RSA-USA

Source; Bloomberg, Investec Wealth and Investment

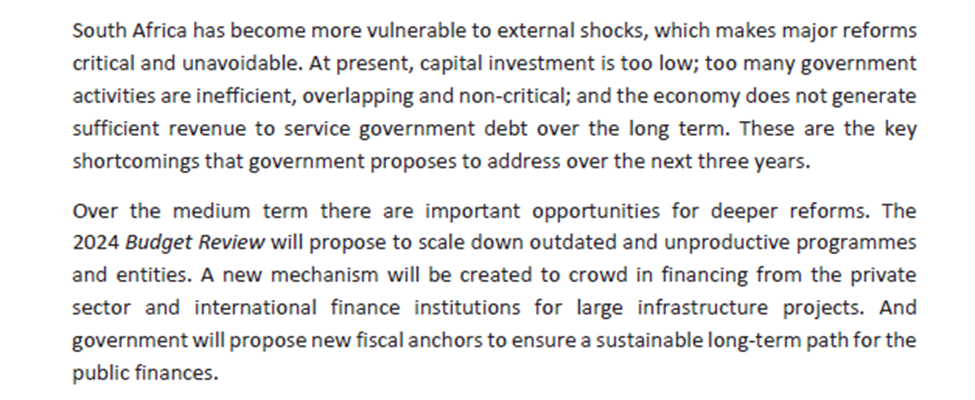

In reading the Budget Review and listening to the Minister one is struck by how deeply dissatisfied the government is with its own performance. The statement is a catalogue of government failure.

To quote the statement

The case for reconfiguring government, as it is put, is vigorously argued by the government itself. It will however need its own genuine champions informed by events rather than a stale ideology. It will have quite simply to put the private sector and private sector incentives in control of much of the activities so badly performed by the SOE’s and government departments generally, that could be outsourced. It can be called private public partnerships rather than privatization, but the essential reforms required will be to incentivize operating managers on the bottom line and return on capital- as the private sector does – to thrive and survive. The upside is incalculable.

And as far as funding a reformed public sector, the place to start would be to dispose of key underperforming assets on the best possible terms. Selling assets or leasing them over the long term would be equivalent methods for raising capital and reducing government debt. The leases can be sold to funders (foreign and local) who would be very keen to provide finance on favourable terms, given credible operators. The Transnet iron-ore line from Sishen to Saldanha would be an obvious candidate for sale or lease. There will be many other such projects made much more valuable under different operating control. For the mines to lease and operate their essential gateways to the market would add many billions to their values and taxable incomes.

Recessions are viewed through the back window.

The odds on a US recession in the next twelve months have receded in the light of the continued willingness of US households to spend more- despite much higher interest rates and reductions in the supply of money and bank credit. Spending on goods and food services rose by 0.7% in September on top of a robust increase of 0.8% in August. The annual increase in retail sales is 3.7% and the increase over the past three months is running at an annual equivalent of 8% p.a. Prices at retail level are falling. They stimulate demand but they also devalue the inventories held to satisfy demand. Prices have their supply and demand causes. They also have their effects on demand- and supply. Lower prices stimulate demand and incomes are now growing faster than prices.

All that is holding up the US CPI – now 3.7% up on a year ago – are house prices – and what are imputed as owners’ equivalent rent. That is at what the owners could earn if they rented their homes They are up 7% on a year before. They have a huge weight in the CPI – over 25% – and if excluded from the CPI – would have headline inflation running in the US below the 2% target. Cash rentals account for a further 7% of the US CPI. By contrast food eaten at home carries a weight of only 8.6% in the CPI and food eaten out is 4.8% of the US CPI Index. SA also includes owners’ equivalent rent in its CPI with a weight of 12.99% and actual rentals account for only 3.5% of the index. Both rental series in SA are up by a below average 2.6% on a year before. The headline inflation rate in SA was 5.4% in September.

Owners equivalent rent is a very different animal to other prices. Higher implicit rentals based on the improved value of an owner’s home are not the usual drag on spending. The extra wealth in homes, as would all increases in household wealth, more valuable pension plans, more valuable share portfolios, etc. will encourage more, not less spending. The boom in US house prices post Covid has had much to do with the ability and willingness of US households to spend more and help push up prices generally. Average house prices in the US are now falling under pressure form much higher mortgage rates and house price inflation to date will be falling away rapidly as will owner’s equivalent rentals. Thus helping to reduce headline inflation.

The question investors are asking about both inflation (falling) and the state of the economy ( holding up) is what will it all mean for interest rates. The stronger the economy the lesser the pressure on the Fed to lower short rates. And the greater will be the pressure on long term rates in the US. The key ten-year Treasury Bond is now offering 4.9% p.a. reaching a 16 year high. In the share market what is expected to be gained on the swings of earnings may be lost on the roundabouts of higher interest rates, used to discount future earnings. But if inflation is subdued, any visible weakness in the economy, can be followed immediately by lower interest rates. This thought will be consoling to investors.

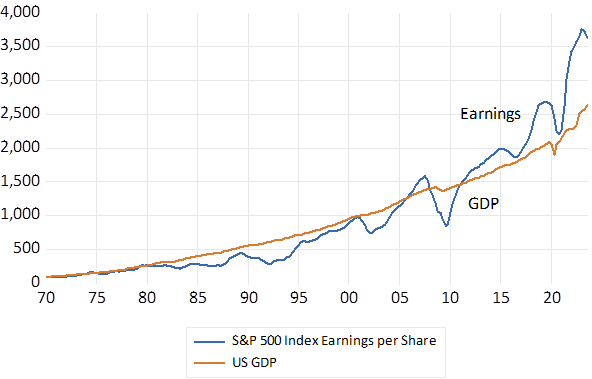

The attention paid to GDP by investors is fully justified. Where GDP goes so will the earnings reported by companies. Their correlation since 1970 is (R=0.97) Though helpfully to shareholders in recent years earnings have been running well ahead of earnings indicating widening profit margins from the IT giants. GDP , on a quarter-to-quarter basis, is a highly volatile series. Though growth in earnings is much more volatile.

US GDP and S&P 500 Earnings. Current values. (1970=100)

Source; Bloomberg, Federal Reserve Bank of St. Louis and Investec Wealth and Investment.

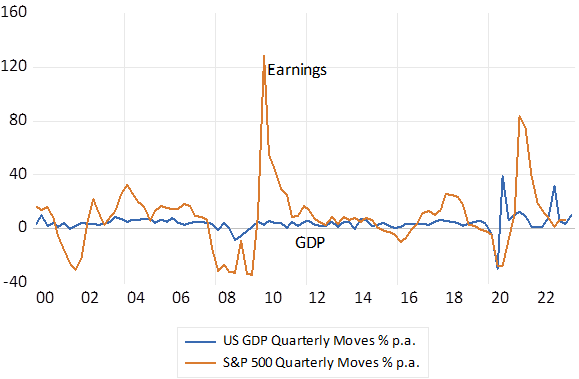

The underlying trend in GDP and earnings will never be obvious. To make sense of their momentum, to recognize some persistent cycle, the data has to be smoothed and compared to a year before. Thus we will know only in a year or more whether the US economy has escaped a recession. It is not recessions that move markets, only expected recessions do so. And the jury will always remain out.

GDP and S&P 500 Earnings Growth Quarter to Quarter % Annualised.

Source; Bloomberg, Federal Reserve Bank of St. Louis and Investec Wealth and Investment.